EUR/USD

Unfortunately, the dollar did not directly correlate with the stock market, continuing its choppy corrective fall. Now, the correlation has become typical during the crisis, especially when taking into account falling bonds and oil prices. The euro has been declining for 12 consecutive weeks, which is already a record for the single currency.

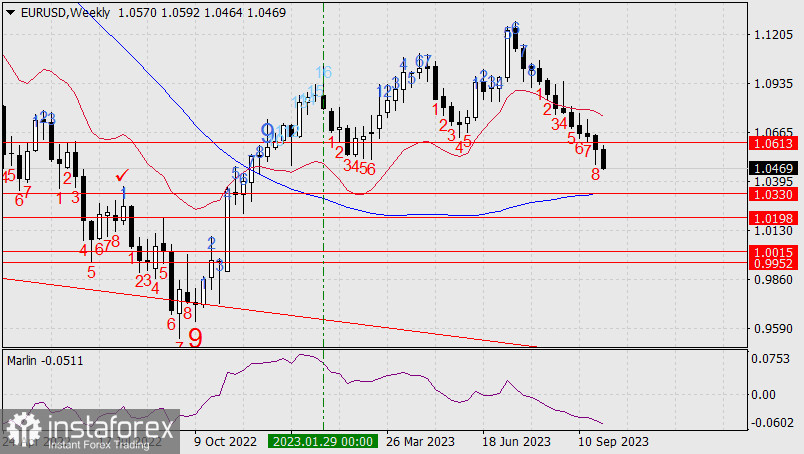

But what does the Sequential indicator show us? It indicates that the pair may continue to fall for another week, and a reversal may occur after the 13th week of decline according to this indicator's algorithm. In January 2023, the reversal occurred even after the 16th week of growth. Here, we see that the nearest reversal (from the 9th candle) may occur from the level of 1.0330 (MACD line), and if the count of descending candles continues, then it would be from the level of 1.0198 (the peak of August 2022). In this scenario, the correction could be so deep that the bar count starts again from one, which would mean that the euro will fall significantly below parity.

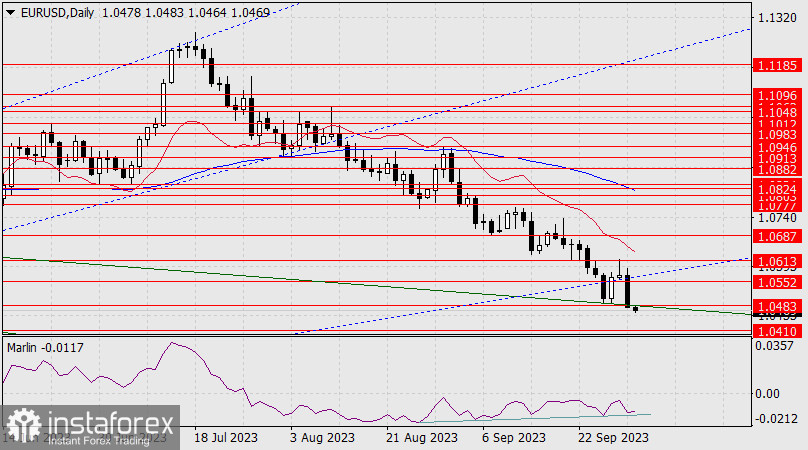

The current corrective structure of the decline is becoming increasingly deceptive. Now, on the daily chart, the price has fallen below the support level of 1.0483 and the embedded price channel line. To completely eliminate the signs of a reversal, the Marlin oscillator needs to move below the converging line to break the convergence and make it invalid. Formally, the 1.0410 target is already open.

On the 4-hour chart, the price is declining below both indicator lines, and Marlin is decreasing in the negative territory. There is a possibility of forming a convergence if the price consolidates above 1.0483. A bearish trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română