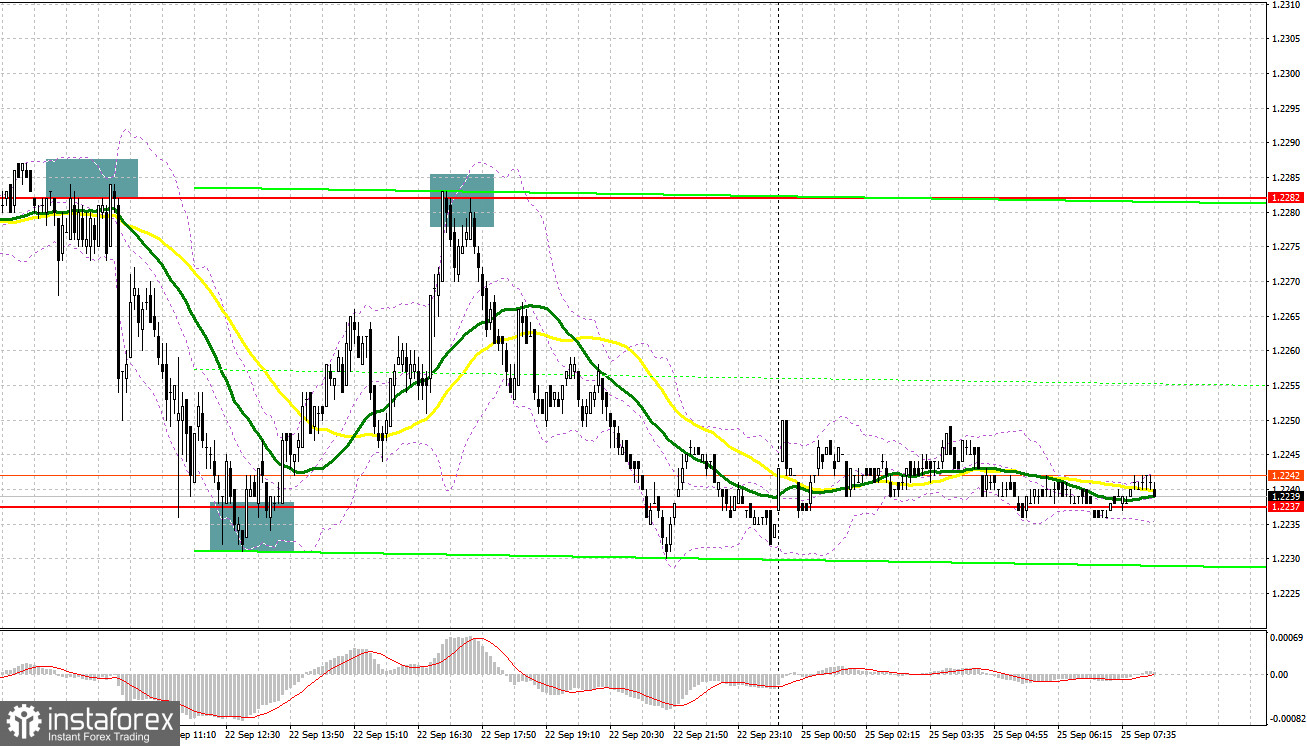

On Friday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2282 as a possible entry point. The rise and a false breakout at this level created a sell signal, and the pair fell to the support at 1.2237, making it possible to take about 40 pips. In the afternoon, protecting the daily low at 1.2237 brought back the bulls, resulting in a 40-pip rise, but the bears emerged and defended 1.2282. As a result, the pair was under pressure again, leading to a pound sell-off at the end of the week.

For long positions on GBP/USD:

Relatively weak UK manufacturing and services PMI numbers for September exerted downward pressure on the pound on Friday morning. It is obvious that high interest rates in the UK will continue to weigh on activity, which could lead to a recession by the end of the year. This will mount pressure on the British pound, which has been actively losing against the US dollar lately. Today, traders can look to the Confederation of British Industries' report on UK retail sales, so don't count on significant support from major buyers as this isn't a crucial report. Like last Friday, it's best to act around 1.2232, where a false breakout will signal market entry into long positions with a recovery to the nearest resistance at 1.2282, which is in line with the bearish moving averages. A breakout and stabilization above this range will bolster buyer confidence, signaling long positions aiming for 1.2327. The more distant target is the 1.2375 area, where I will be taking profits. If there is another dip to 1.2232 without buyer activity, pressure on the pound will increase, aiming for new monthly lows. In that case, only the defense of 1.2192 and a false breakout there will signal long positions. I plan to buy GBP/USD immediately on a rebound only from the 1.2154 low, aiming for a daily correction of 30-35 pips.

For short positions on GBP/USD:

Bears need to defend the nearest resistance at 1.2282. Ideally, the best scenario would be a false breakout at 1.2282 similar to what I discussed above, which will signal a sell opportunity. GBP/USD may decline towards 1.2232 - a monthly low. A breakout and an upward retest of this range will strike a significant blow to the bulls, opening a downward path for the pair to reach support at 1.2192. The more distant target remains the 1.2154 area, where I will be taking profits. If GBP/USD rises and there is no activity at 1.2282 – which is possible – buyers will get a chance for a correction. In that case, I will postpone selling the pair until a false breakout at 1.2327. If there is no downward movement there, I will sell the pound immediately on a rebound from 1.2375, bearing in mind a 30-35-pips downward intraday correction.

COT report:

The COT report (Commitments of Traders) for September 12 indicated an increase in both long and short positions. The released data on average earnings in the UK, which clearly has a negative impact on inflation, combined with the decrease in the UK's GDP led to another sell-off in the British pound, which may intensify in the near future. Apart from the Bank of England's meeting, where further actions regarding interest rates are not clear, a consumer price index report is planned. Almost all economists expect an increase in inflationary pressure in the UK in August. Given the backdrop of a weakening economy, we may expect another significant sell-off of the pound against the US dollar. The latest COT report indicates that non-commercial long positions increased by 4,720 to 97,365, while non-commercial short positions also jumped by 4,930 to 51,191. As a result, the spread between long and short positions increased by 2,735. The weekly closing price dropped to 1.2486 from 1.2567.

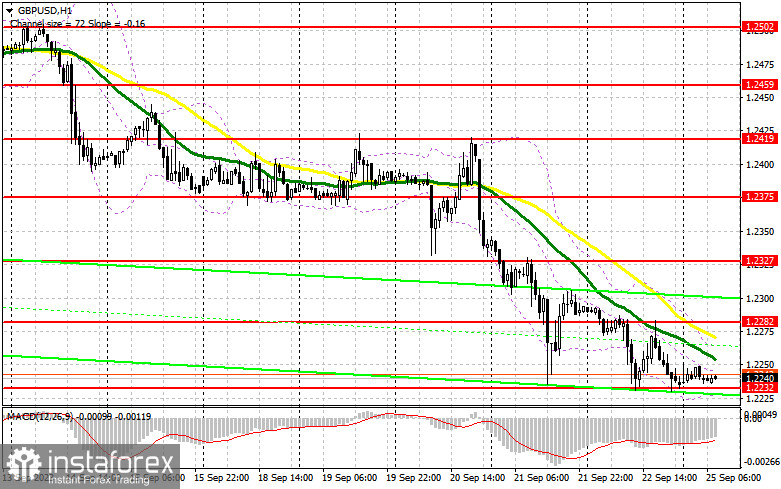

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair grows, the upper band of the indicator near 1.2265 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română