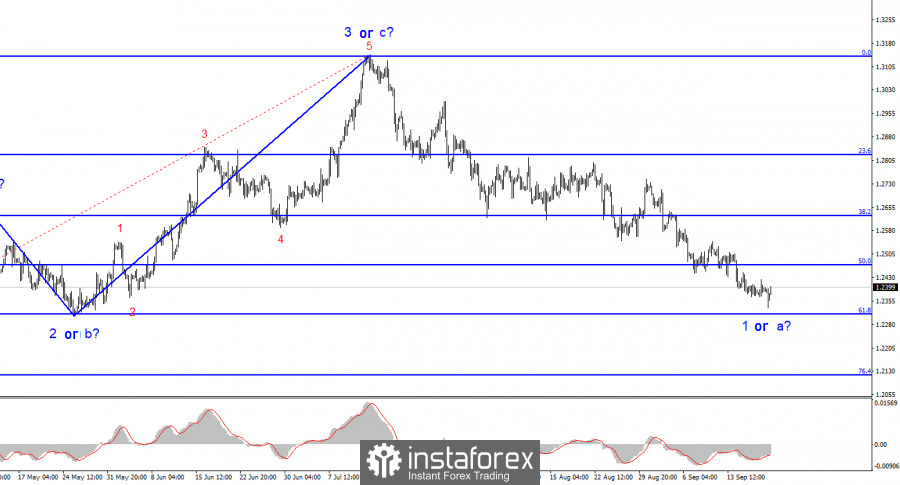

Regarding the pound/dollar pair, the wave analysis remains relatively simple and clear. The construction of the upward wave 3 or C has been completed, and the construction of a new downward trend segment has started, which theoretically could still be wave D. Still, the probability of this is close to zero. I don't see any reason for the British currency to resume ascent, so I do not consider this scenario. The entire upward trend segment may still take on a five-wave form if the market finds new substantial reasons for long-term purchases. I do not see any such reasons at the moment.

The internal wave structure of the first wave of the new trend segment looks complex, and it isn't easy to discern five waves within it. However, five waves are visible in the euro currency, and there has been an unsuccessful attempt to break through the level of 1.0636, which equates to 100.0%, according to Fibonacci. If the construction of the downward wave set is completed in the euro, there is an 80% probability that it will also be completed in the pound.

The Bank of England will raise the rate, but this may be the last.

The exchange rate of the pound/dollar pair increased by ten basis points on Wednesday. The amplitude of movements was very weak, but today, it was not weak, although it cannot be called strong either. In the morning, the UK released an inflation report, which showed a slowdown in August to 6.7% year-on-year, while the market expected an increase. Core inflation also decreased in August, and the market did not expect such a significant slowdown – down to 6.2%. These two indicators primarily indicate that the British regulator now has the opportunity to soften its "hawkish" tone slightly. I want to remind you that in the last 6-12 months, the Bank of England has been chasing the Federal Reserve while also watching with shock the rise in inflation in the country. The rate had to be raised to its current levels, and tomorrow (there are all reasons to believe), it will rise again to 5.5%. Thus, the Federal Reserve and the Bank of England rates will be equal.

However, there is little doubt that the upcoming rate hike could mark the conclusion of the current cycle.. Second, with the current rate level (much higher than, for example, in the European Union), there is hope for a gradual decline in inflation to 2%. Third, raising the rate further means further weakening the economy. Britain has avoided a recession, but it may still begin in 2024. The stronger the rate rises, the higher the chances of a recession occurring. Based on the above, the September increase will be the last.

General Conclusions:

The wave picture of the pound/dollar pair suggests a decline within a new downward trend segment. There is a risk of completing the current downward wave if it is wave D, but we are currently witnessing the construction of the first wave of the downward segment. At most, the pound can expect wave 2 or B construction in the near future. According to Fibonacci, I still recommend staying in sales with targets around 1.2311, which equates to 61.8%.

The picture is similar to the euro/dollar pair on a larger wave scale, but there are still some differences. The descending corrective trend segment is complete, and the construction of a new upward one is ongoing, which may already be complete or take on a full-fledged five-wave form.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română