On the hourly chart, the GBP/USD pair declined on Friday after securing below the corrective level of 161.8% (1.2250). The next target is very close at 1.2201. If the pair's rate stays below it, it will favor further downward movement towards the next level at 1.2112. If the quotes rise above the 1.2250 level, it will benefit the pound and lead to some growth, but the upper line of the descending corridor limits this growth.

There's nothing to add in terms of waves at the moment. For the fourth day in a row, the pound's quotes have declined, which can be considered a single downward wave. This wave has long broken the last low, so the "bearish" trend continues, and there is no sign of its completion soon. The most realistic sign of completion would be a new downward wave that does not break the current low. This may take several days.

Business activity indices were released on Friday in the UK and the USA. The British indices did not show anything special: the manufacturing sector grew slightly, and the service sector declined slightly, with all changes below the 50 level. The report on retail trade also fell slightly below traders' expectations, so no matter how you look at it, the pound's decline was predictable on Friday and Thursday. It has been consistent for the past two months as well.

The key event for the pound can be considered the pause in tightening monetary policy in the UK, which traders have anticipated for a few months. The moment of the pause was in the air and happened last week. Now, the pound can only hope for the mercy of the bears, who will not be selling the pound for another 5-6 months. There is no reason for it.

On the 4-hour chart, the pair continues its decline and has secured below the corrective level of 50.0% (1.2289). Thus, the downward movement can be continued towards the next level at 1.2008. A "bullish" divergence has formed on the RSI indicator, which allowed for some growth expectations but has already been canceled. The 1,2250 level on the hourly chart also did not stop the decline. It is practically free now.

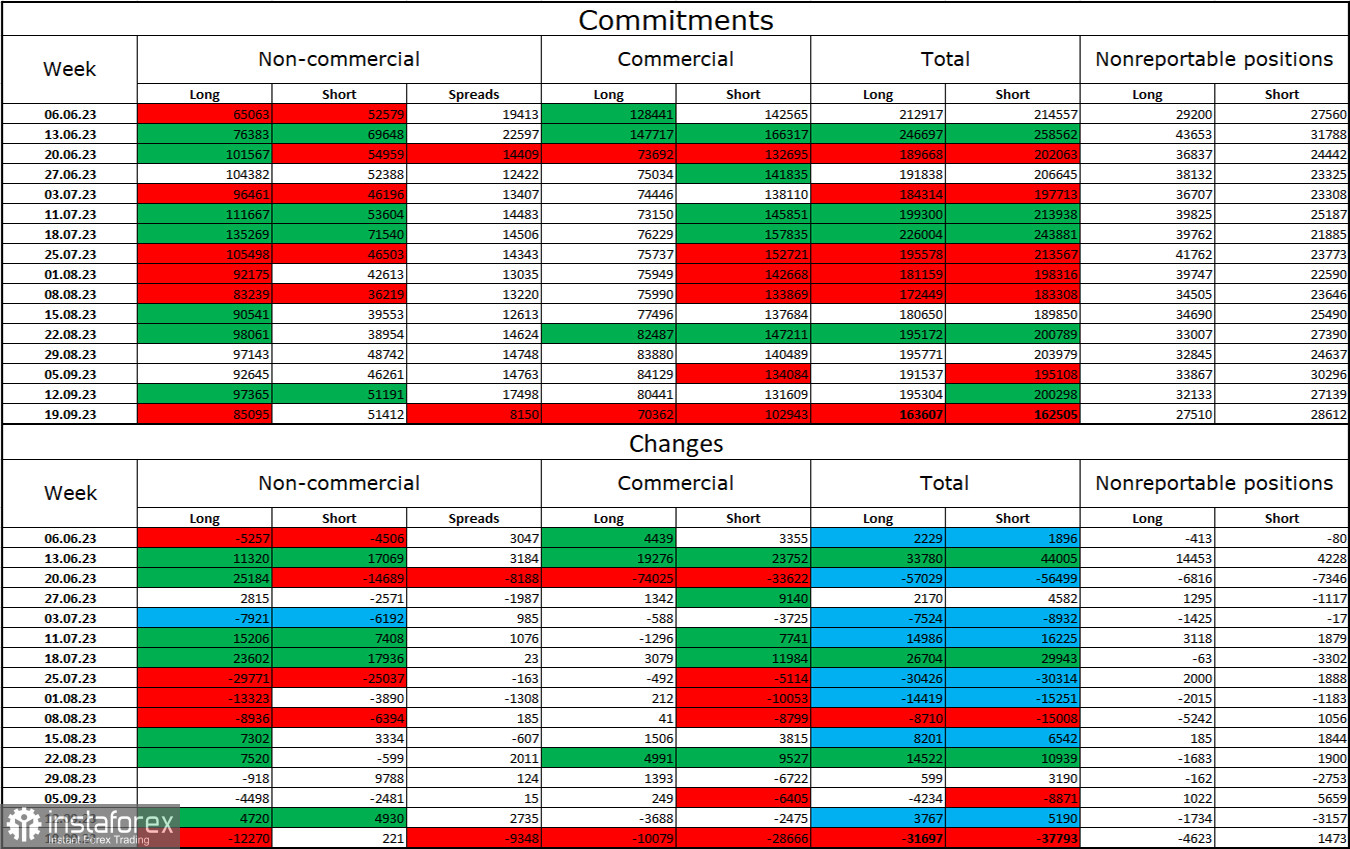

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders in the past reporting week has become less "bullish." The number of long contracts held by speculators decreased by 12,270 units, while the number of short contracts increased by 221. The overall sentiment of major players remains bullish, and the gap between the number of long and short contracts narrows each week: it's already 85,000 versus 55,000. The British pound had decent prospects for further growth, but many factors have favored the US dollar. I do not expect a strong rally in the pound sterling soon. Over time, bulls will continue to offload their Buy positions, similar to what is happening with the European currency. The Bank of England can only change the market situation if it continues to raise the interest rate longer than planned. Still, the latest meeting showed that this factor could be more reliable.

Economic Calendar for the US and the UK:

Monday's economic calendar contains a few interesting entries. The impact of the news background on the market sentiment will be absent today.

GBP/USD Forecast and Trader Advice:

Selling the pound was possible when it closed below 1.2250 with a target at 1.2201. New sales can be considered if it closes below 1.2201 with a target of 1.2112. I do not recommend buying in such a strong "bearish" trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română