The market takes everything into account. This time it's about the bond market. The dynamics of the bond market influence other markets—Forex, stock indices, and ultimately the economy. If the yield on U.S. Treasury bonds continues to rise, it will further accelerate the sell-off in equities. The decline in the S&P 500 will begin to affect consumer sentiment and behavior, leading to a slowdown in GDP. In the initial stages, this is favorable for bears on EUR/USD, but in the end, it poses a risk of weakening the Fed's monetary policy—bad news for the U.S. dollar.

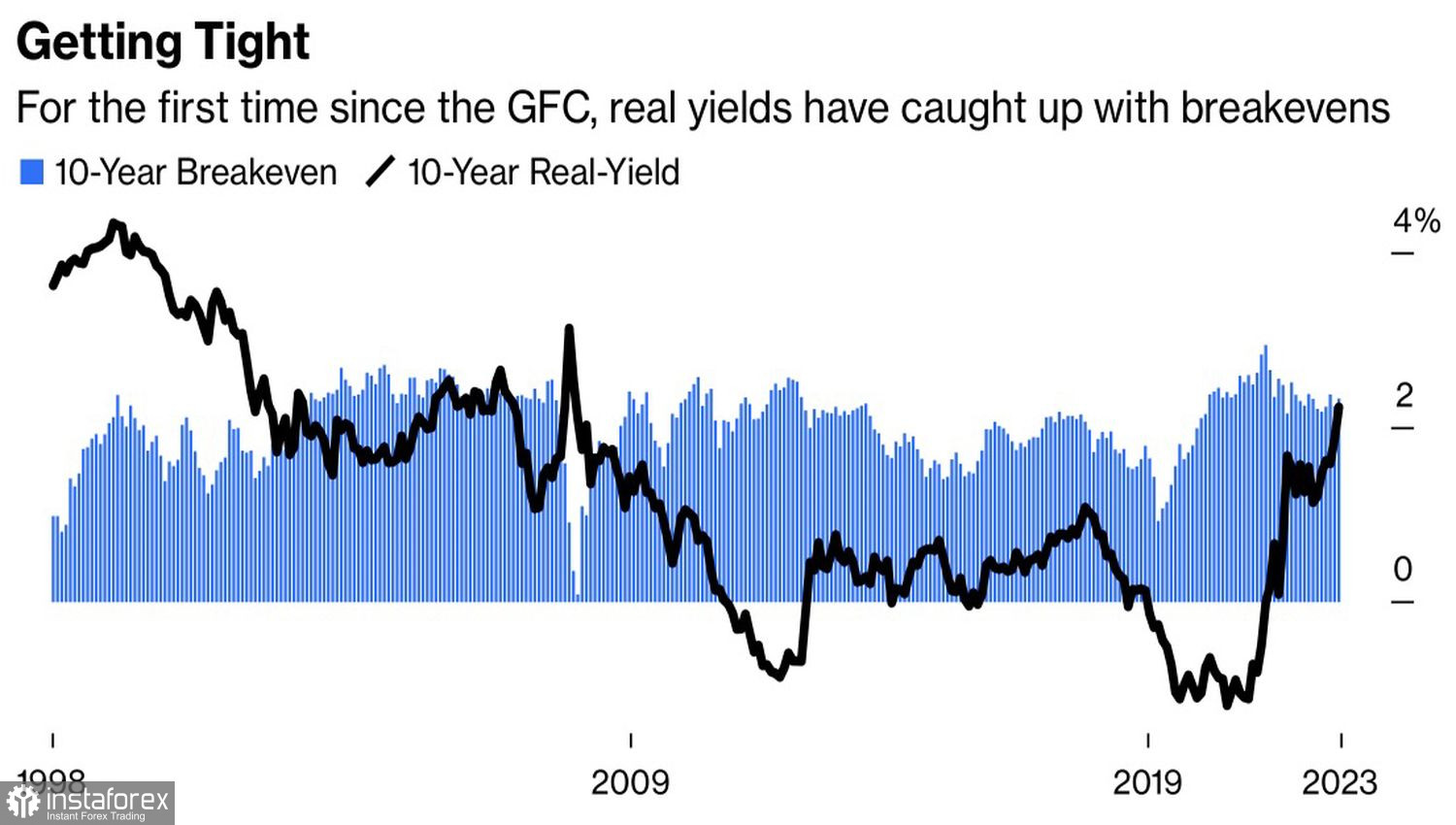

As the Federal Reserve has repeatedly noted, monetary tightening affects the U.S. economy with a time lag. The most damage is done by the rapid rise in real yields on U.S. Treasury bonds. Business and consumer costs increase, incomes fall, and GDP slows down.

Dynamics of U.S. bond yields

However, as long as this process is in its early stages, the U.S. dollar continues to benefit from the divergence in economic growth. U.S. stock indices outpace their European counterparts, which, according to Credit Agricole, is one of the drivers of the peak in EUR/USD. Two other drivers are external pressure and worsening internal problems. International trade volumes continue to decline, which negatively affects the export-oriented eurozone. At the same time, Bloomberg reports that the ECB intends to increase reserve requirement ratios, adding to the negative impact on the economy.

If the November–July rally in EUR/USD was based on expectations that the ECB would continue monetary tightening after the Fed puts an end to the process, the situation has changed now. Even the hawks at the European Central Bank are talking about keeping the deposit rate at 4% for an extended period. Meanwhile, even FOMC centrists are in favor of resuming the cycle. The interest rate differential between the U.S. and Europe may widen further, providing support for the U.S. dollar.

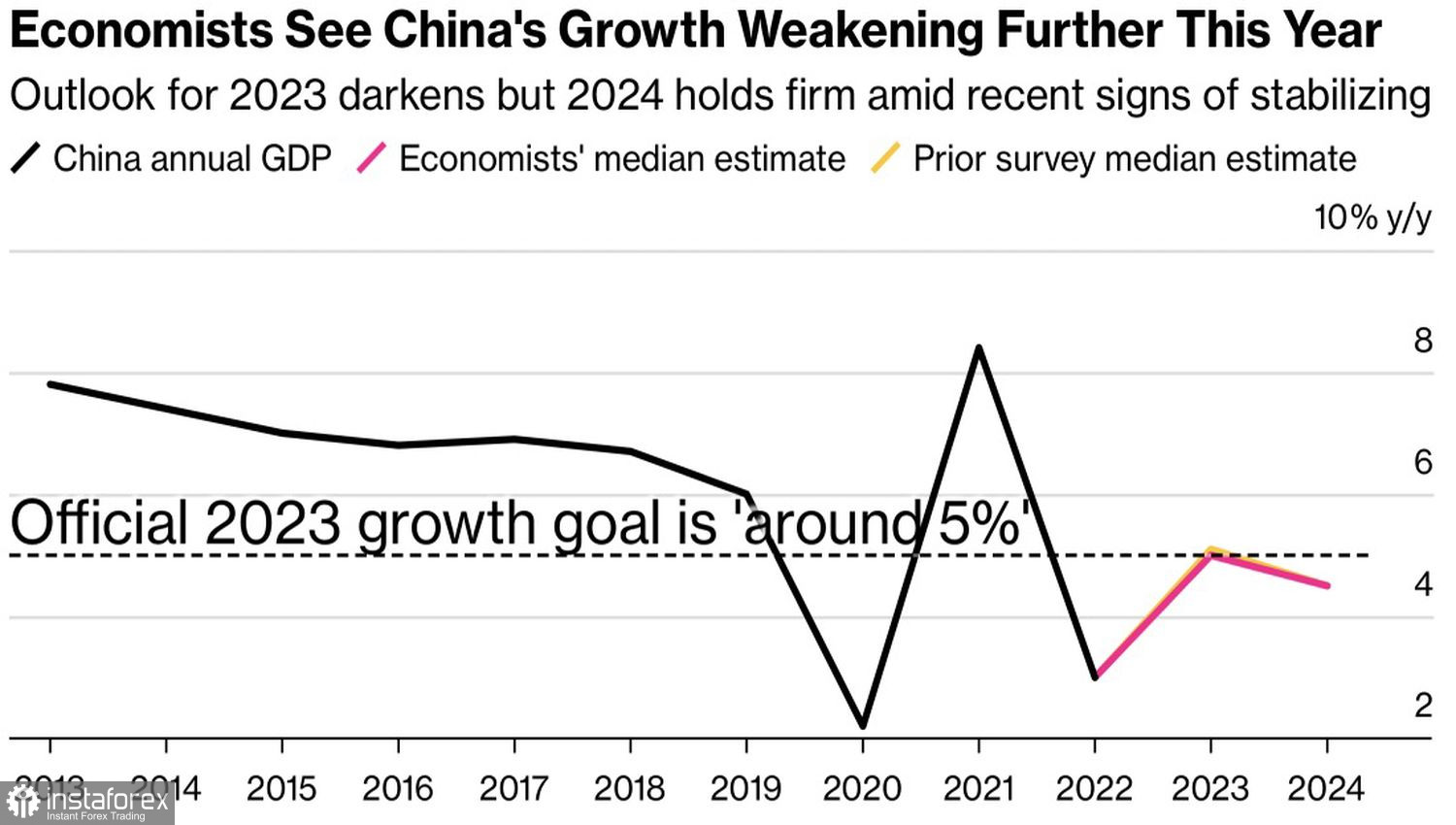

However, it is not advisable to assume that the euro has thrown in the towel. According to Bloomberg's expert forecasts, China may achieve its government target of 5% GDP growth. The acceleration of China's economy will provide support to the export-oriented eurozone.

Dynamics and forecasts for China's GDP

In the short term, a decline in U.S. Treasury bond yields could trigger a correction mechanism for EUR/USD. The reason is that Republicans and Democrats in the Senate have reached an agreement that the U.S. government shutdown will occur in mid-November rather than early October as previously expected. If their agreement is supported in the House of Representatives, U.S. debt yields and the dollar will decline.

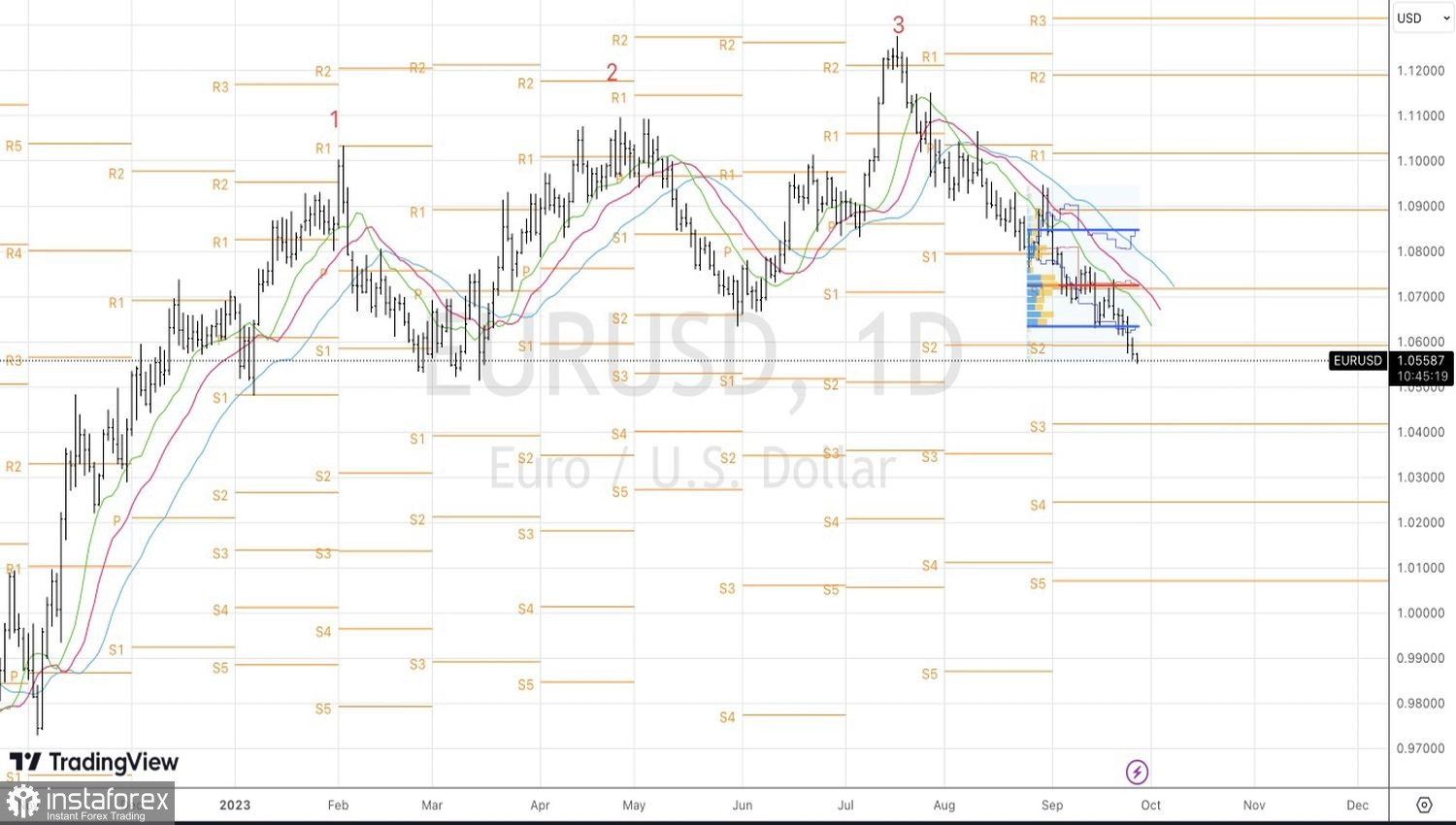

Technically, on the daily chart, the attacks by the bears on EUR/USD continue. However, a return of the main currency pair above the pivot level of 1.059 or a rebound from the convergence zone of 1.051–1.0535 would be grounds for profit-taking on previously established short positions and for a reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română