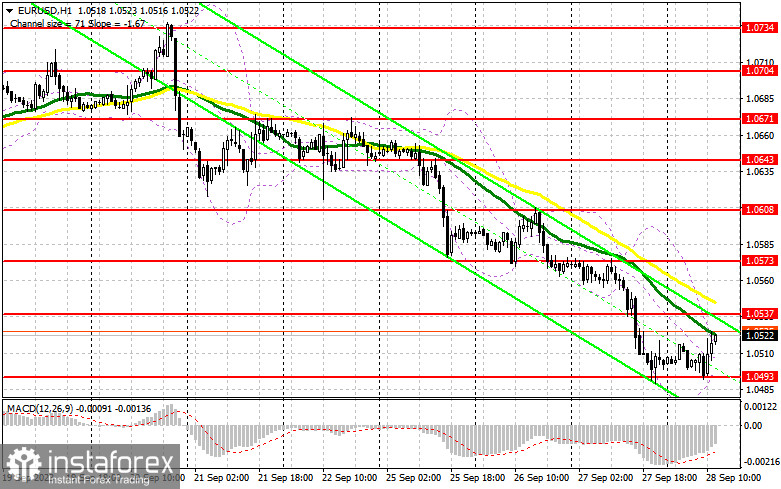

In my morning forecast, I drew attention to the level of 1.0516 and recommended making trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout created an excellent selling entry point for the euro. However, at the time of writing this article, the downward movement did not materialize, indicating a relatively high level of euro buyers' activity around the annual lows. For this reason, I decided to exit the market and reevaluate the technical picture for the second half of the day.

To open long positions on EUR/USD:

The euro has slightly risen after data showed that inflation in the German regions began to weaken, while in Spain, it showed a sharp increase. Ahead, we have data on overall price pressure in Germany as well as several important statistics from the United States. The number of initial jobless claims and the change in GDP for the second quarter of this year will be the drivers for the euro's growth if the figures turn out worse than economists' forecasts. However, do not forget that in the evening, we will have a speech by the Chairman of the Federal Reserve, Jerome Powell, who is likely to remind the markets that the committee plans to continue its fight against inflation, which will positively affect the dollar's positions. Considering the upward correction of the pair, I plan to act only on declines, particularly around the new support level of 1.0493 formed at the end of the European session. The formation of a false breakout there will provide a good entry point for long positions, with the expectation of an upward correction of the pair to retest the resistance at 1.0536, where moving averages that favor sellers are located. Only a breakthrough and a top-down test of this range will strengthen demand for the euro, giving a chance for a surge towards 1.0573. The most distant target will be the area around 1.0608, where I will take a profit. In the case of a decline in EUR/USD and a bearish reaction to Powell's statements, as well as the absence of activity at 1.0493 (the annual low), the downward trend will continue to develop. In this case, only the formation of a false breakout around 1.0439 will signal an entry into the market. I will consider opening long positions from 1.0395 with the aim of an upward correction within the day by 30-35 points.

To open short positions on EUR/USD:

Clearly, sellers need a break, which can lead to a larger upward correction of the euro. To develop a bearish market, we need good statistics from the United States and the protection of the nearest resistance at 1.0537. A false breakout at this level will create a good entry point for selling with a downward movement to the new annual low of 1.0493. Only after a breakthrough and consolidation below this range, as well as a bottom-up retest, do I expect to receive another selling signal with the target of reaching 1.0439, which will restart the bearish market. The most distant target will be the area around 1.0395, where I will take a profit. However, movement to this level will only occur in the case of a very hawkish stance by the Fed Chairman. In the event of an upward movement in EUR/USD during the American session and the absence of bears at 1.0537, buyers will have a good chance of a pair recovery. In this scenario, I will postpone short positions until the new resistance at 1.0573, where the euro has already fallen once yesterday. It's possible to sell there, but only after an unsuccessful consolidation. I will consider opening short positions from the maximum of 1.0608 with the aim of a downward correction within the day by 30-35 points.

In the Commitment of Traders (COT) report as of September 19th, there was a sharp reduction in long positions and an increase in short positions. Negative changes in the eurozone economy and the risk of further interest rate hikes by the ECB have all contributed to the continued development of the bearish market. Not even the Fed's decision to keep rates unchanged helped the euro, although it should be noted that policymakers made it clear that they do not rule out another increase in borrowing costs in the United States by the end of this year. The COT report indicates that non-commercial long positions decreased by 4,952 to 207,424, while non-commercial short positions increased by 6,147 to 105,443. As a result, the spread between long and short positions narrowed by 8,290. The closing price decreased to 1.0719 from 1.0736, indicating a bearish market.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), and they differ from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In the case of an uptrend, the upper boundary of the indicator around 1.0530 will act as resistance.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period - 50. Marked in yellow on the chart;

• Moving average (determines the current trend by smoothing volatility and noise). Period - 30. Marked in green on the chart;

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9;

• Bollinger Bands (Bollinger Bands). Period - 20;

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements;

• Long non-commercial positions represent the total long open position of non-commercial traders;

• Short non-commercial positions represent the total short open position of non-commercial traders;

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română