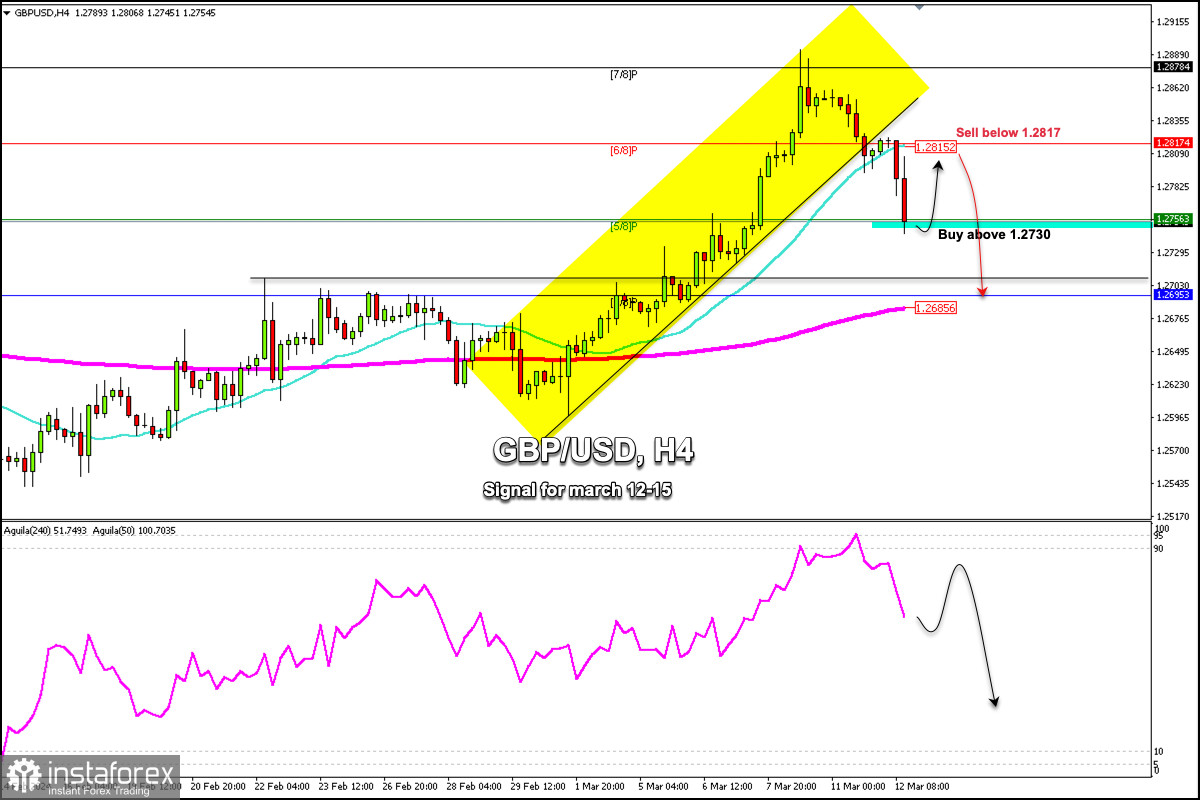

The British pound is trading around 1.2756, below the 21 SMA, and below 6/8 Murray, with a technical correction after reaching 7/8 Murray. We can see on the H4 chart that the British pound dropped below 1.2815 after breaking sharply from the uptrend channel. Now GBP/USD could be showing signs of a trend reversal but we should expect a technical bounce to occur around 5/8 Murray which could be seen as a buying opportunity.

GBP/USD could find strong support around 1.2730. This level coincides with weekly support and could allow us to buy on the technical rebound. So, the instrument could reach 1.2815.

Technically and according to the H4 chart, the British pound has a negative outlook. GBP/USD is expected to reach the 200 EMA located at 1.2685 in the short term. If it consolidates below this area, the next target could be the psychological level of 1.25.

For the British pound to resume its bullish cycle, the instrument should consolidate above 6/8 Murray at 1.2817. Then, we could look for buying opportunities with the target of 1.2878. GBP/USD could even reach the psychological level of 1.30.

Conversely, as long as the British pound trades below 1.2817 (6/8 Murray), the outlook will remain negative and any technical bounce will be seen as an opportunity to sell with targets at 1.2685 and 1.2580.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română