The yen remains vulnerable amid differences in the monetary policies of the Bank of Japan and other major central banks, such as the U.S. Federal Reserve and the European Central Bank (ECB).

The Fed meeting will conclude today with the announcement of the interest rate decision at 18:00 (GMT). On Friday, the Bank of Japan will hold its regular meeting. It is widely expected that the bank's leaders will refrain from making changes to the monetary policy for now.

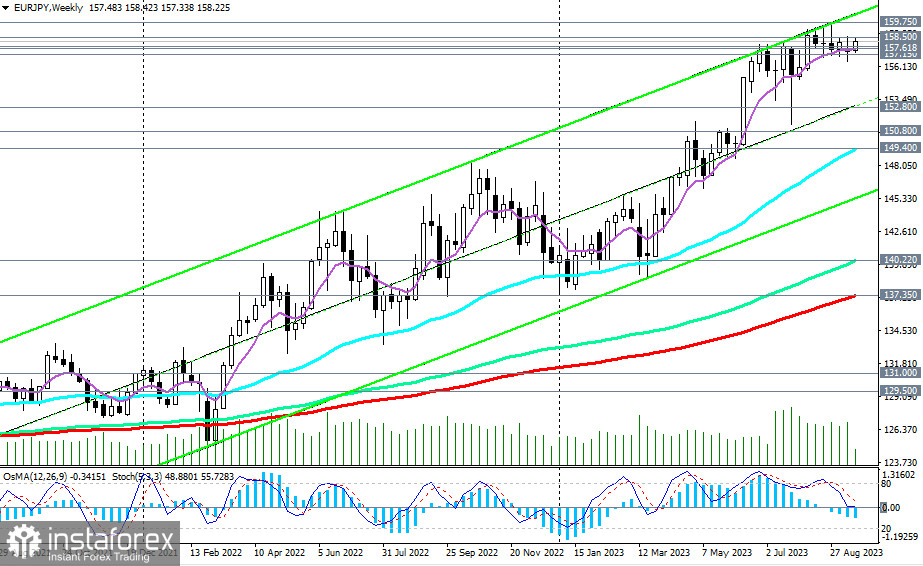

However, if Bank of Japan Governor Kazuo Ueda reiterates statements made by him and his predecessor, Haruhiko Kuroda, about the need to "patiently continue easing monetary policy" after the Friday meeting, the yen may continue to decline. The EUR/JPY pair could once again test the recent local high (since September 2008) at 159.75 and possibly move higher towards the record high of 170.00, almost reached in July 2008 during the economic crisis.

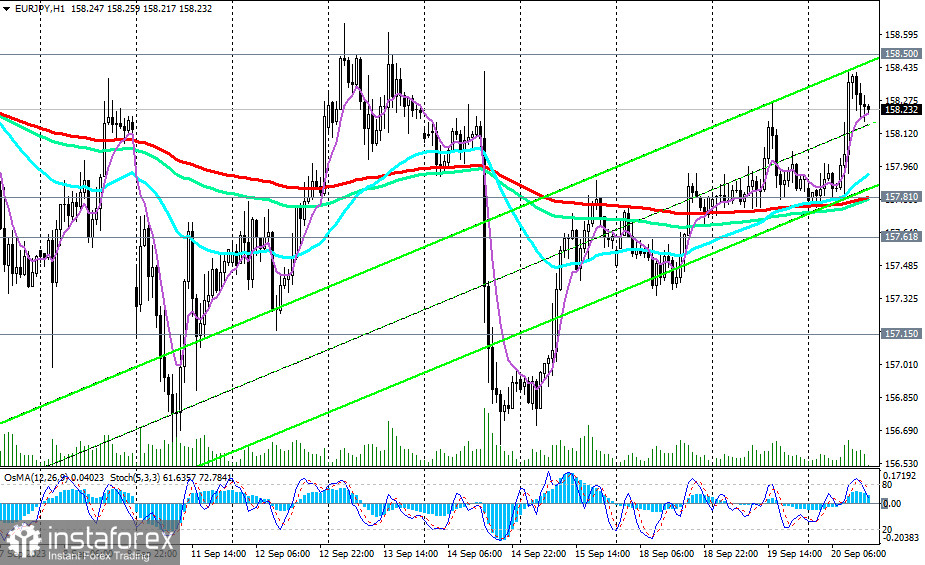

A signal for the start of such a move could be the break above the upper boundary of the range formed between the levels of 158.50 and 157.15 (50 EMA on the daily chart).

On the other hand, a break below the lower boundary of this range and the support level of 157.15 may trigger further declines in EUR/JPY with targets at key support levels of 150.80 (200 EMA on the daily chart) and 149.40 (50 EMA on the weekly chart), which separate the medium-term bull market from the bearish one.

For now, the prevailing trend is a stable bull trend with a strong upward momentum, so expecting a decline in the pair is not advisable. Long positions remain preferable.

Support levels: 157.81, 157.62, 157.15, 157.00, 156.00, 155.00, 152.80, 150.80, 149.40, 149.00

Resistance levels: 158.50, 159.00, 159.75

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română