On the hourly chart, the GBP/USD pair on Thursday experienced a decline to the corrective level of 161.8% (1.2250). The rebound from this level allowed for a slight rise but had no significant impact. The market sentiment remains bearish, and yesterday, the Bank of England did everything to ensure that it stays this way for a long time. Therefore, today, if the exchange rate consolidates below the level of 1.2250, the likelihood of further decline towards the next level at 1.2201 and beyond 1.2112 will increase.

After yesterday's events, the wave situation has not changed at all. A new downward wave has formed, which easily broke the last low, and the last upward wave did not even attempt to approach the peak from September 20. Thus, at the moment, there is no sign of the end of the bearish trend. Although today's information background may be weaker than yesterday, the chances of closing below 1.2250 are significantly higher than for a second bounce from this level.

The Bank of England, for the first time in a year and a half, decided not to raise the interest rate. The accompanying statement mentioned that the rate may still be raised in the future if inflationary risks increase again. Still, the Bank of England expects further slowing of consumer prices and believes that the current rate may be sufficient to return inflation to 2%. Of course, not soon.

Today, the UK released a report on retail trade, which increased by 0.4% in August, as traders had expected. Therefore, this news did not support the pound, and the results of the Bank of England's meeting may continue to support the bears for a few more weeks.

On the 4-hour chart, the pair continues its downward trend and has consolidated below the 50.0% correction level at 1.2289. Thus, the process of decline may continue towards the next level at 1.2008. A bullish divergence has formed in the RSI indicator, which suggests some upward movement. In this regard, the 1.2250 level on the hourly chart is now more important. A rise in the British pound may start from it, and a decline in it may continue below it.

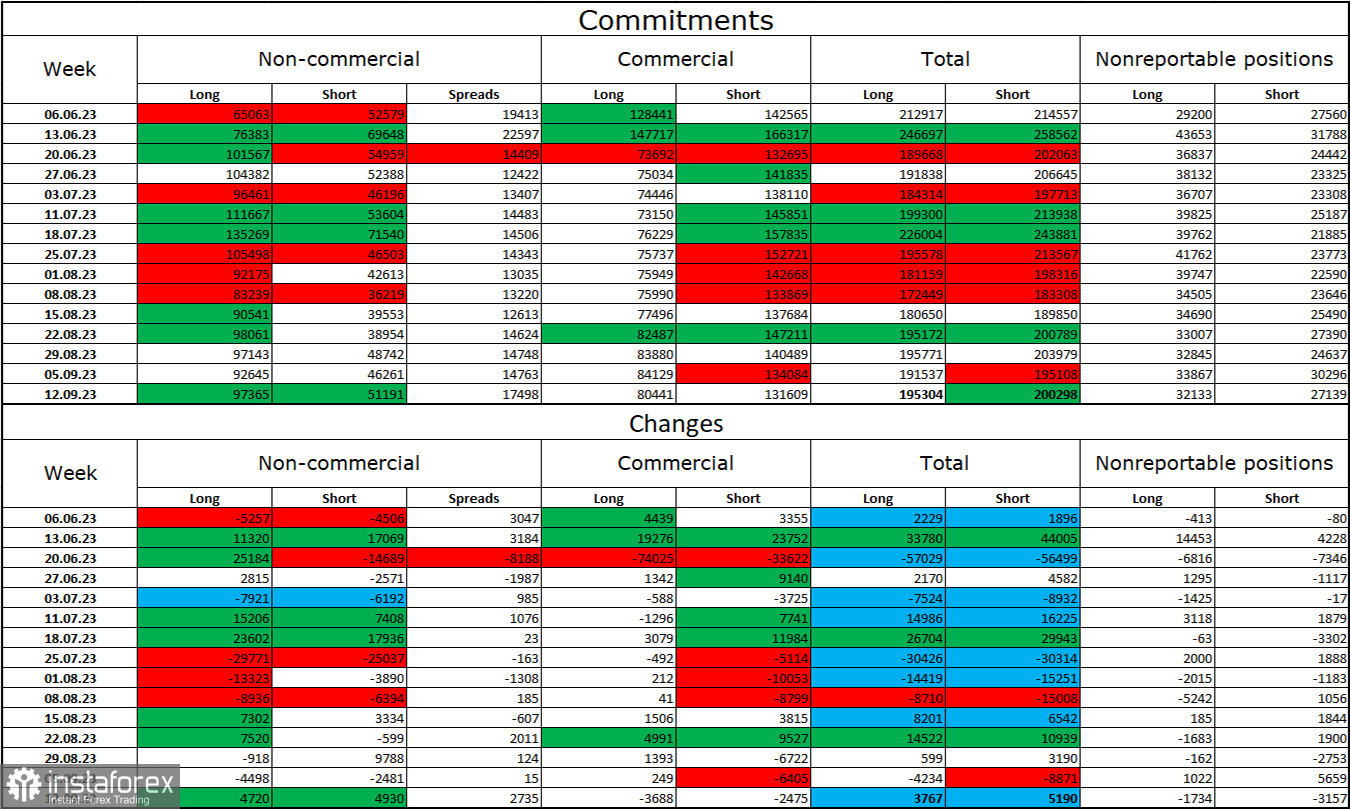

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became less bullish during the last reporting week. The number of long contracts held by speculators increased by 4720 units, while the number of short contracts increased by 4930. The overall sentiment of large players remains bullish, and there is still an almost twofold gap between the number of long and short contracts: 97 thousand versus 51 thousand. The British pound had good prospects for further growth a few weeks ago, but now, many factors have favored the US dollar. I do not expect a strong rise in the pound sterling soon. Over time, bulls will continue to get rid of buy positions, as is the case with the European currency. If the Bank of England continues to raise rates longer than planned, it can change the market situation. We will find out the answer to this question later this week.

News Calendar for the United States and the United Kingdom:

United Kingdom - Retail Sales Volume (06:00 UTC).

United Kingdom - Purchasing Managers' Index (PMI) in the Manufacturing Sector (08:30 UTC).

United Kingdom - Purchasing Managers' Index (PMI) in the Services Sector (08:30 UTC).

United States - Purchasing Managers' Index (PMI) in the Manufacturing Sector (13:45 UTC).

United States - Purchasing Managers' Index (PMI) in the Services Sector (13:45 UTC).

The economic events calendar on Friday includes several interesting entries, but none are considered highly important. The impact of the news on market sentiment today may be relatively weak.

GBP/USD forecast and tips for traders:

Selling the British pound was possible on a rebound from the level of 1.2440 with a target of 1.2342. The target has been reached. New sales were possible when closing below 1.2342 with targets at 1.2289 and 1.2250, which have also been achieved. Today, selling is possible when closing below 1.2250 and buying on a rebound from this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română