On the hourly chart, the GBP/USD pair fell to the level of 1.2112 on Wednesday and rebounded from it. The long-awaited rebound gives traders hope for a reversal in favor of the British pound and some growth towards the level of 1.2201. If the pair's exchange rate consolidates below the level of 1.2112, it will benefit the US currency and continue to fall towards the next Fibonacci level of 200.0%–1.2039.

For the sixth day in a row, a downward wave is forming. There are no signs of the "bearish" trend ending. There are no signs of the current downward wave ending. At best, they will appear if an upward wave is formed now and the next downward wave does not break the current low near the level of 1.2112, which cannot even be considered the low of the wave yet. In any case, this task has a time frame of several days, at the very least.

Yesterday, the British pound continued to decline. The report on orders for durable goods in the United States supported the dollar, and in addition, there was a speech by Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, who often takes a "hawkish" view. In the current circumstances, almost the entire FOMC holds a "hawkish" view. Kashkari stated that interest rates may need to be raised even more, but he did not want to make forecasts now. There is still a month and a half until the next FOMC meeting, during which time at least one inflation report will be released. If the Consumer Price Index starts to decline again, new tightening may not be necessary. But at the moment, everything is moving towards another rate hike by the FOMC by the end of the year.

On the 4-hour chart, the pair continues to decline and has consolidated below the corrective level of 50.0% (1.2289). Thus, the decline of the British pound may continue towards the next level of 1.2008. A new "bullish" divergence is looming on the CCI indicator, which allows for some growth, but it has not yet formed. The level of 1.2112 on the hourly chart has a chance to stop the free fall of the British pound.

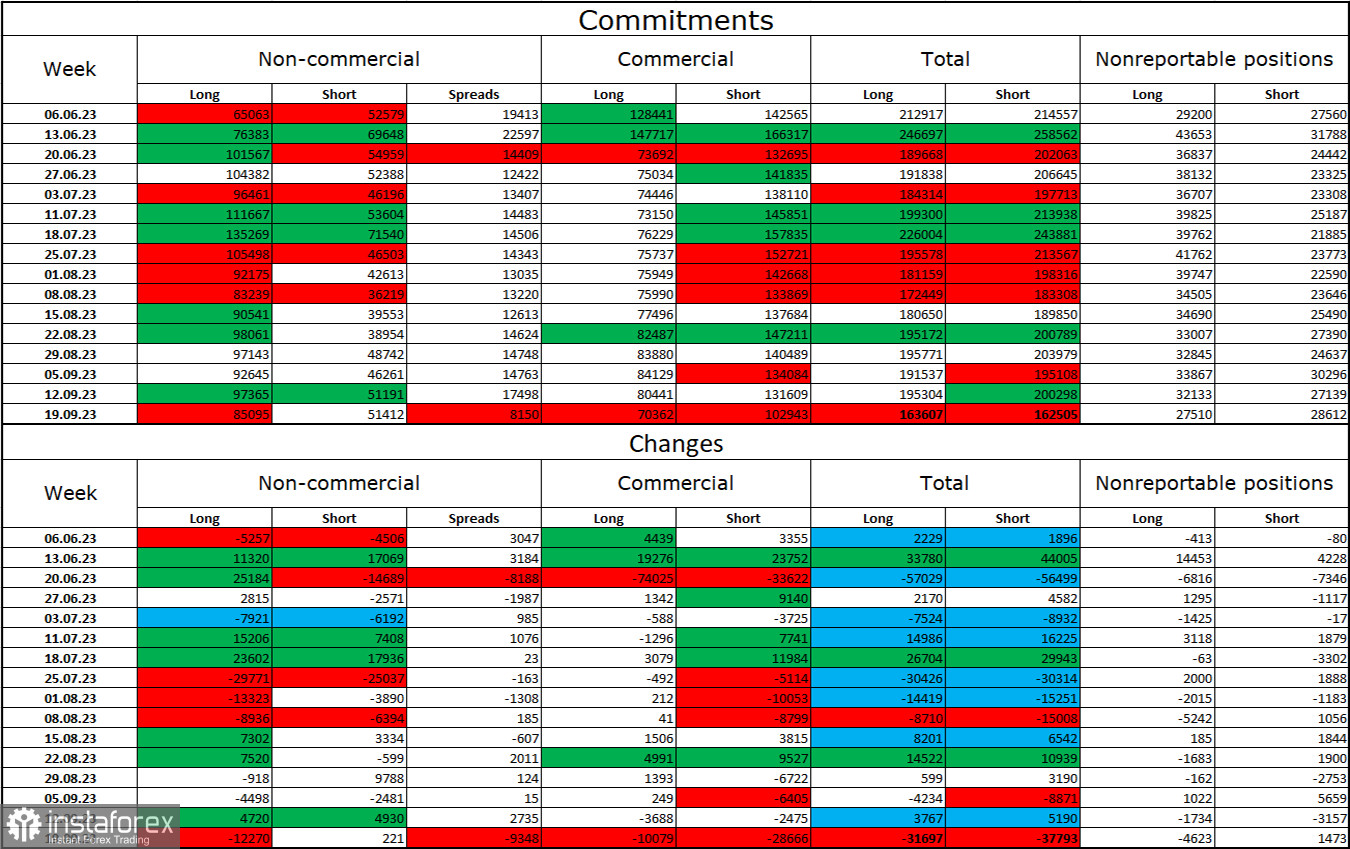

Commitments of Traders (COT) report:

The sentiment of "non-commercial" traders in the last reporting week has become less "bullish" again. The number of long contracts held by speculators decreased by 12,270 units, while the number of short contracts increased by 221 units. The overall sentiment of major players remains bullish, and the gap between the number of long and short contracts is shrinking every week: already 85,000 versus 55,000. In my opinion, the British pound had decent prospects for further growth, but now many factors have turned in favor of the US dollar. I do not expect a strong rise in the pound sterling in the near future. I believe that over time, bulls will continue to liquidate their buy positions, as is the case with the euro. Only the Bank of England can change the market situation if it continues to raise rates longer than planned, but the last meeting showed that this factor should not be counted on.

News calendar for the US and the UK:

US - GDP in the second quarter (12:30 UTC).

US - Initial jobless claims (12:30 UTC).

US - Speech by the head of the Federal Reserve, Mr. Powell (20:00 UTC).

On Thursday, the economic events calendar contains several quite important entries. The impact of the information background on market sentiment today may have a moderate effect.

Forecast for GBP/USD and trader recommendations:

Selling the pound was possible upon closing below 1.2201, with a target of 1.2112 on the hourly chart. The target has been met. New sales - upon closing below 1.2112 with a target of 1.2039. Buying is possible today upon a rebound from the level of 1.2112 on the hourly chart, with a target of 1.2201.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română