Another day has passed in the forex market, and once again, the British pound and euro both closed lower. On any given day, we can identify certain factors that may have pulled down the euro and pound while boosting the dollar (although it may look the opposite on charts). However, the weak news background, in my humble opinion, is not the cause of the almost daily decline in demand for European currencies.

First of all, there have been no news updates from the UK since the Bank of England's meeting. Nevertheless, the British pound has been declining every day. One might assume that it's due to American news, but there's a problem with this hypothesis: there haven't been any important news or reports from the US either. Of course, reports are occasionally published, and FOMC members make statements, but not all of them strongly support the dollar, and not all of them are significant enough to boost the US currency.

Based on all of the above, I believe that the news background we receive every day is not the reason why the dollar keeps rising. On Wednesday, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said that there's nearly a 50-50 chance that interest rates may need to move significantly higher than previously anticipated, which was difficult to predict in advance. Kashkari also said that everybody on the Federal Open Market Committee is committed to bringing inflation back down to the Fed's 2% target, and the accelerated pace of inflation over the past two months now suggests that the Bank would then have to raise rates further, possibly as soon as November. Did Kashkari's remarks boost the dollar on Wednesday? Theoretically, they could have, but then why was demand for the US currency decreasing over the past year when the FOMC was raising rates every one and a half months?

I believe that currently, several factors are working in favor of the US currency. This includes concerns about global economic conditions, the prolonged rise of the euro and pound, which had to come to an end at some point, and the dovish stances of the European Central Bank and the Bank of England. In addition, the strong state of the US economy compared to the European and British economies also contributes to this trend. I believe that in the near future, corrective waves will begin to form, but then we will see a new decline, which could sink both instruments even lower than their current positions.

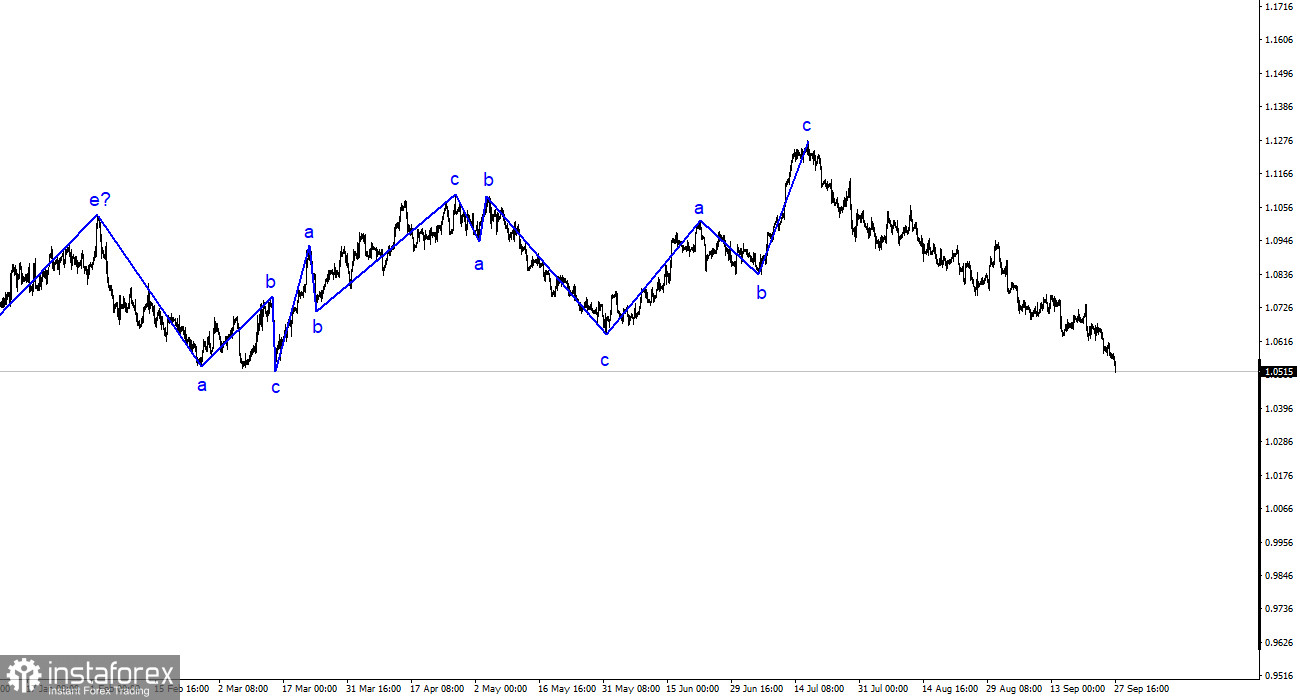

Based on the analysis conducted, I came to the conclusion that a downward wave pattern is being formed. I still believe that targets in the 1.0500-1.0600 range for the downtrend are quite feasible, especially since they are quite near. Therefore, I will continue to sell the instrument. Since the downward wave did not end near the 1.0637 level, we can expect the pair to fall to the 1.05 mark and the level of 1.0465, which is equivalent to the 127.2% Fibonacci retracement. However, the second corrective wave will start sooner or later.

The wave pattern of the GBP/USD instrument suggests a decline within a new downtrend. At most, the British pound can expect the formation of wave 2 or b in the near future. However, even with a corrective wave, there are still significant challenges. At this time, I would remain cautious about selling, as an unsuccessful attempt to break below the 1.2115 level may indicate that the market is ready to form a corrective wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română