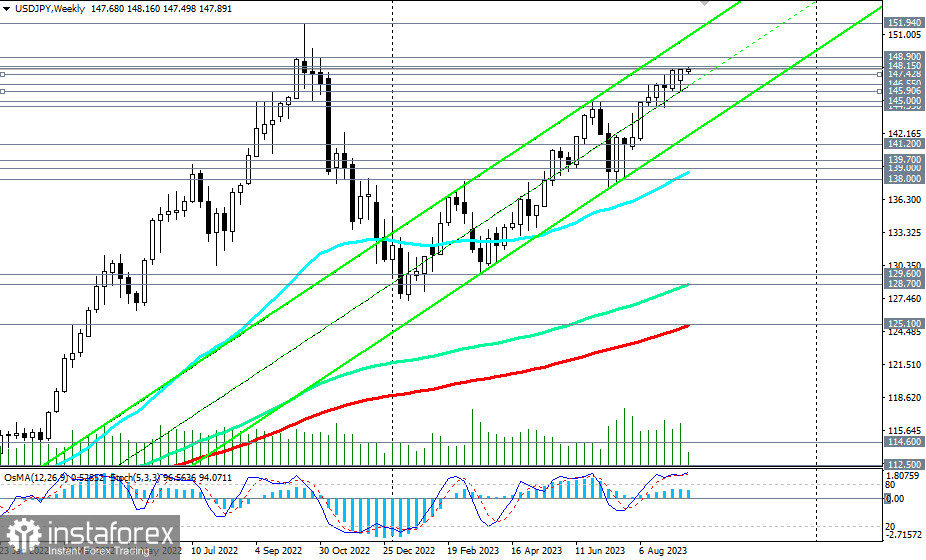

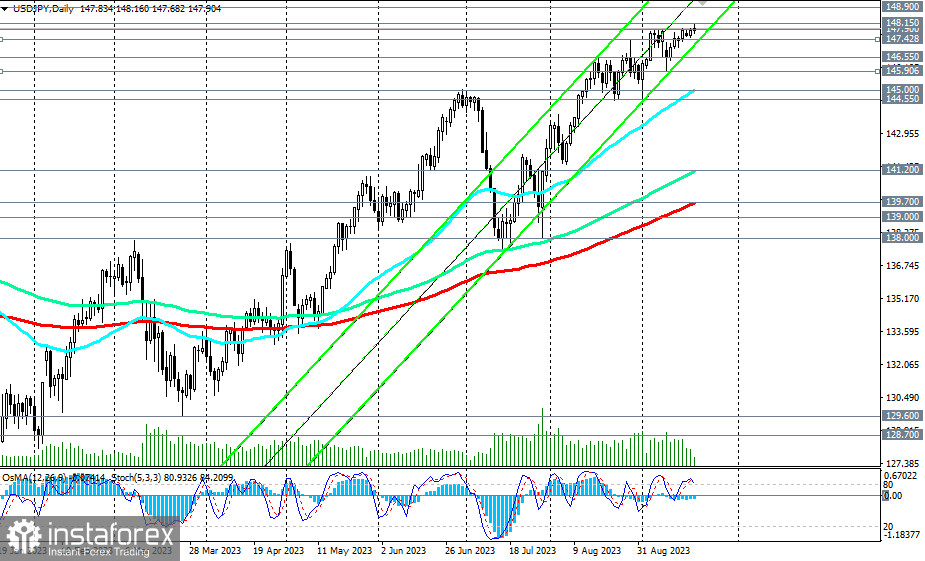

The USD/JPY currency pair may move towards the 150.00 mark and possibly higher if the Federal Reserve voices hawkish comments regarding its monetary policy prospects. However, if Bank of Japan Governor Kazuo Ueda, following the central bank's meeting this Friday, attempts once again to "lull" the markets with his mantra about the need to "patiently continue easing monetary policy," then USD/JPY could jump above the 151.00 level and attempt to retest last year's high at 151.95.

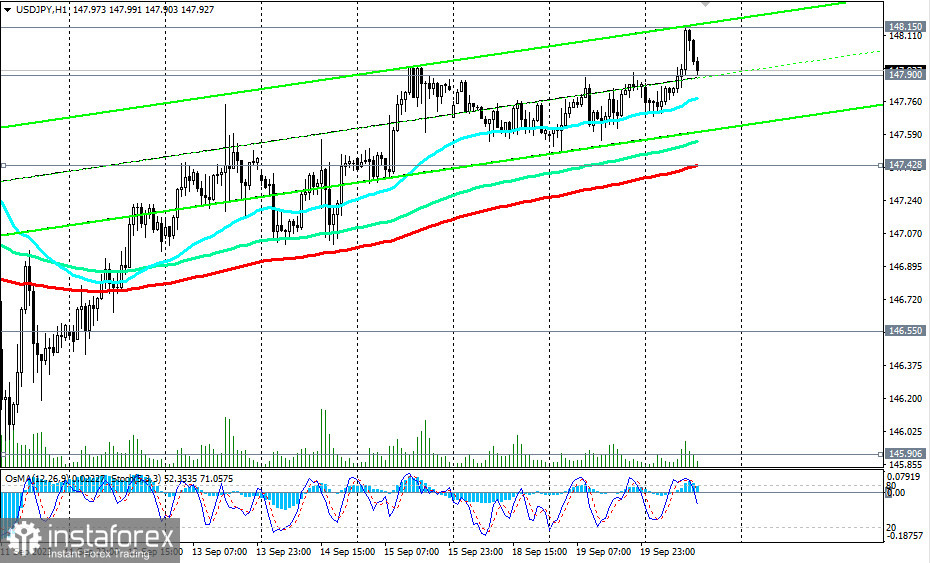

A signal for initiating such a move could be a break of today's high at 148.15. Purchases are also possible on a pullback to the support level at 147.43 (200 EMA on the 1-hour chart).

However, a break below this level could mark the beginning of an alternative scenario for a decline in the pair. If the downward correction does not stop at support levels of 146.55, 146.00, and 145.90 (200 EMA on the 4-hour chart), then after breaking the important support level at 145.00 (50 EMA on the daily chart) and the local support level at 144.55, USD/JPY risks continuing its decline, possibly down to key support levels at 141.20 (144 EMA on the daily chart), 139.70 (200 EMA on the daily chart), 139.00 (50 EMA on the weekly chart), which separate the medium-term bullish market from the bearish one.

For now, long positions remain preferable.

Support levels: 147.90, 147.43, 147.00, 146.55, 146.00, 145.90, 145.00, 144.80, 144.55, 141.20, 140.00, 139.70, 139.00, 138.00

Resistance levels: 148.15, 148.90, 150.00, 151.00, 152.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română