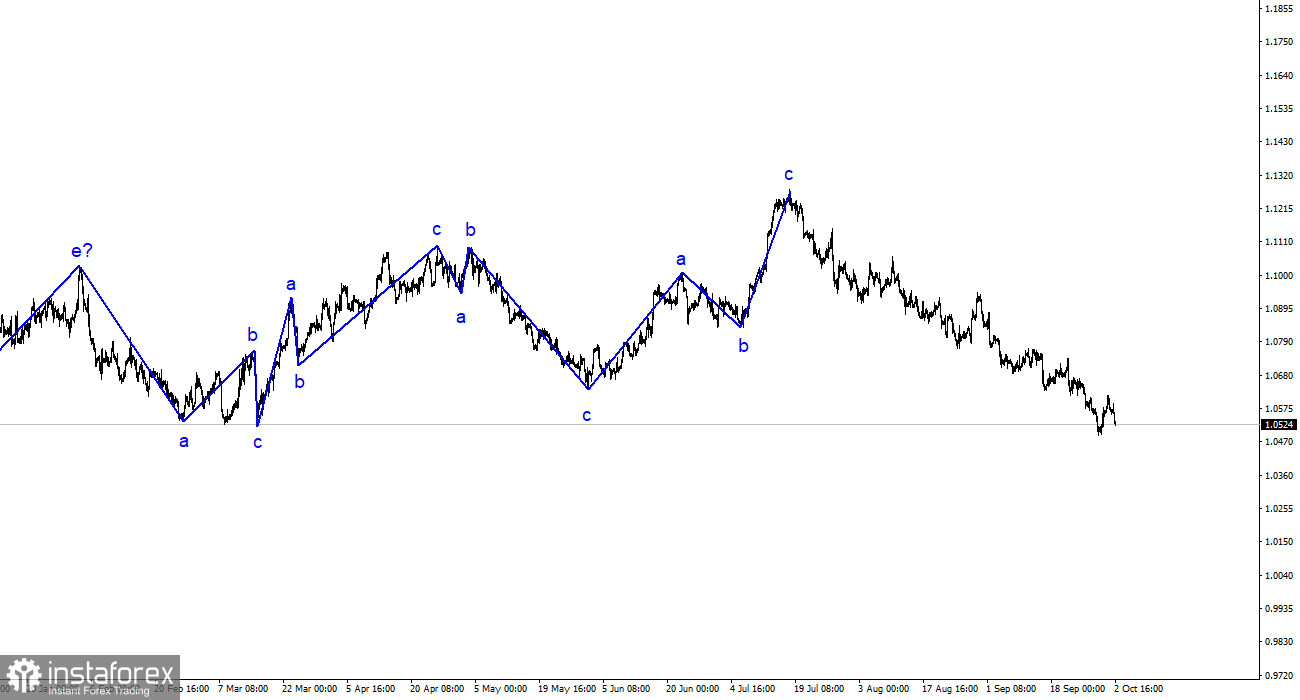

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that alternate with each other consistently. Over the past few months, I have regularly mentioned that I expected the pair to be around the 5th figure, from where the construction of the last ascending three-wave structure began. This week, that target was reached. The assumed first wave of the new descending trend segment may continue its formation, although there are currently signs of its completion. These signs are mostly related to the possible completion of the first wave of the British pound.

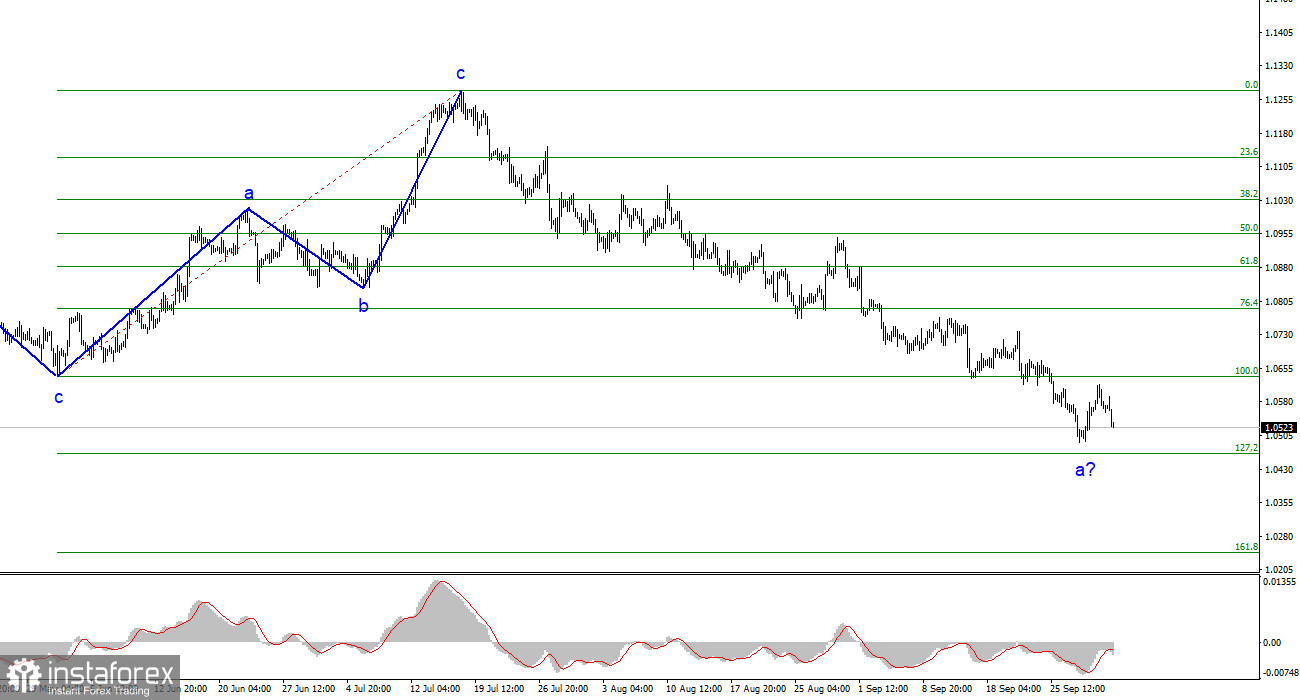

None of the recent price increases resembled a full-fledged wave 2 or b. Therefore, all of these were internal corrective waves within wave 1 or a. If this is indeed the case, the decline in quotes may continue for some time during this wave. This means that the overall decline of the European currency will not be completed yet, as the construction of the third wave is still required. Within the first wave, five internal waves can already be traced, so its completion is approaching. A successful attempt to break above the level of 1.0637, which is equivalent to 100.0% according to Fibonacci, currently indicates the market's readiness to continue selling the pair with targets located around 1.0463.

The euro is uncertain about how to react to inflation.

The euro/dollar pair's exchange rate fell by 60 basis points on Monday. Demand for the euro continued to decline almost overnight. It started falling on Friday, to be precise. Honestly, I had questions about the pair's decline even on Friday. Today, these questions have neither increased nor decreased. The economic reports released on Monday in the European Union and Germany were, if one could put it this way, "predictably poor." The Business Activity Index in the manufacturing sector of Germany increased in September, but it increased from 39.1 points to 39.6 points. Obviously, such growth is challenging to attribute to the euro's positive factors. The same goes for the Business Activity Index in the manufacturing sector of the entire European Union. The indicator decreased from 43.5 points to 43.4 points. In other words, it remained practically unchanged. The unemployment rate remained unchanged at 6.4%, but the value of the previous month (July) was revised upward to 6.5%.

Based on all of the above, none of the reports had the potential to boost the euro. However, these reports should not have caused a significant decline in the European currency either. Therefore, I believe that the market maintains a "bearish" sentiment and has not yet completed the construction of the descending wave. This is why the demand for the EU currency continues to decline at such a pace. At this rate, the euro may fall much lower than the 5–6 figures I mentioned in recent months.

General Conclusions:

Based on the analysis conducted, I conclude that the construction of a downward wave set continues. The targets in the range of 1.0500–1.0600 have been ideally worked out, but the decline may continue for some time. Therefore, I continue to recommend selling the pair. Since the descending wave has not completed near the level of 1.0637, we can now expect a decline to the level of 1.0463, which is equivalent to 127.2% according to Fibonacci. However, the second corrective wave will start sooner or later on its own.

On a larger wave scale, the wave analysis of the ascending trend segment has taken on an extended form, but it is likely completed. We have seen five upward waves, which are most likely the structure of a-b-c-d-e. After that, the pair built four three-wave structures: two downward and two upward. Now, it has probably moved on to the stage of building another extended three-wave descending structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română