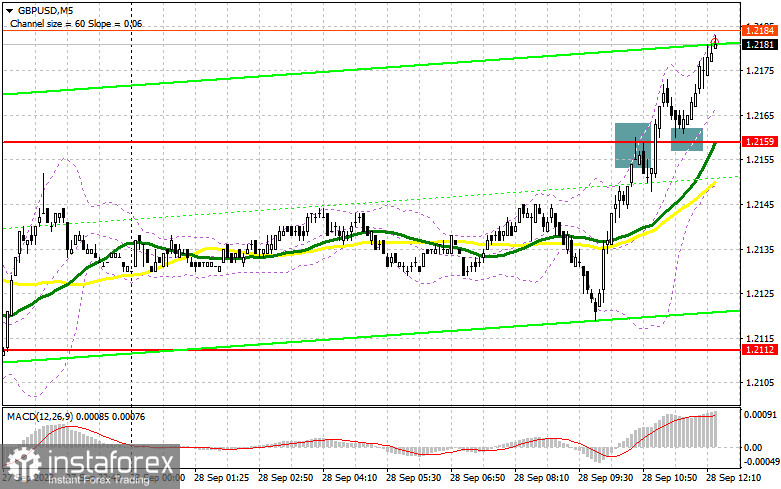

In my morning forecast, I drew attention to the level of 1.21589 and recommended making entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 1.2158 signaled a sell-off, but there was no downward movement, which resulted in loss fixation. The breakthrough and the subsequent retest of 1.2158 allowed for another entry point into long positions, resulting in an upward movement of more than 30. I did not revise the technical picture for the second half of the day.

To open long positions on GBP/USD, the following is required:

The further direction of the pound will depend on the reaction to US data: the number of initial jobless claims and the change in GDP for the second quarter of this year will be the drivers for further pound growth if the indicators turn out worse than economists' forecasts. The speech of the Chairman of the Federal Reserve, Jerome Powell, who last week mentioned the possibility of a peak in interest rates, could also help the pound in the second half of the day. However, in the event of a drop in GBP/USD in all of these events, I prefer to act around the level of 1.2159, which buyers actively defended in the first half of the day. The formation of a false breakout at 1.2159 will allow for another entry point into long positions with a correction to 1.2203. A breakthrough and consolidation above this range will strengthen buyer confidence, giving a signal to open long positions with a target at 1.2247, where I expect more significant sellers. The ultimate target will be the area of 1.2280, where I will make a profit. In the case of a decline to 1.2159, as well as the absence of activity from buyers in the second half of the day, pressure on the pound will return. In this case, only the defense of 1.2112, as well as a false breakout there, will signal an entry into long positions. I plan to buy GBP/USD immediately on a bounce from 1.2072, targeting a pair correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Apparently, the correction for the pound is gaining momentum, so be extremely cautious with sales in these conditions. Only the defense of the nearest resistance at 1.2203, combined with very strong labor market statistics in the United States, where the number of weekly initial jobless claims is expected to decrease again, will allow for a false breakout at 1.2203 and entry points for short positions. The target in this case will be the new support at 1.2159. A breakthrough and retest from the bottom up of this range against the backdrop of hawkish comments from Federal Reserve Chairman Jerome Powell regarding future interest rates will deal a serious blow to bullish positions, allowing for a drop to support at 1.2112. The more distant target remains the area of 1.2072, where I will take a profit. However, a move to this level will only occur in the case of a very hawkish position by the Federal Reserve Chairman. In the case of an uptrend in GBP/USD during the American session and the absence of activity at 1.2203 in the second half of the day, buyers will have an excellent opportunity to build an upward correction. In this case, I will postpone sales until a false breakout at 1.2247. In the absence of downward movement even there, I will sell the pound immediately on a rebound from 1.2280, but only with the expectation of a pair correction down by 30-35 points within the day.

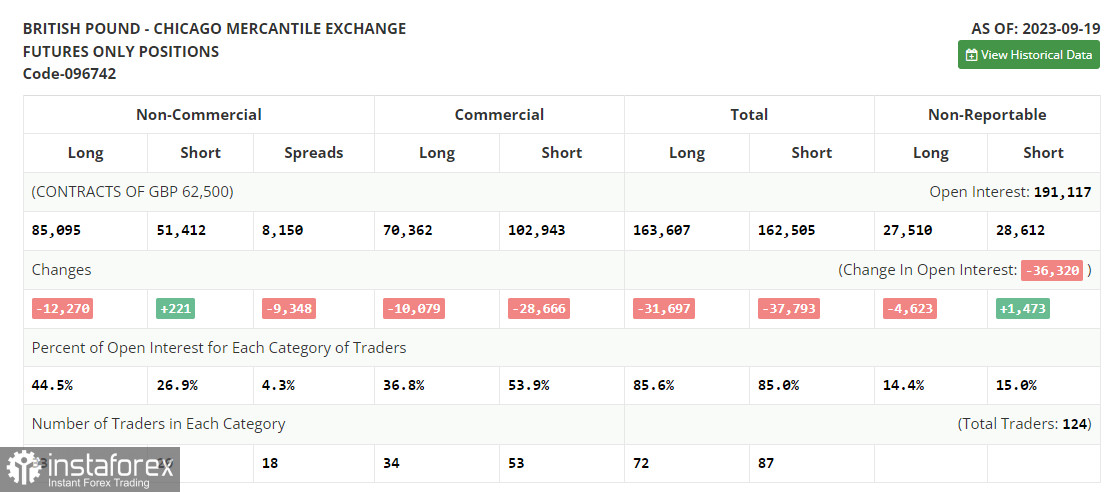

In the COT report (Commitment of Traders) as of September 19th, there was a reduction in long positions and a minimal increase in short positions. This indicates that while there are fewer buyers of the pound, there is no clear increase in sellers. The released data on inflation reduction in the UK influenced the decision of the Bank of England, which kept interest rates unchanged, surprising many. Traders perceived this news as negative, as the regulator appears to be at the peak of its rate hike cycle, making the pound less attractive in this position. Considering that the UK economy may demonstrate a sharp slowdown in the third quarter, it's not surprising that the pound is actively declining against the US dollar. The latest COT report indicates that long non-commercial positions decreased by 12,270 to 85,095, while short non-commercial positions increased by only 221 to 51,412. As a result, the spread between long and short positions decreased by 9,348. The weekly price dropped and amounted to 1.2390, compared to 1.2486.

Indicator Signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating the formation of an upward correction for the pound.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decrease, the lower boundary of the indicator around 1.2112 will act as support.

Description of Indicators:

Moving average (determines the current trend by smoothing volatility and noise). Period - 50. Marked on the chart in yellow.Moving average (determines the current trend by smoothing volatility and noise). Period - 30. Marked on the chart in green.MACD indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages). Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.Bollinger Bands. Period - 20.Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The total non-commercial net position is the difference between the short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română