Today, the GBP/USD currency pair updated its almost 4-month price low, approaching the base of the 23rd figure. Once again, inflation is the driving factor behind the pound's performance, as it continues to demonstrate a downward trend. Many components of today's release were in the "red zone," reflecting a decrease in inflationary pressure. It's worth noting that tomorrow, September 21, the Bank of England will hold its next meeting. Even if the English regulator decides to raise the interest rate, this decision is unlikely to provide long-term support for the pound, as it is likely to be a "dovish hike," meaning the last in the current tightening cycle of monetary policy.

Nevertheless, in my view, the Bank of England will take a wait-and-see position tomorrow, preserving the option to raise the rate in the future if inflation picks up again against the backdrop of rising oil prices. Currently, there is no urgent need for this, as the key inflation indicators in the UK show a declining trend in response to the aggressive policies pursued by the central bank over the past year.

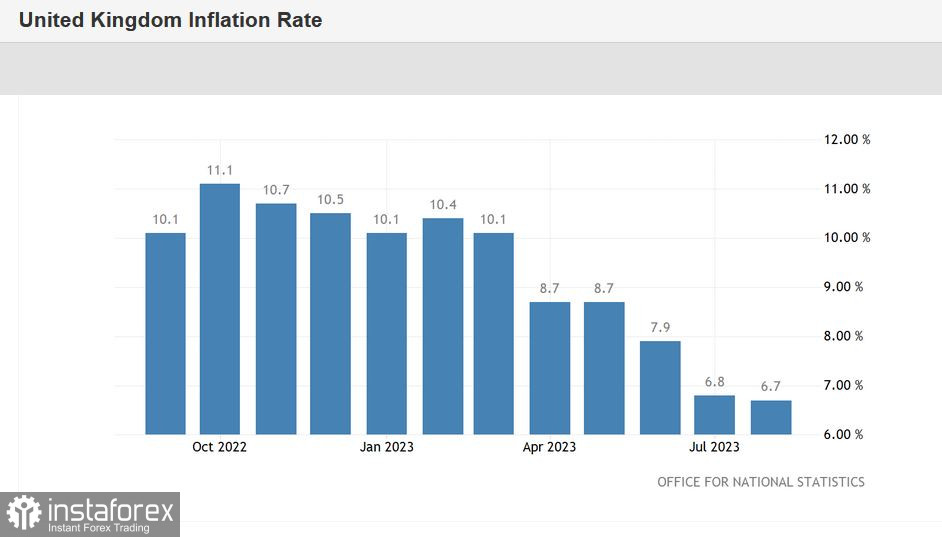

In terms of dry numbers, the situation looks as follows: the overall Consumer Price Index (CPI) on a monthly basis, on the one hand, has emerged from the negative territory (a decline to -0.4% was recorded in July), but on the other hand, it has demonstrated minimal growth (0.3% compared to an expected rise of 0.9%). On an annual basis, the overall index is also in the "red zone," standing at 6.7% (the forecast was 7.0%)—the weakest pace of growth since February 2022. This component of the report has been consistently declining for the third consecutive month.

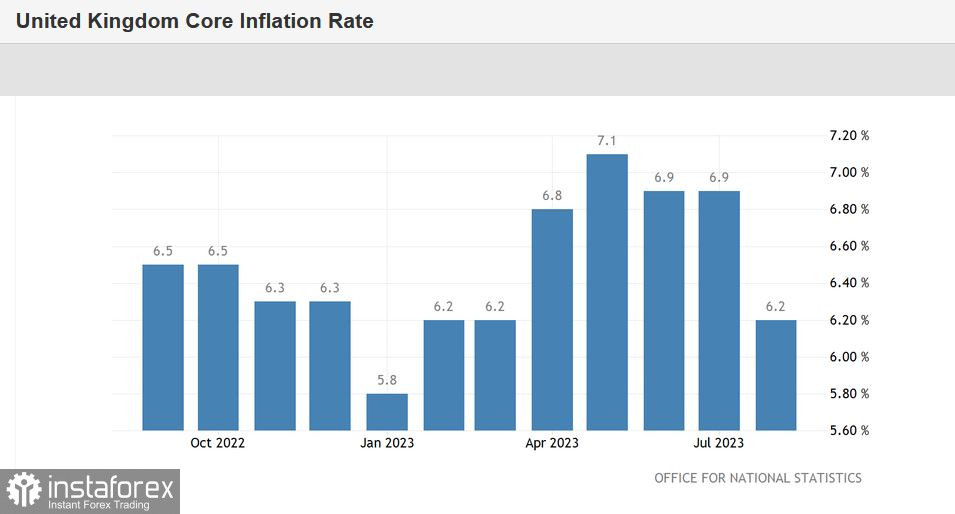

It's worth mentioning the core Consumer Price Index, which excludes energy and food prices. In June and July, it stood at 6.9%, but in August, it sharply fell to 6.2%. This is in contrast to the expectations of most experts who predicted a minimal decline to 6.8%.

The Retail Price Index, which British employers use in wage negotiations, is also in the red—0.6% MoM compared to an expected rise of 0.9% MoM and 9.1% YoY against a forecast growth to 9.3% YoY.

However, some components of the release turned out to be in the green but still remained in the negative territory. For example, the Producer Price Index (PPI) on an annual basis "grew" to -2.3% (compared to a forecast of -2.7%), and the Producer Price Index (PPI) stood at -0.4% YoY compared to an expected decline to -0.6% YoY.

Commenting on the published report, representatives of the UK's Office for National Statistics noted that the greatest contribution to the slowdown in year-on-year inflation in August came from a decrease in food prices: the growth in prices for food and non-alcoholic beverages slowed down last month to 13.6% (compared to 14.8% in July).

Reacting to the disclosed figures, the GBP/USD pair updated its almost four-month price low, reaching 1.2330, just a little shy of the support level at 1.2320 (the lower line of the Bollinger Bands indicator on the daily chart). In this price area, sellers took profit, thus triggering a corrective pullback. Traders are clearly cautious ahead of the announcements of the results of the September meeting of the Federal Reserve (today) and the Bank of England (on Thursday).

Traders' concerns are well-founded. The Federal Reserve and the English regulator may present "hawkish surprises." The Federal Reserve, in the context of a more hawkish tone and (possibly) an announcement of a rate hike in November, and the Bank of England, in the context of a possible rate increase.

This scenario is not ruled out by some experts. In particular, currency strategists at the Oversea-Chinese Banking Corporation stated that the Bank of England may decide on a 25-basis-point interest rate hike because wage growth remains high, and the core Consumer Price Index (CPI) is elevated.

Supporters of a loosely termed "dovish" scenario point to the decline in the core CPI and the consistent decrease in the overall CPI, as mentioned earlier. In addition, there is weak growth in the British economy. Recall that the UK's GDP contracted by 0.5% MoM in July (the worst result since December 2022). On a quarterly basis, the indicator also turned red, rising by 0.2% against a forecast of 0.4% growth. Industrial production in July dropped by 0.7% MoM, with a forecast of a 0.4% MoM decline. This is the worst result since August 2022.

As we can see, the intrigue regarding the results of the September meeting of the Bank of England persists, and thus, uncertainty about the fate of the British currency remains. However, a turning point for the GBP/USD pair may only be achieved through a significant weakening of the greenback, in the event that the Federal Reserve is not on the side of the U.S. currency. The English regulator is unlikely to become an ally of the pound, even if it raises the interest rate. It is likely that the bank will follow the path of the ECB, which, on the one hand, raised rates but, on the other hand, indicated that this is the "final act" of the current cycle.

Given the high degree of uncertainty, it is advisable to maintain a wait-and-see position on the GBP/USD pair. Long positions are risky by default, while selling should be considered only after the bears of the pair establish themselves below the support level at 1.2320 (the lower line of the Bollinger Bands indicator on the daily chart). In this case, the next target of the downward movement will be 1.2250 (the lower line of the Bollinger Bands on the weekly chart).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română