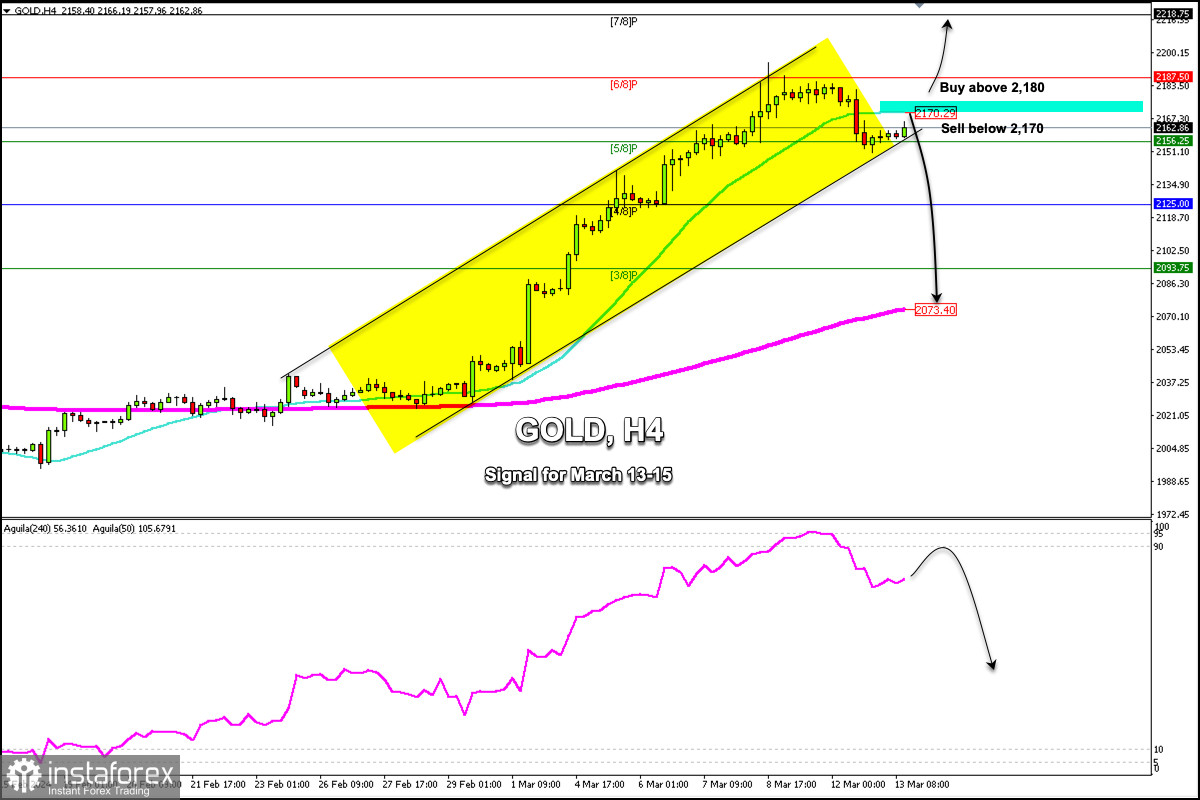

Early in the American session, Gold (XAU/USD) is trading around 2,162, below the 21 SMA, and within the trend channel forming since February 29, but showing signs of exhaustion.

Yesterday, gold fell sharply as a result of higher-than-expected US inflation data. This caused an increase in Treasury bond yields which in turn, forced gold to lose more than $30 from 2,184 to 2,150.

We see a recovery in gold. It is now trading above 5/8 Murray which could mean it could face the strong resistance of 2,170 (21 SMA). In case gold fails to break and consolidate above this zone, we could expect a bearish acceleration and it will be seen as an opportunity to sell. In the short term, the instrument could reach 2,125 and even the 200 EMA located at 2,073.

According to the eagle indicator, gold reached the 95-point zone on March 8th which represents a strongly overbought market. It means that gold could go ahead with the technical correction in the coming days and could reach 2,073 (200 EMA).

Gold could resume its bullish cycle if it consolidates above 2,180 on the H4 chart. Then, we could expect it to reach 2,187 in the next few days, and finally, 7/8 Murray at 2,218.

Our trading plan for the next few days will be to sell gold below 2,170 (21 SMA), with targets at 2,156, 2,125, 2,093, and finally, at 2,073. We should avoid selling only if gold returns or trades above the 6/8 Murray at 2,187.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română