Markets have paused their sell-off in anticipation of crucial US inflation data set to be published this Friday.

Notably, this recent sell-off was not haphazard, which seems to reflect a consensus among investors that no impending broad-scale financial crisis in the US is coming. While events of the past weeks have culminated in heightened market reactions, the pivotal question remains whether the sell-off will continue. As mentioned earlier, the spotlight will be on tomorrow's US inflation figures.

According to the consensus forecast, the core Personal Consumption Expenditures (PCE) Price Index is expected to maintain a monthly growth rate of 0.2%, while annually, it might decline to 3.9% from 4.2%. However, the overall PCE figure is anticipated to increase to 3.5% from 3.3%. Simultaneously, personal income is predicted to rise to 0.4% from 0.2% the previous month, while spending could decrease from 0.8% to 0.5%.

Given these projections, the data could present a mixed picture. Market participants will closely watch for hints regarding the Federal Reserve's future interest rate decisions. It is well-known that the Fed often factors in the core PCE value when determining rate hikes. A decline in this indicator, even in line with predictions, could suggest a broader consumer inflation dip. This might, in turn, persuade the Fed to hold off on rate hikes and only signal potential future increases if deemed necessary.

Considering the unfolding scenario, we believe that if tomorrow's data, especially from the US, does not disappoint investors, it might serve as a catalyst for renewed purchases of risk assets, a reduction in Treasury yields, and consequently, a weakening of the US dollar in the forex market.

Daily forecast:

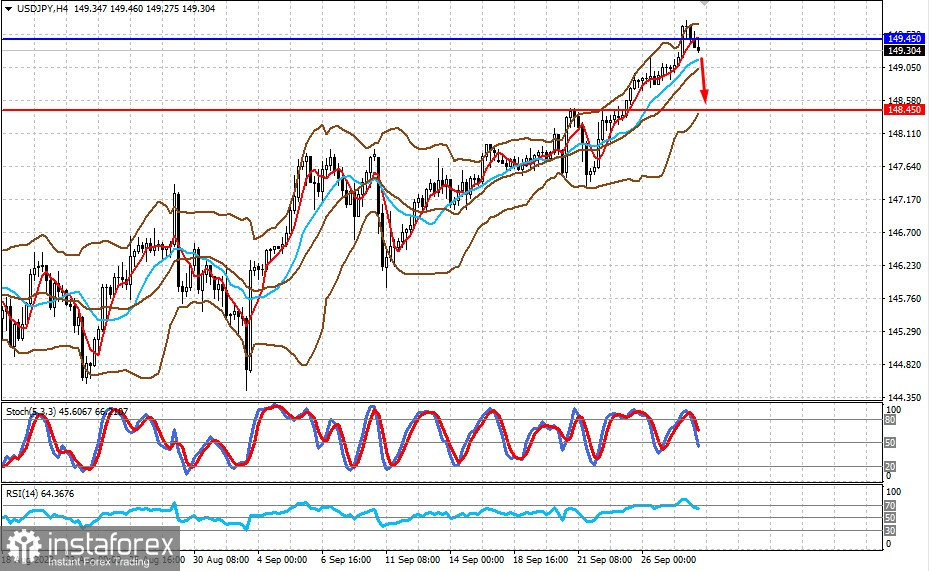

USD/JPY

The pair has shown a downward reversal and is trading below the 149.45 mark. A decline in US Treasury yields in anticipation of tomorrow's inflation figures could push the pair down to 148.45.

USD/CAD

The pair is currently trading above the 1.3485 mark, and any decline below this point could amplify the bearish pressure on the pair, potentially leading to a drop towards the 1.3400 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română