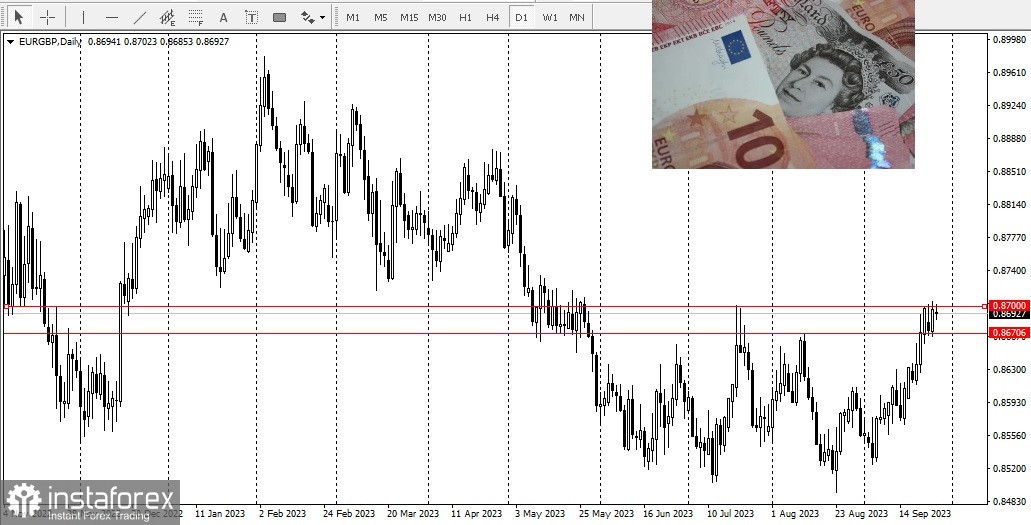

EUR/GBP continues to struggle at 0.8700.

On the one hand, pound is under pressure due to an unexpected pause by the Bank of England, following a recent slowdown in inflation. This is the main factor helping the pair rise, as it signals the cooling of the UK labor market, reigniting concerns about a recession. The Monetary Policy Committee voted to keep the key interest rate at 5.25%. Meanwhile, ECB President Christine Lagarde recently stated that interest rates would remain at their current levels for as long as necessary. ECB Executive Board member Frank Elderson also mentioned in an interview that interest rates could be raised again, which diminishes the belief that the ECB's next step will be a rate cut. This also supports the pair to rise.

On the other hand, concerns have intensified that a deep economic downturn in the eurozone

will prompt further rate hikes, especially after the disappointing publication of the forecasted consumer climate index for Germany (GfK), which fell to -26.5 in September compared to a revised lower reading of -25.6 in the previous month. This indicates that trust in the eurozone's largest economy remains fragile, and the tightening of monetary policy may have reached its peak. This kept traders from making new bullish bets on the pair, limiting its growth potential.

Therefore, before making new bets, it is necessary to wait for important news, including the Consumer Price Index for Germany. And although signals suggest that the path of least resistance for spot prices is upward, it is too early to make buying bets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română