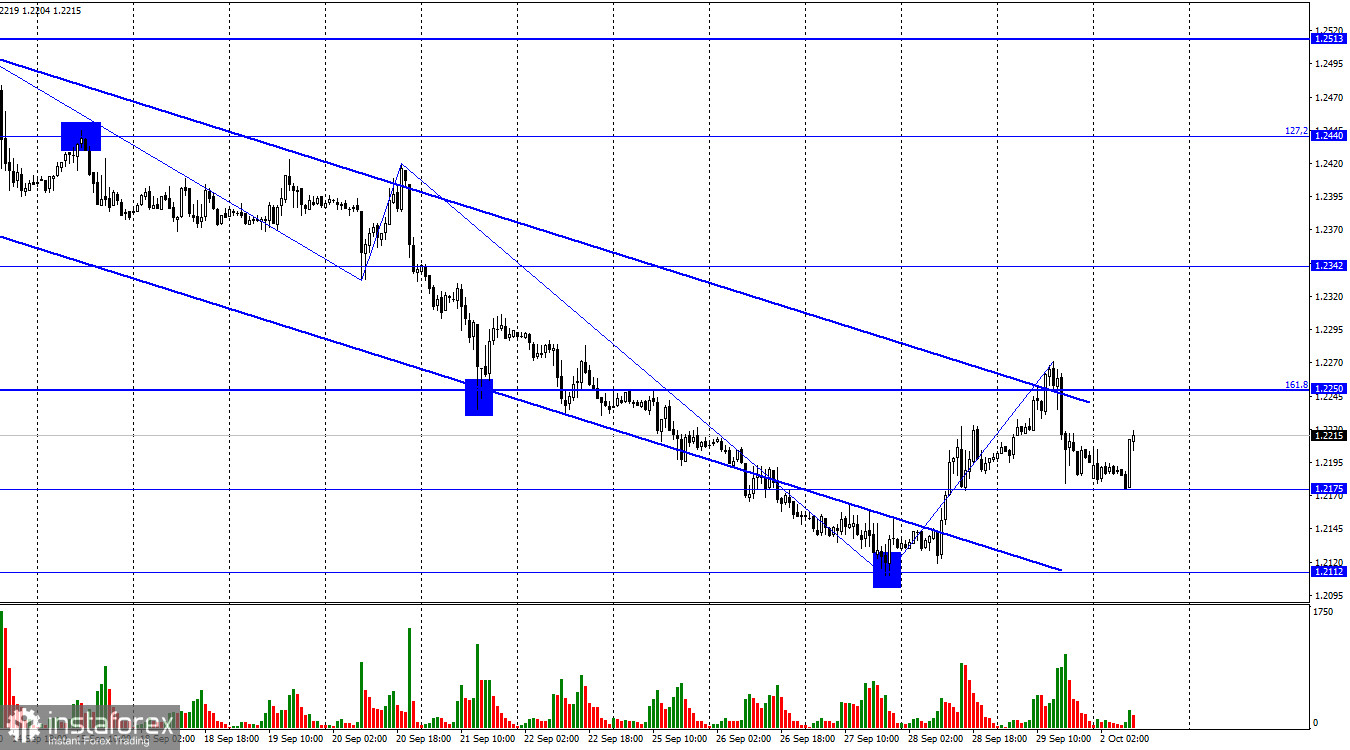

On the hourly chart, the GBP/USD pair reversed course around the corrective level of 161.8% (1.2250) in favor of the US dollar on Friday, falling to the level of 1.2175. This is a new level; I added it today. A sustained break below this level will favor further declines towards the 1.2112 level. A rebound from there will allow us to expect a return to the 1.2250 level. The descending trend channel, albeit reluctantly, still maintains a bearish trend.

The waves still indicate only a bearish trend. A fairly strong bullish wave formed on Thursday and Friday last week, but the previous bearish wave was even stronger, so the overall picture has not changed. If Friday's downward wave does not break the low of September 27th, it will be the first sign of the end of the bearish trend. But as of Monday morning, I would not rush to draw such a conclusion.

The British economy continues to grow from quarter to quarter, but these data do not have a strong impact on traders' sentiment. For a long time, only two factors mattered in the market: inflation and interest rates. Now all three central banks have almost completed their tightening procedures, so both inflation and interest rate expectations are no longer as significant as before. Thus, the fact that the British economy is still growing in the midst of a strict monetary policy does not add too much optimism to bullish traders. For now, they can expect a correction, but not an upward trend.

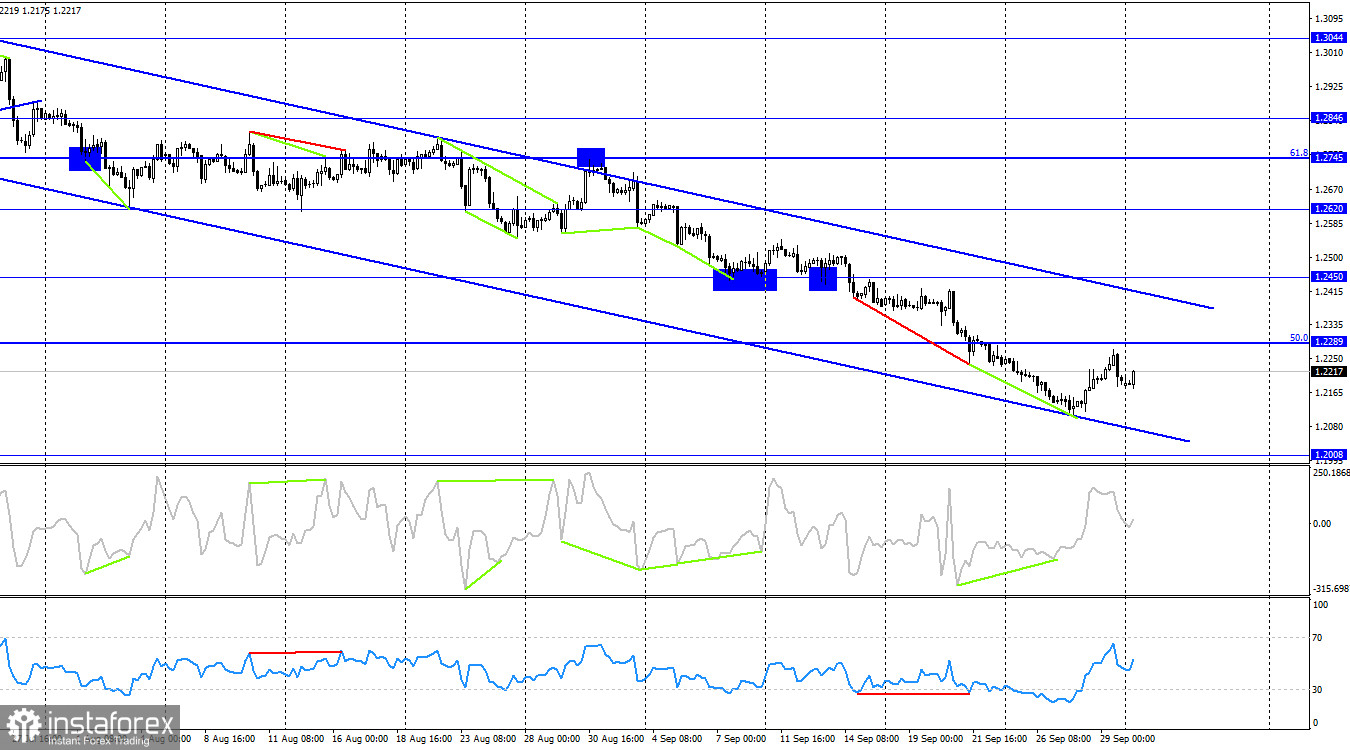

On the 4-hour chart, the pair reversed in favor of the British pound after forming a bullish divergence on the CCI indicator. Thus, a process of growth has begun towards the corrective level of 50.0% (1.2289). A rebound from the 1.2289 level will allow us to anticipate a reversal in favor of the US dollar and a resumption of the decline towards 1.2008. A sustained break above the 1.2289 level increases the likelihood of further growth towards the upper boundary of the descending trend channel.

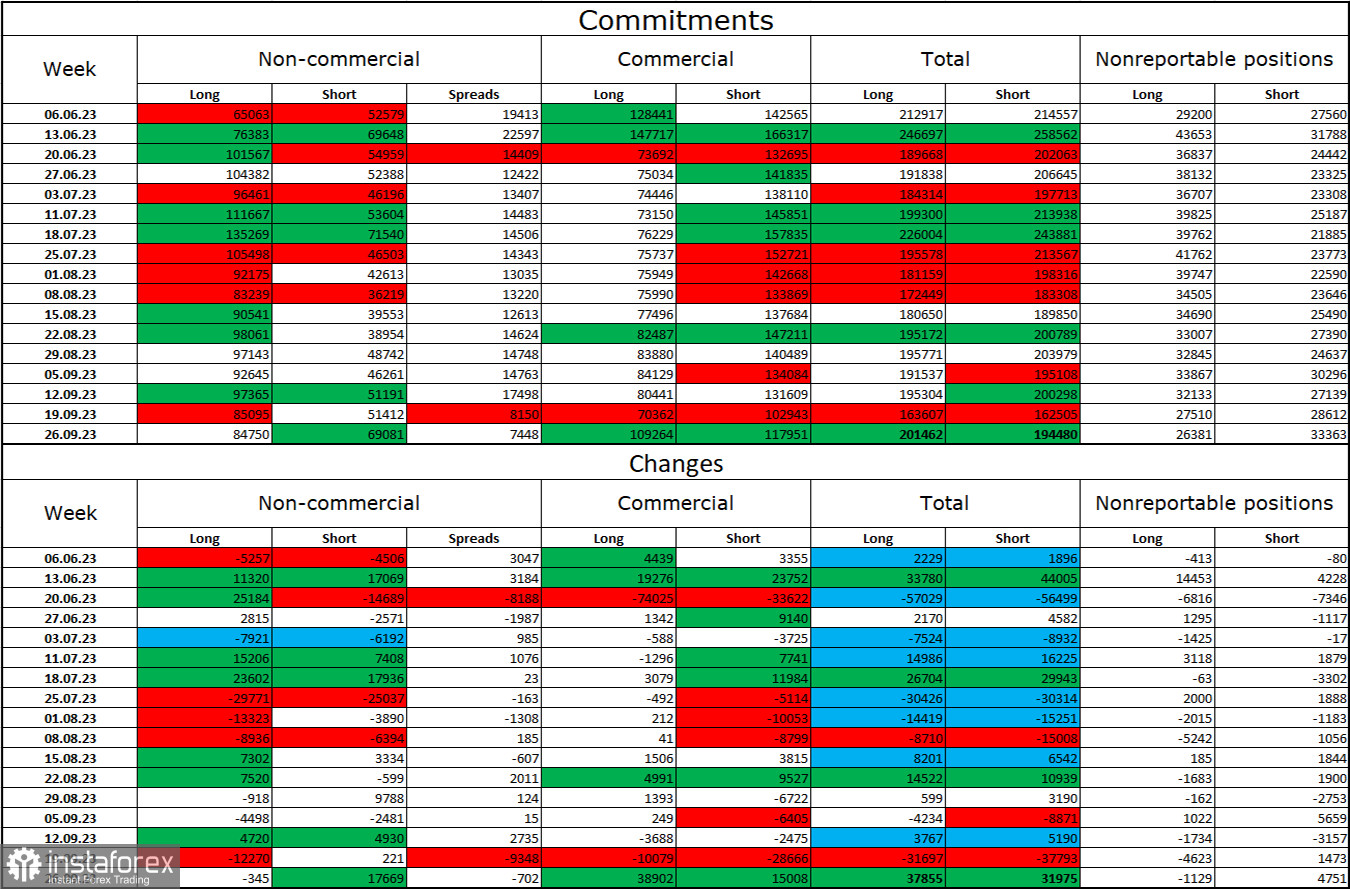

Commitments of Traders (COT) Report:

The sentiment in the "non-commercial" trader category became less bullish again during the last reporting week. The number of long contracts held by speculators decreased by 345 units, while the number of short contracts increased by 17,669 units. The overall sentiment of major players remains bullish, but the gap between the number of long and short contracts is shrinking every week; it's already 85,000 versus 69,000. In my opinion, the pound had good prospects for further growth two months ago, but now many factors have turned in favor of the US dollar. I do not expect a strong rally in the pound sterling in the near future. I believe that over time, bulls will continue to liquidate their buy positions, as is the case with the European currency.

Economic Calendar for the United States and the United Kingdom:

United Kingdom - Manufacturing Purchasing Managers' Index (PMI) (08:30 UTC).

United States - Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) (14:00 UTC).

United States - Speech by the Federal Reserve Chairman, Mr. Powell (15:00 UTC).

Monday's economic calendar includes several interesting entries, with at least two of the three considered important (American). The impact of the news flow on market sentiment today may be of moderate strength.

Forecast for GBP/USD and Trader Recommendations:

Selling the pound was possible on a bounce from the 1.2250 level, with targets at 1.2175 and 1.2112 on the hourly chart. The first target has been reached. I wouldn't recommend rushing into buying today; there is a possibility of a resumption of the decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română