Details of the Economic Calendar on September 25

Monday, as usual, was accompanied by an empty macroeconomic calendar. The publication of important statistical data in the European Union, the United Kingdom, and the United States did not take place.

However, ECB President Christine Lagarde spoke in the European Parliament, clarifying that interest rates would be lowered if inflation decreases. Considering the current decline in inflation in the European Union, the likelihood of a change in the direction of monetary policy is quite high.

This statement led to a rapid decline in the euro in the market.

Analysis of Trading Charts from September 25

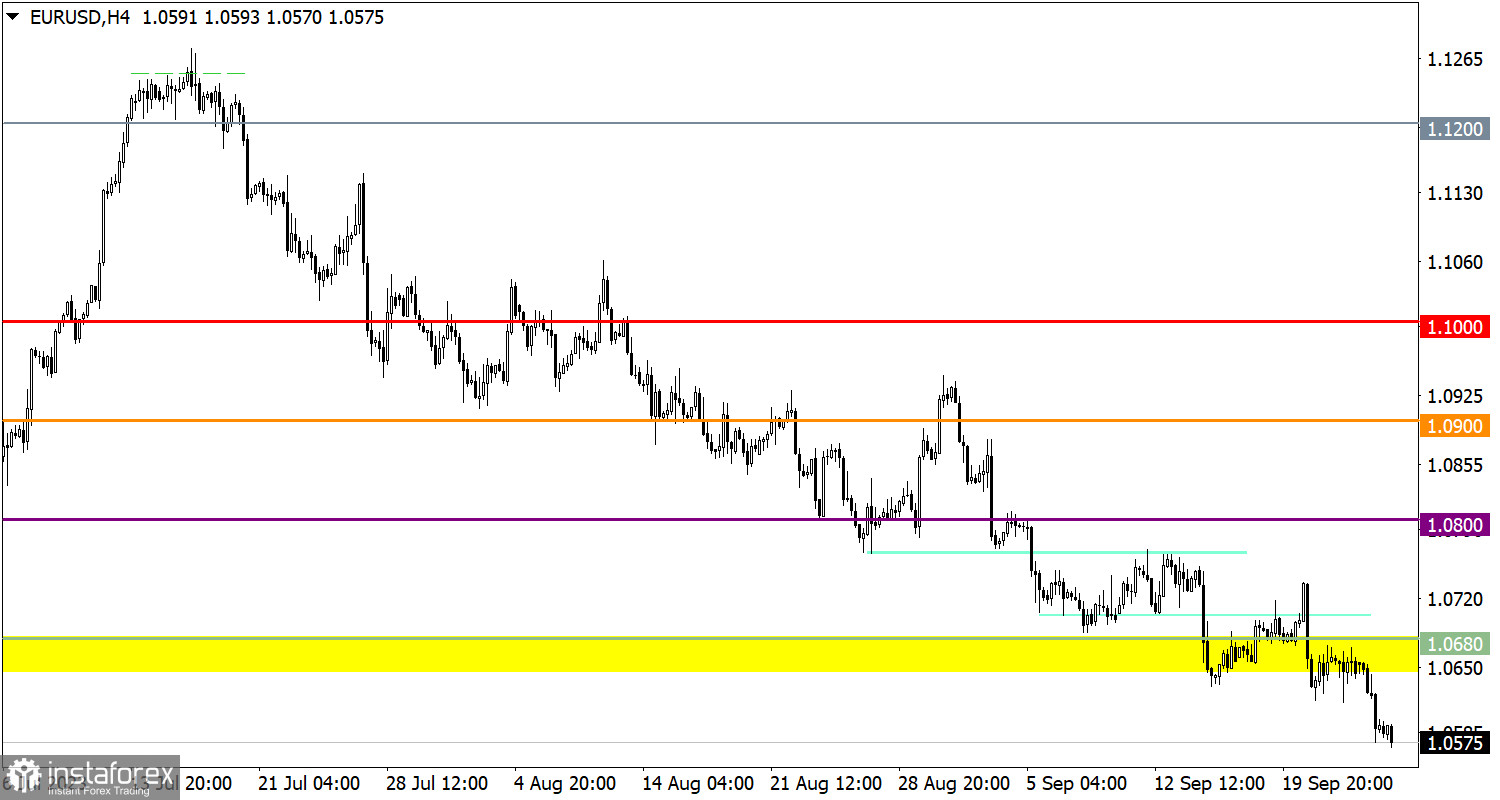

The EUR/USD currency pair ended a period of consolidation with doji candles and a downward impulse, resulting in a new local low.

The GBP/USD pair is in an inertial phase, ignoring technical oversold signals. Another update of the local low led to a decrease in the quote below the 1.2200 level, indicating high speculation on short positions.

Economic Calendar for September 26

Today, data on the construction sector in the United States is expected to be published, with forecasts of an increase in indicators. This is a positive signal for the economy, but it is necessary to see the actual figures first, as there are doubts about the forecast.

EUR/USD Trading Plan for September 26

Stabilization of the price below 1.0600 increases the chances of sellers for further weakening of the euro towards the support level of 1.0500. However, it is worth noting that there is a technical oversold signal in the market. Therefore, a pullback or consolidation is considered by traders as an alternative scenario. This movement may occur when the price approaches the 1.0500 level.

GBP/USD Trading Plan for September 26

Currently, the level of 1.2150 is in the path of speculators, but given the inertia, they may not notice it. Thus, the main reference point for sellers is the psychological area of 1.1950/1.2050.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română