The US PCE inflation data, an inflation gauge the Federal Reserve follows closely, turned out to be slightly weaker than expected. Annual changes met expectations, due to revisions of previous months' data; overall prices rose 3.5% in August, slightly higher than the 3.4% increase in July, due to rising gas prices.

The core personal-consumption expenditures price index rose 3.9% YoY in August from 4.3% in July, the lowest level since September 2021. New York Fed President John Williams suggested that the Fed may have completed its rate hike cycle, but warned that rates would need to be kept at a high level for some time. He also stated that the U.S. central bank is "at or near the peak" of its policy rate now, as inflationary pressures have significantly eased. Futures markets continue to expect about a 10 bps rate hike during the remaining two Fed meetings this year.

On Saturday, the U.S. Congress approved a plan to keep the federal government open until mid-November, a decision made just 3 hours before the deadline. The risk of a government shutdown could risk policy missteps for the Fed, even if inflation doesn't decrease as expected. Consequently, U.S. Treasury bond yield prospects are uncertain, as there is a risk of a downgrade by Moody's.

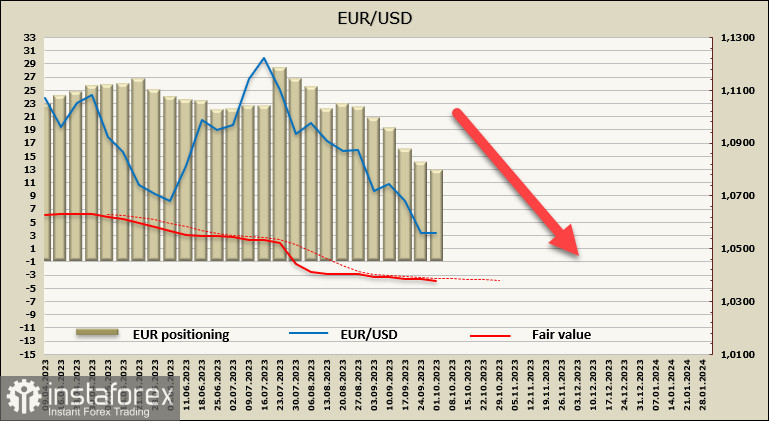

EUR/USD

Inflation in the eurozone has dropped to its lowest level in almost two years. Consumer prices rose by 4.3% YoY in September, compared to 5.2% in the previous month, while core inflation increased by 4.5% YoY. Both figures came in below expectations, even though the market had previously digested weaker regional data.

The government debt to GDP ratio in the Euro Area fell to 91.5% at the end of 2022 and is likely to drop below 90% this year. On one hand, this is below the upper threshold of 93% seen after the eurozone debt crisis in the mid-2010s, but on the other hand, it's still far from the 84% low recorded in 2019.

The math is simple. Currently, the budget deficit in the eurozone is expected to be 2.9% of GDP in 2024. To further reduce the debt-to-GDP ratio next year, nominal GDP would need to grow by more than 3.3%, which is highly unlikely.

The European Central Bank will likely have to choose between too-high inflation relative to its target or a growing debt-to-GDP ratio. Consequently, it is difficult to expect the euro to rise with such conditions under any scenario, whether it involves inflation above the target level or concerns about the sustainability of debt.

The net long EUR position decreased by 0.6 billion to 13 billion over the reporting week, and the trend persists. The price is below the long-term average, indicating a weak but clear trend.

The pair has reached the 1.0514 target that we mentioned in the previous review, but it has not managed to consolidate below this mark. We view the upward pullback as a correction, and there is no basis for a full-scale reversal. The nearest resistance, where the corrective rise may end, is the upper band at 1.0620/40, and we expect the pair to fall after a brief consolidation. The nearest support is the technical level of 1.0405, representing a 50% correction from the euro's rise since September 2022.

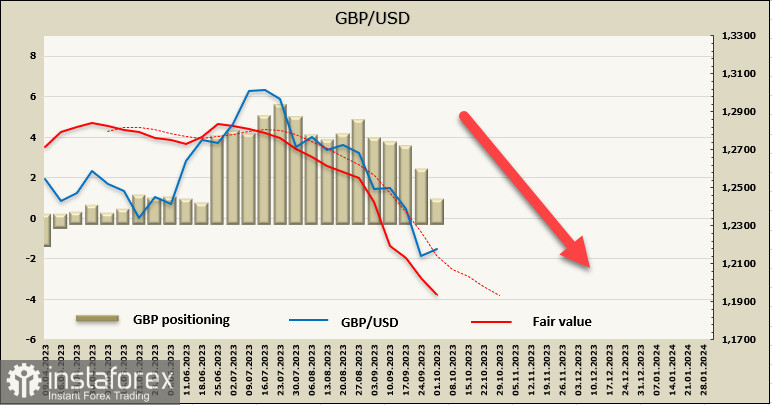

GBP/USD

On Friday, the UK's National Office for Statistics published a series of positive reports. UK GDP is estimated to have increased by an unrevised 0.2% in the 2nd quarter, in line with forecasts, and annual growth increased from 0.4% to 0.6%. There is also an increase in commercial investments and consumer credit, which is good for the overall economy but hinders the goal of reducing consumer demand as a key factor in combating inflation.

Good macroeconomic indicators may provide short-term support for the pound since there's a high probability of a shift in the Bank of England's stance towards a more hawkish position. However, the market views such data as secondary, so significant corrective growth is not expected.

The net long GBP position sharply decreased by 1.4 billion to 1.2 billion over the reporting week. The speculative bias is still in the bullish side, but the trend is obvious, and after the blatantly dovish meeting of the BoE, there are no reasons to expect a reversal of market expectations in favor of buying. The price is distinctly heading downwards.

The pound is falling and has not yet reached the target of 1.2074 indicated earlier this week. We assume that there will be another attempt in the near future. Resistance for a corrective rise is near 1.2305, and there are no grounds to expect the pound to move higher. The long-term target is 1.1740/90.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română