On the hourly chart, the GBP/USD pair continued its downward movement within the descending trend corridor towards the level of 1.2342, which it successfully reached this morning. Recently, the movement has become more of a horizontal one, with minimal market activity. A rebound from the level of 1.2342 would allow us to expect a reversal in favor of the British pound and some growth towards the upper line of the corridor. If the quotes close below 1.2342, the likelihood of further decline towards the next corrective level of 161.8% (1.2250) would increase.

The recent downward wave has broken all previous lows. This is already obvious, and the wave is not even finished yet. Therefore, the "bearish" trend is still in place, and there are no signs of completion. Signs of a trend reversal may only appear if the price rises to 1.2500 today. However, on Wednesday, the pair continued to decline, making it impossible to reach the level of 1.2550 soon.

Today, in the United Kingdom, reports on the main and core inflation were released, and they turned out to be quite unexpected. Both inflation types have decreased, much more than traders expected to see. Along with inflation, the British pound has also fallen, as a decline in inflation ahead of the Bank of England meeting (which will take place tomorrow) is seen as bad news for the pound rather than good. However, the current CPI value will not affect the Bank of England's decision. Traders expect another interest rate hike of 0.25%, and inflation is still too high to expect a pause from the Bank of England in September. Interestingly, with each passing day, it increasingly smells like a pause. The British regulator has been raising rates for a year and a half, and someday this procedure will be completed.

On the 4-hour chart, the pair continues to decline despite previously closing above the descending trend corridor. The closing of the pair's rate below the level of 1.2450 increases the chances of further decline of the British pound towards the next Fibonacci level of 50.0% - 1.2289, which is very close. A bounce from this level would allow the British pound to recover slightly. According to the RSI indicator, a "bullish" divergence is looming. A strong rise in the British pound can only be expected after closing above the corridor.

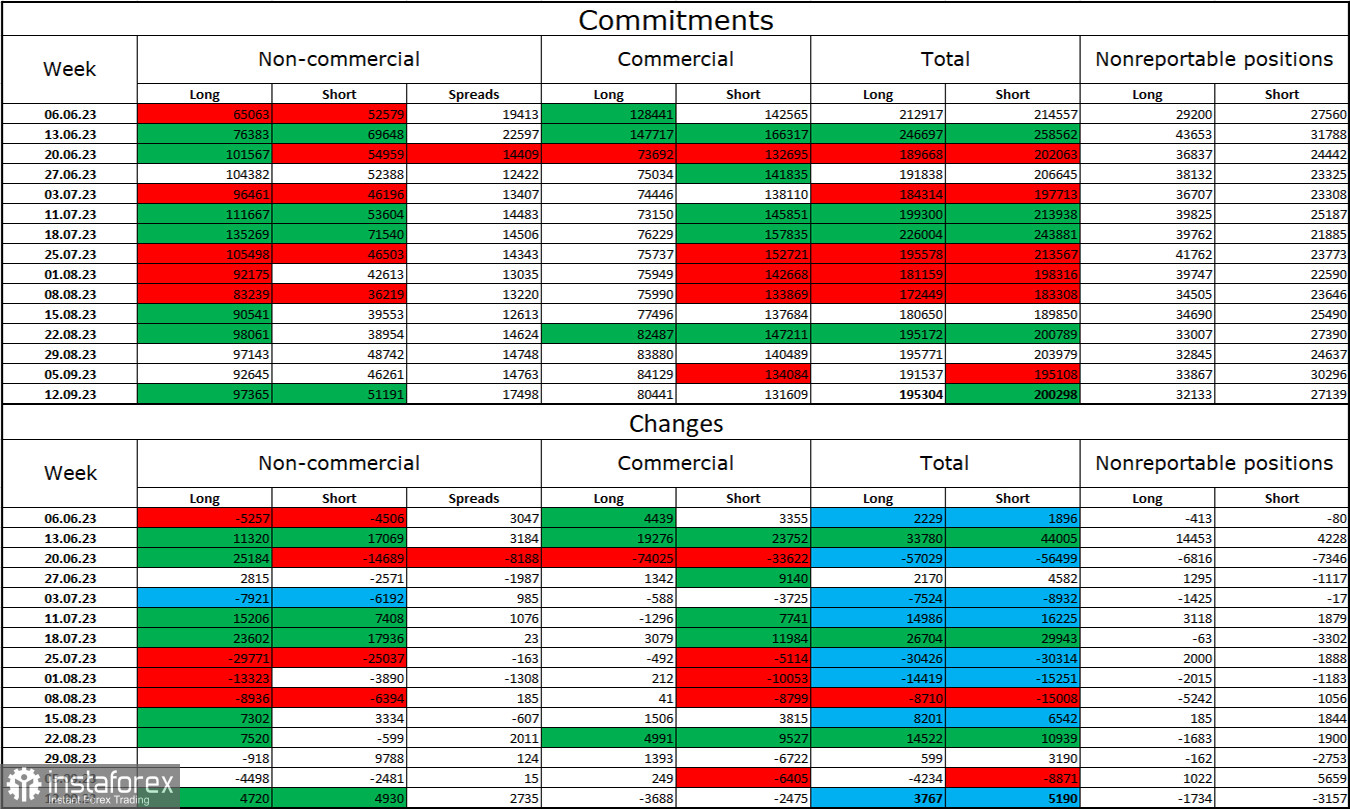

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category over the past reporting week has become less "bullish" again. The number of long contracts held by speculators increased by 4,720 units, while the number of short contracts increased by 4,930. The overall sentiment of major players remains bullish, and there is still an almost twofold gap between the number of Long and Short contracts: 97 thousand versus 51 thousand. The British pound had decent prospects for further growth a few weeks ago, but now, many factors have favored the US dollar. I don't expect a strong rally of the British pound soon. Over time, bulls will continue to unwind their Buy positions, just as they did with the euro. The Bank of England can change the market dynamics if it continues to raise interest rates longer than planned. We will find out the answer to this question precisely this week.

News calendar for the US and the UK:

UK - Inflation and core inflation report (06:00 UTC).

US - FOMC interest rate decision (18:00 UTC).

US - FOMC economic projections (18:00 UTC).

US - FOMC statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

Wednesday's economic events calendar contains some interesting entries. The impact of the news on market sentiment for the rest of the day can be significant.

GBP/USD forecast and trader recommendations:

Selling the British pound was possible on a rebound from the level of 1.2440 with a target of 1.2342. The target has been reached. New sales can occur if the price closes below 1.2342 with a target of 1.2289. For buying, a rebound from the level of 1.2342 with a target of 1.2440 is required today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română