To start with, while speaking before the European Parliament on Monday, European Central Bank President Christine Lagarde said that "in any case, our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary." In other words, Lagarde stated that interest rates would only be lowered if inflation goes down; it's just that they will remain somewhat restrictive. In other words, slightly higher than necessary at the appropriate rate of consumer price growth. This is necessary for further slowdown in inflation. And if we also consider the inflation forecasts, the preliminary assessment of which is published this Friday, indicating a significant slowdown in consumer price growth, then everything falls into place. Lagarde has actually warned us about the forthcoming easing of monetary policy. This is why the single currency continued to decline.

However, the euro is significantly oversold, and a correction has long been brewing in the market. It is quite possible that it will happen today, especially since the economic calendar is basically empty.

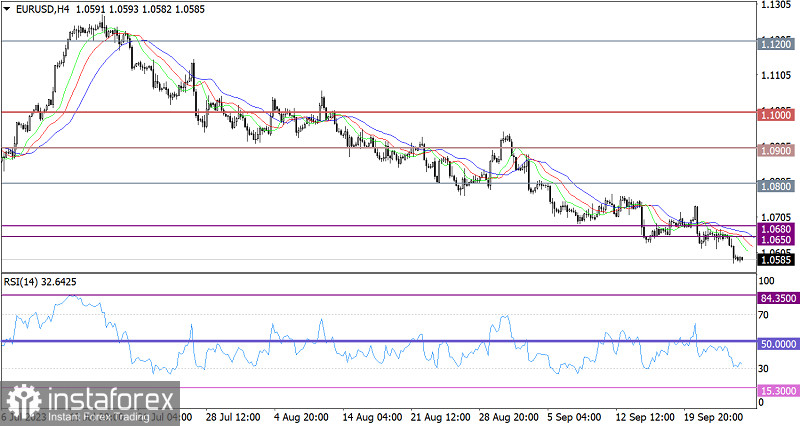

The EUR/USD pair ended the consolidation of various Doji-type candles with a downward movement. As a result, the local low was updated.

On the four-hour and daily charts, the RSI indicates that the pair looks deeply oversold.

On the four-hour chart, the Alligator's MAs are pointing downward, in line with the main cycle's direction.

Outlook

Keeping the price below 1.0600 increases the bears' chances of pushing the euro towards the support level of 1.0500. However, take note that a technical signal indicates that the euro is oversold. Thus, traders consider a pullback or consolidation as an alternative scenario. Perhaps this will occur when the price approaches the level of 1.0500.

Complex indicator analysis indicates a bearish signal in the short-, mid- and long-term timeframes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română