At the beginning of the week, Wall Street's key indices saw growth, thanks to the influence of large-cap companies like Alphabet and Tesla, which contributed to strengthening the Nasdaq's technology sector. The market is also anticipating the upcoming meeting of the Federal Reserve System of the U.S., drawing investor attention.

A significant boost to the market came from the announcement that Apple is discussing with Google the incorporation of the Gemini AI engine into the iPhone, which had a substantial impact on Alphabet's shares, the parent company of Google.

This innovation supported the communications services sector, which grew by nearly 3%, becoming the leader among the 11 key sectors of the S&P 500 and reaching its highest level since September 2021.

Tesla (TSLA.O) shares demonstrated significant growth, increasing by 6.3%, and leading the S&P 500 companies in growth pace. This increase followed the company's announcement of imminent price hikes for the Model Y electric vehicles in certain European regions.

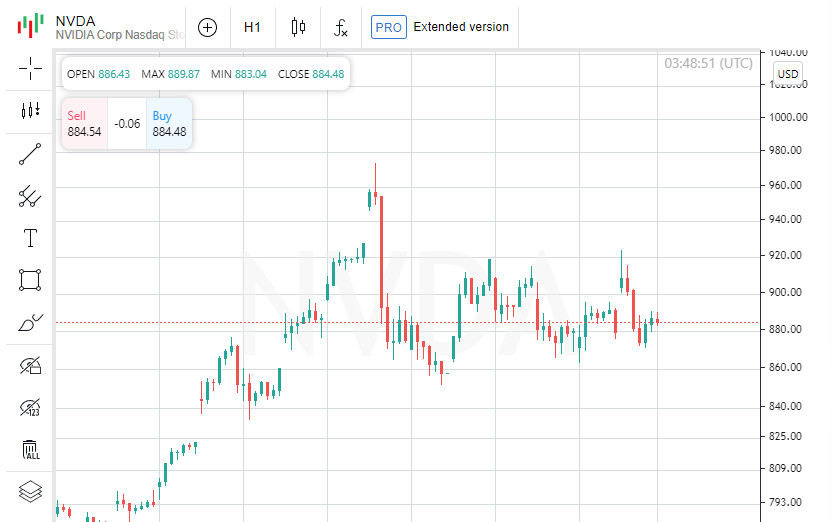

Nvidia (NVDA.O) shares also saw an increase, this time by 0.7%, but their closing was notably lower than the day's high. This event coincided with the start of the company's annual artificial intelligence developers conference, where the community anticipates new chip announcements from CEO Jensen Huang.

Lindsey Bell, a leading strategist at 248 Ventures in Charlotte, North Carolina, highlights the growing dilemma for investors torn between optimism about AI applications in the tech sector and concerns over the upcoming Federal Reserve policy update.

"The market is eager to continue trading activity, yet the focus is on the Federal Reserve's actions this week," notes Bell, emphasizing the tension among investors ahead of crucial decisions.

The Dow Jones Industrial Average gained 75.66 points (0.20%), closing at 38,790.43, while the S&P 500 increased by 32.33 points (0.63%), reaching 5,149.42. In turn, the Nasdaq Composite added 130.27 points (0.82%), closing at 16,103.45. This marked the end of a three-day losing streak for Nasdaq.

The Philadelphia Semiconductor Index gave up its preliminary gains and ended the day almost unchanged, while the S&P 500 technology sector grew by 0.5%. Among the 11 key S&P sectors, the most vulnerable to declines were real estate, sensitive to interest rate changes, and the healthcare sector, where the decrease was 0.02%.

Higher-than-expected inflation figures led market participants to reassess expectations regarding how soon and aggressively the central bank will cut interest rates this year.

The change in perception was reflected in the decreased probability of rate cuts in June from the previous 71% to 51% in the short term, as indicated by CME FedWatch data.

The speculation that the Federal Reserve might adopt a tough stance in its upcoming meeting poses risks for equity capital.

"Today's growth gives investors a chance to lock in profits before the Fed potentially expresses a stance that is more likely to disappoint the market than provide confidence after recent gains," noted Samir Samana, a senior global market strategist at Wells Fargo Investment Institute in Charlotte.

In its latest statement on Monday, Goldman Sachs adjusted its forecasts, now expecting three interest rate cuts in 2024 instead of the previously predicted four, after actual inflation data showed higher than expected figures.

"Given that market indicators are near recent highs, it's hard to imagine what could act as a catalyst for further growth.

At the same time, it's not too hard to envision scenarios that could lead to investor disappointment," Samana points out, focusing on the actions of the Federal Reserve and the high valuations of technology companies' stocks.

Nasdaq (NDAQ.O), the exchange trading shares of leading American technology giants, reported the resolution of a technical malfunction that disrupted trading operations two hours before opening on Monday, emphasizing that all systems are now functioning normally again.

The company did not provide details regarding the severity of the issue, which marked the second technical glitch in recent months. The official website statement mentioned that the incident was related to the order matching mechanism, i.e., the software systems processing buy and sell orders.

Last year, its competitor, the New York Stock Exchange (NYSE), also experienced a technical malfunction, preventing auctions for a significant number of stocks from starting at the usual time. This led to extensive trading delays, confusion regarding the accuracy of stock order executions, and the temporary suspension of trading for more than 250 securities.

Xpeng shares, traded on the American market, increased by 1.9% thanks to the company's ambitious plans to offer a more affordable range of electric vehicles amidst fierce competition in pricing.

Boeing (BA.N) shares experienced a decline of 1.5% after media reports emerged that the company was summoned to federal court in Seattle. The summons was related to an incident on January 5, when an explosion of a door plug occurred during a flight operated by Alaska Airlines (ALK.N) involving a Boeing aircraft.

Super Micro Computer (SMCI.O), a company that joined the S&P 500 index at the beginning of the week, lost its previous gains and ended the day down by 6.4%, marking the most significant percentage loss among the companies of the base index for the day.

Nevertheless, shares of companies that have recently shown sharp growth due to bets on their potential benefit from the development of artificial intelligence continue to remain positive since the beginning of the year, showing an increase of more than 252%.

At the New York Stock Exchange, the day ended with 224 new highs and 58 new lows, while the number of stocks that rose exceeded the number that fell by a ratio of 1.17 to 1.

On the Nasdaq exchange, the number of stocks that closed in the plus was 1905 versus 2400 that ended the day in decline, reflecting a predominance of the latter by approximately a ratio of 1.26 to 1.

The S&P 500 index recorded 41 new highs for 52 weeks and just one new low, while Nasdaq registered 102 new highs and 131 new lows.

The trading volume on American exchanges reached 11.16 billion shares, compared with an average of 12.41 billion over the last 20 trading sessions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română