The EUR/USD pair corrected higher on Friday. The bears clearly overestimated their strength: the fourth figure proved to be beyond their capabilities, although they did test the support level at 1.0500. But it's one thing to "dip" briefly into the territory of the fourth figure, and quite another to settle in this price range. As a result, sellers gave up, and buyers took the initiative, as they pushed the price towards the boundaries of the sixth price level.

A corrective phase began on Thursday, and on Friday, it was fueled by influential inflation data. On the other hand, the reports didn't particularly move the pair in one specific direction (in favor of the euro and against the dollar). However, the market interpreted them precisely this way.

There is certainly some logic in this. After all, if the European Central Bank has effectively put an end to the current cycle of tightening monetary policy, the Federal Reserve has tied the fate of interest rates to the dynamics of inflation. Therefore, Friday's reports, which reflected a slowdown in inflation both in the eurozone and the US, hit the greenback harder than the single currency. This prompted the bulls to organize a fairly large counterattack. However, it's not advisable to trust this price movement.

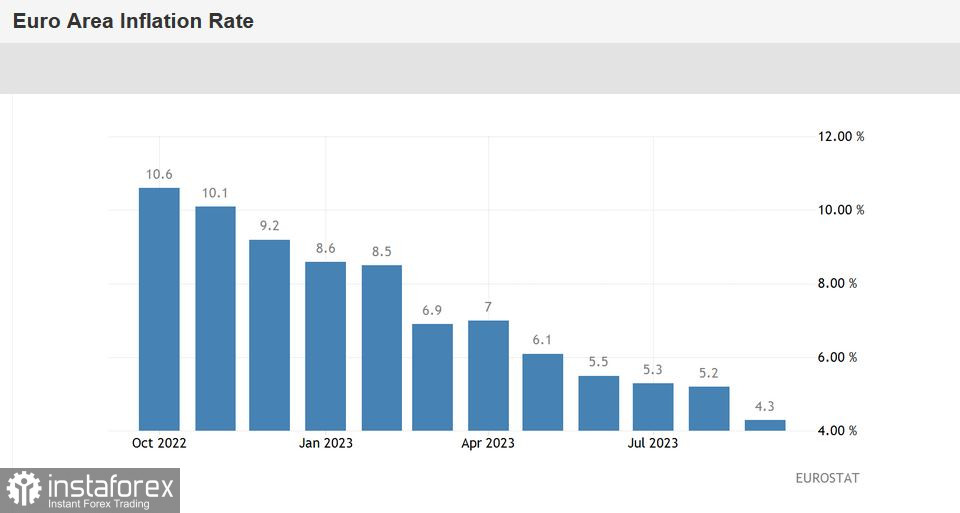

Inflation in the eurozone has slowed to a two-year low

On Friday, traders eyed reports on European inflation and the US core Personal Consumption Expenditure Price Index. These reports are rarely published on the same day, but that was the case on Friday.

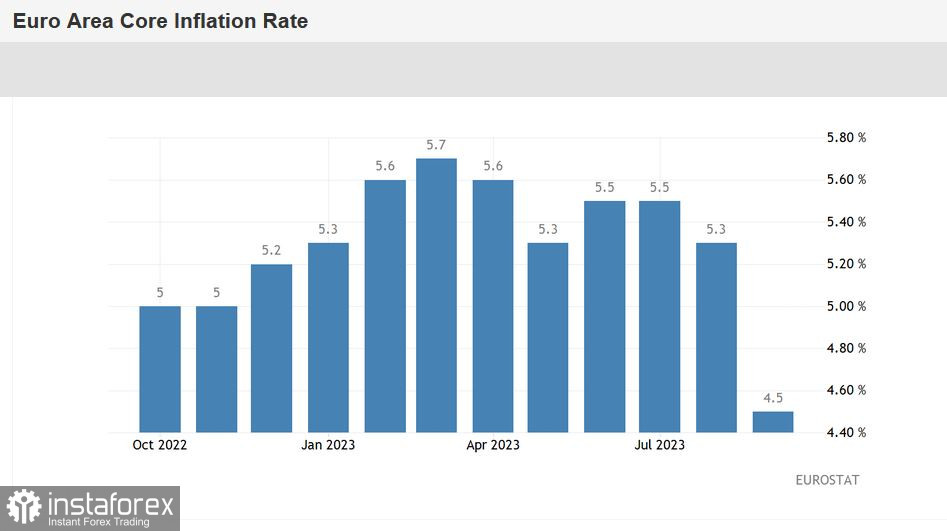

According to the data, eurozone consumer prices rose at an annual rate of 4.3% in September, against forecasts of 4.5%. The indicator has been steadily declining for the past five months, despite rising oil prices. Take note that this was the lowest level since October 2021. The core index, excluding energy and food prices, also entered the "red zone," reaching 4.5% (versus a forecast of 4.8%). We have to take note of several points here. Firstly, the core CPI in September decreased quite sharply from the August value of 5.3%. Secondly, the indicator fell below the 5% mark for the first time since August 2022. And thirdly, for the first time in many months, both the overall and core indices entered the "red zone," showing a "synchronized" decline.

The structure of this data indicates that energy prices fell by 4.7% on an annual basis after declining by 3.3% in August. The growth in prices for food, alcohol, and tobacco products slowed to 8.8% (from the previous figure of 9.7%), and for services, it slowed to 4.7% (from the August figure of 5.5%).

In other words, inflation is slowing down at an active, even preemptive pace. This confirms the validity of the ECB's actions, which put the process of tightening monetary policy on hold (after the September rate hike), placing hopes on the cumulative effect of earlier decisions.

In the grand scheme of things, Friday's report did not have a decisive impact in the context of any ECB counteractions. Even if all components of the data had come out at the forecast level (or even in the "green zone"), the ECB would have continued to hold its defense, maintaining the status quo at the upcoming meetings. But the disclosed figures effectively put an end to the discussion of whether the central bank would raise interest rates in the near future. The answer is clear: no, it will not.

Core PCE Index: expected decrease

On the other hand, intrigue persists in the US, although the chances of an upcoming Fed rate hike has decreased following the release of the Core PCE Index. Recall that after the September meeting, the Fed signaled that it could raise interest rates at one of the two remaining meetings in 2023 – either in November or December. Such intentions were reflected in the "dot plot" (12 out of 19 members of the Committee contemplated a rate hike), and Fed Chair Jerome Powell also discussed this at the concluding press conference. However, once again, the Fed tied this issue to inflation, which has recently been picking up (Consumer Price Index, Producer Price Index).

However, Friday's data tilted the scales towards a wait-and-see position. The core Personal Consumption Expenditures (PCE) Price Index in the United States came in at 3.9% on an annual basis. On the one hand, the reading met expectations. But on the other hand, it's the slowest pace of growth since September 2021. In monthly terms, the index increased by 0.1% (against an expected rise of 0.3%). This is the lowest value of the index since July 2022.

Conclusions

The latest reports reflected a slowdown in inflation in the eurozone, as well as a decline in the Core PCE Index – a crucial inflation indicator closely monitored by members of the Fed. The bulls benefitted from the latest data, due to reduced hawkish expectations regarding the Fed's future course of actions. According to the CME FedWatch Tool, the probability of a rate hike in November is currently only 15%. In December, it is at 30%.

The dollar came under pressure, but it's still risky to consider long positions in the EUR/USD pair. Firstly, buyers failed to break through the resistance level at 1.0610 (the Tenkan-sen line on the daily chart), despite the impulsive price growth. This is a telling sign of how indecisive the bulls are.

Secondly, a shutdown is looming ahead. As early as Monday, hundreds of thousands of U.S. government employees could be placed on unpaid leave as Congress fails to pass a budget for the next fiscal year. Without going into details, it can be stated that ultra-conservative Republicans in the House of Representatives will not allow a compromise solution – at least in the coming days. Therefore, the shutdown scenario is very likely, and in essence, guaranteed.

Amid risk-off sentiments, the dollar could regain its lost positions, especially against the euro, which has now completely lost hope of an ECB rate hike this year. In such an uncertain environment, it's not advisable to consider long positions at all, and it may be best to hold off on selling until Monday – by that time, the political crisis in the United States will either worsen (which is likely) or resolve (which is highly unlikely).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română