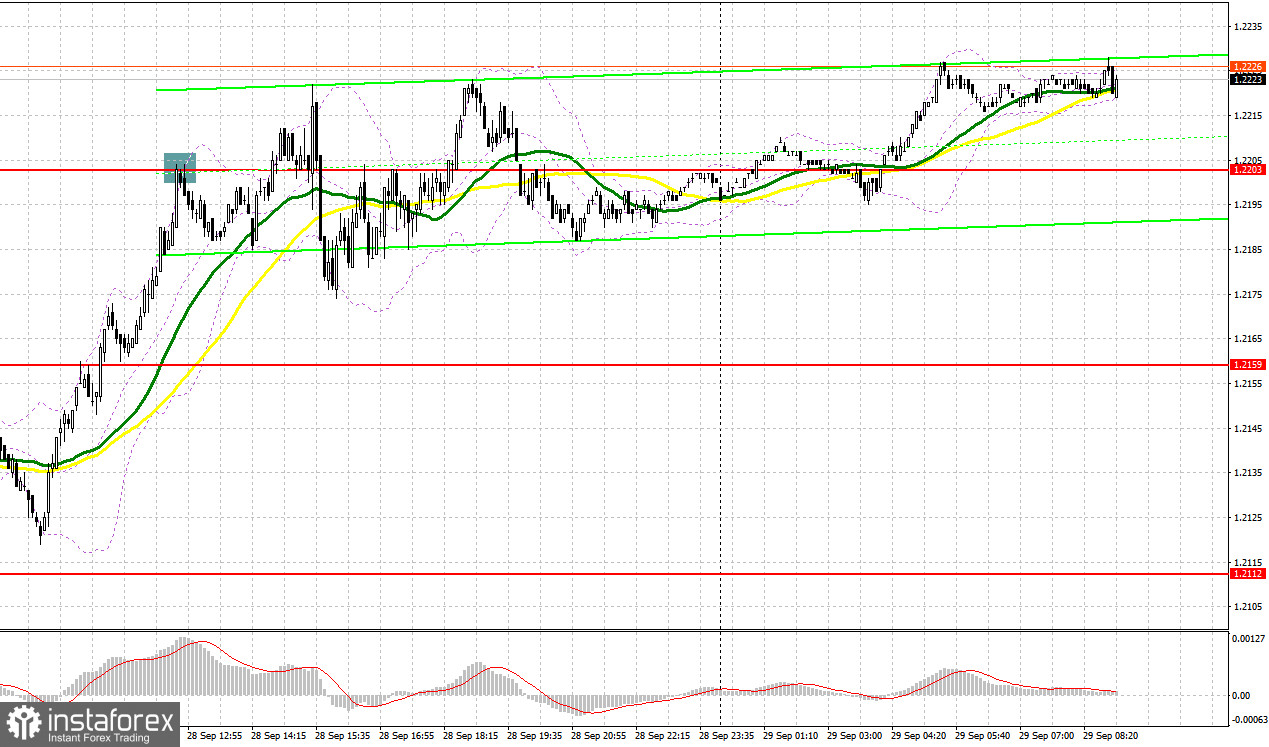

Yesterday, the pair formed several signals to enter the market. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2158 as a possible entry point. A rise to this level and its false breakout generated a sell signal but the pair failed to move down. As a result, I had to close positions with losses. A breakout and a retest of 1.2158 created an entry point into long positions, sending the price upwards by more than 30 pips. In the afternoon, selling activity on a false breakout at 1.2203 sent the quotes down by 15 pips but then the price rebounded from there.

For long positions on GBP/USD

Today's positive UK GDP data for Q2 has already lent support to the pair, but the spotlight now shifts towards lending figures. The change in the M4 money supply aggregate and the number of approved mortgage applications will be the primary growth driver (or possibly a downturn driver) for the pound in the first half of the day. Adverse figures and a decline in lending might push GBP/USD downward, a scenario I intend to capitalize on.

I plan to act only near the recent low of 1.2198, where the pound experienced significant buying yesterday. A false breakout at this level could provide an initial long entry against the bearish trend with a correctional target at the nearest resistance of 1.2247. A sustained move and consolidation above this range might pave the way for an extended bullish correction, bolstering buyers' confidence. This would signal the opening of long positions targeting 1.2280. The ultimate target would be the 1.2327 area where I'd be looking to take profits. If the pair declines to 1.2198 without buyer activity, bearish pressure on the pound will likely return, opening the path to a low of 1.2159, where the moving averages support the buyers. A false breakout here would signal long entries. I plan to instantly buy GBP/USD on a bounce from the 1.2112 low, aiming for a daily intraday correction of 30-35 pips.

For short positions on GBP/USD

Bears should guard the nearest resistance at 1.2247 closely. Otherwise, a resurgence in bearish pressure by month-end seems unlikely. An ideal scenario would be a false breakout at this level, generating a sell signal with a movement towards the day's fresh low at 1.2198. Breaching this level and subsequently retesting it from below would challenge the bullish sentiment, providing a window to target support at 1.2159. A further aim remains at this month's low of 1.2112, where I'd be taking profits. Should GBP/USD rise and remain unchallenged at 1.2247 (with buyers having all the momentum), I'd postpone short positions until a false breakout at 1.2280 occurs. If there is no downward movement there, I'd sell the pound on an immediate rebound from 1.2327, targeting an intraday correction of 30-35 pips.

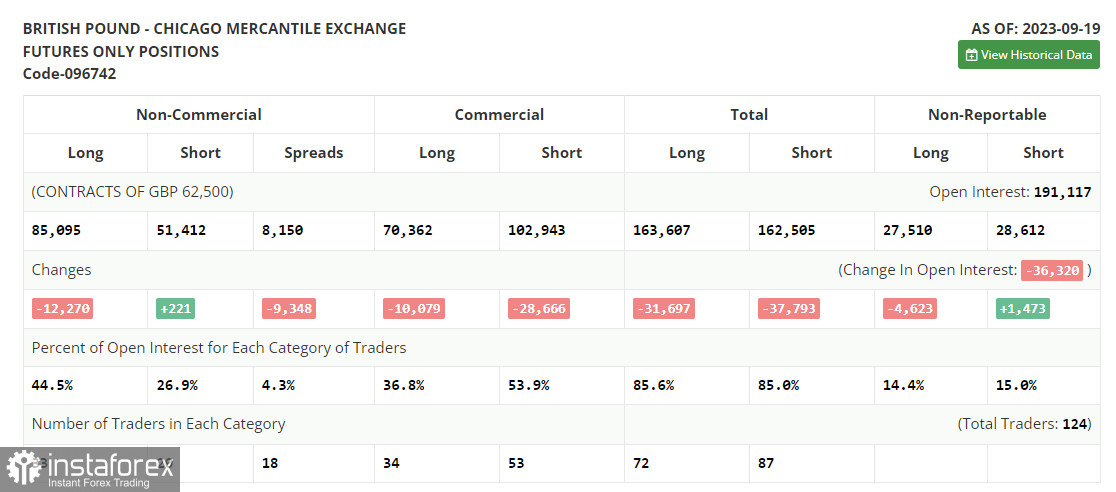

COT report

The Commitments of Traders report for September 19 a decline in long positions and a minor increase in short positions. This suggests that while the number of pound buyers is decreasing, there is not a pronounced rise in sellers. Recent data showing a reduction in UK inflation influenced the Bank of England's decision to maintain steady interest rates, surprising many in the process. Traders perceived this news negatively, as it seems the regulator might be at the peak of its interest rate hiking cycle, making the pound less appealing in its current stance. Given the potential for the UK economy to show significant deceleration in Q3, it is no wonder the pound is facing downward pressure against the US dollar. The latest COT report reveals that non-commercial long positions declined by 12,270 to stand at 85,095, while non-commercial short positions increased by only 221, reaching 51,412. Consequently, the spread between long and short positions narrowed by 9,348. The weekly closing price dropped to 1.2390 from 1.2486.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates the formation of an upward correction.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.2185 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română