The EUR/USD currency pair continued its downward movement throughout Tuesday. Volatility remained relatively weak, and the decline was not too strong. Nevertheless, it is very stable and raises no questions. We have repeatedly mentioned in recent weeks that such a movement is expected from the European currency, even if it seems illogical at first glance. For example, on Monday and Tuesday, there were no significant events or publications to justify the continued decline of the European currency. Last week, we expected an upward correction, which has yet to materialize. However, this market situation is the most logical one after the euro either rose unjustifiably in the first half of the year or simply held at a very high level without a correction.

We believe that this factor is crucial for the euro and the dollar right now. Consider this: if the Federal Reserve has raised and is raising interest rates more aggressively than the ECB, why have we seen the euro currency rise over the past year? Assume that the market has already set prices for all rate increases in the United States. In that case, why weren't rate hikes in the European Union priced the same way? The European economy has been struggling for several quarters, while in the US, we have seen quarterly growth of 2-3%. Based on all these factors, we have constantly stated that it's time for the pair to move downward. Significantly and for the long term. We do not rule out the possibility that, by the end of the year, the euro currency will return to parity with the dollar.

In the 24-hour timeframe, the pair has breached the important Fibonacci level of 38.2% (1.0609) and is now almost guaranteed to drop to the 5th level. Remember that we have long referred to level 1.05 as the target. However, the movement to the south may not end there. We fully consider the possibility of a drop to the next Fibonacci level of 23.6% (1.0200).

Muller and de Cos are once again pushing the euro lower.

There have been no significant macroeconomic publications in the past few days. Only today in the United States will the report on durable goods orders be published, which can be considered more or less significant. However, over the past few days and the entire last week, we have witnessed speeches by representatives of the ECB's monetary committee. Several times a day. In principle, it became clear last week that the ECB is on the home stretch and will raise rates at most one more time. As we have mentioned, in the case of the ECB or the Federal Reserve, such actions can be considered logical, as the central banks have raised (or will raise by the end of the year) rates to almost 6%. Further rate hikes would be risky for the economy. But the situation is different with the ECB. The rate is slightly above 4%, which is clearly insufficient to bring inflation back to the target level in the near future.

But we are not here to judge the ECB; we are merely stating a fact: the ECB's rate has increased too weakly compared to the Federal Reserve's rate, and the euro currency has risen for too long based on expectations of a strong tightening of monetary policy in the European Union. The European currency may continue to decline peacefully because a wave of disappointment has now covered the market.

On Tuesday, Madis Muller from the ECB stated that he does not expect a new rate hike. De Cos and de Galhau, the heads of Spain's and France's central banks, as well as Vice President de Guindos, had previously made similar statements. In one way or another, all ECB representatives have indicated that further tightening will only be possible in the event of accelerated inflation. However, the market is not too satisfied with this formulation because everyone understands that the European Union will be battling high inflation for several years to come. Just like the United Kingdom, but at least with Britain, it can be said that the central bank has done everything it could.

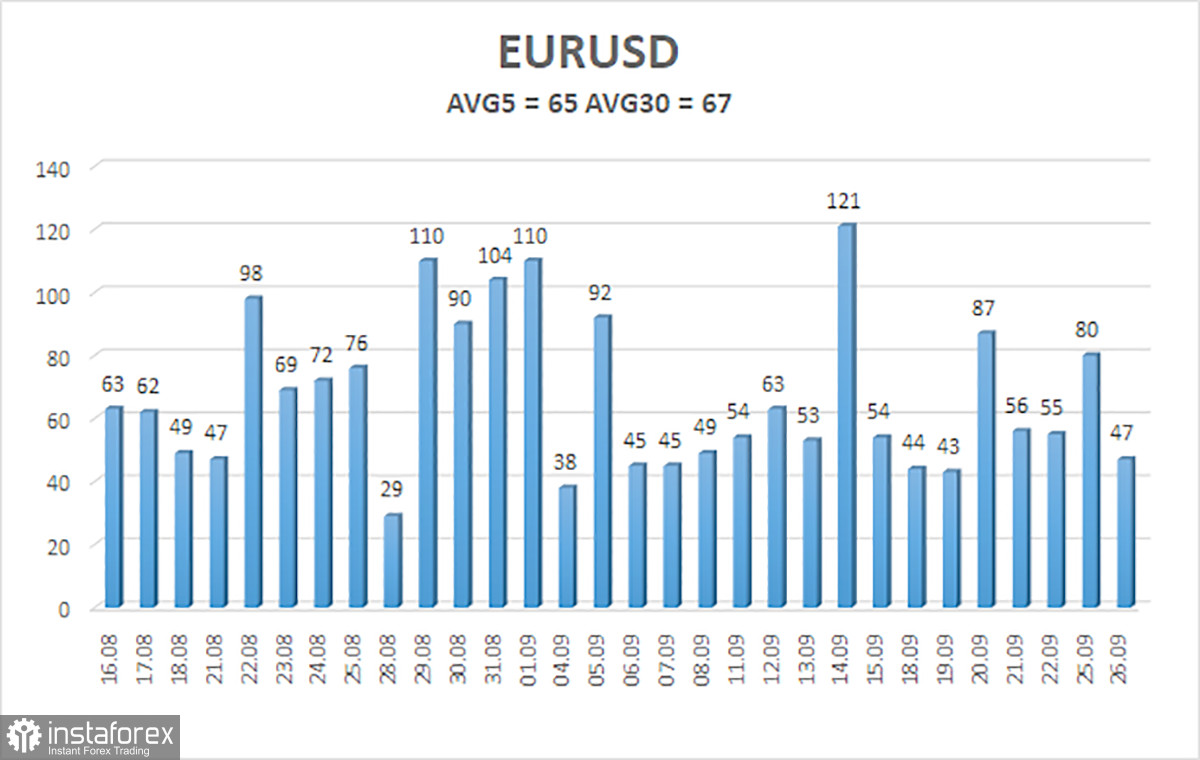

The average volatility of the EUR/USD currency pair over the last 5 trading days as of September 27th is 65 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0495 and 1.0625 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a new attempt to make a slight correction.

The nearest support levels are:

S1: 1.0498

Nearest resistance levels:

R1 = 1.0620

R2: 1.0742

R3: 1.0864

Trading recommendations:

The EUR/USD pair maintains a downtrend. Short positions can be held with targets at 1.0510 and 1.0495 until the price consolidates above the moving average. Long positions can be considered if the price consolidates above the moving average with a target of 1.0742.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are pointing in the same direction, it means the trend is strong right now.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels: target levels for movements and corrections.

Volatility levels (red lines): the probable price channel in which the pair will move in the next day based on current volatility indicators.

CCI indicator: its entry into the overbought region (above +250) or oversold region (below -250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română