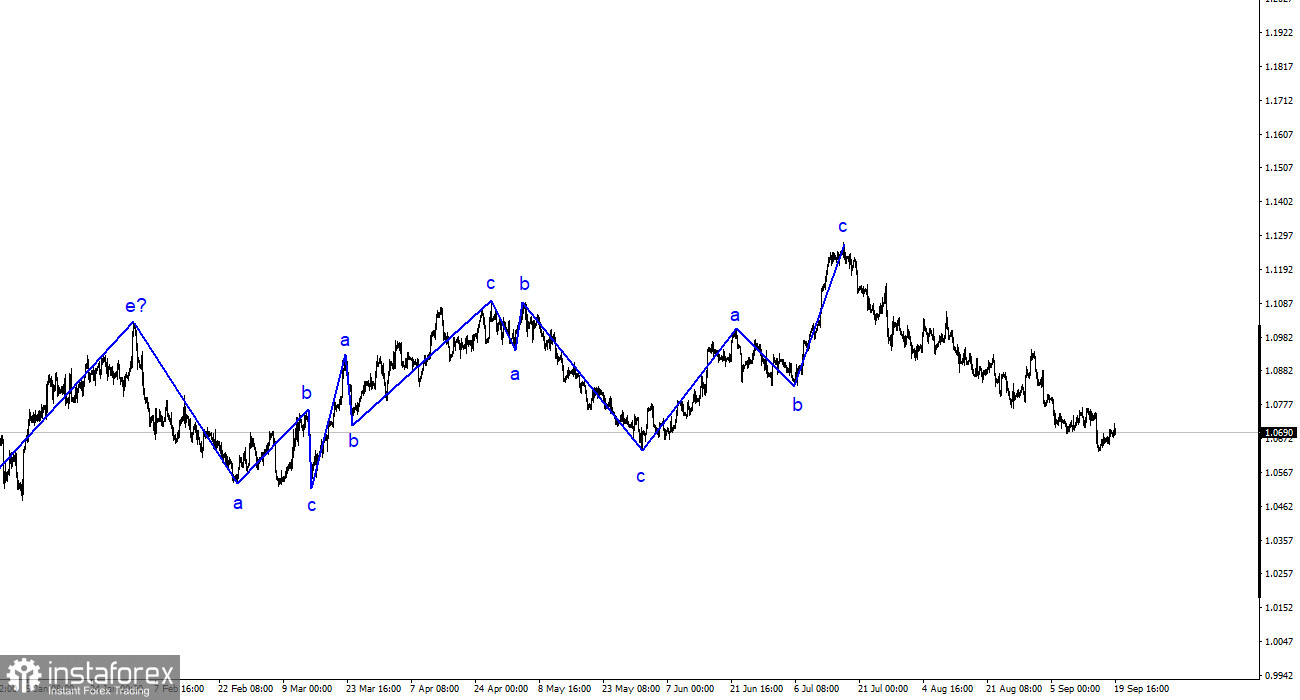

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to approach the 5th figure, where the construction of the last upward three-wave structure began. The pair has yet to reach the 5th figure, but it has come very close to the 6th. The next ascending three-wave structure is complete, so the market continues to build a downward trend segment.

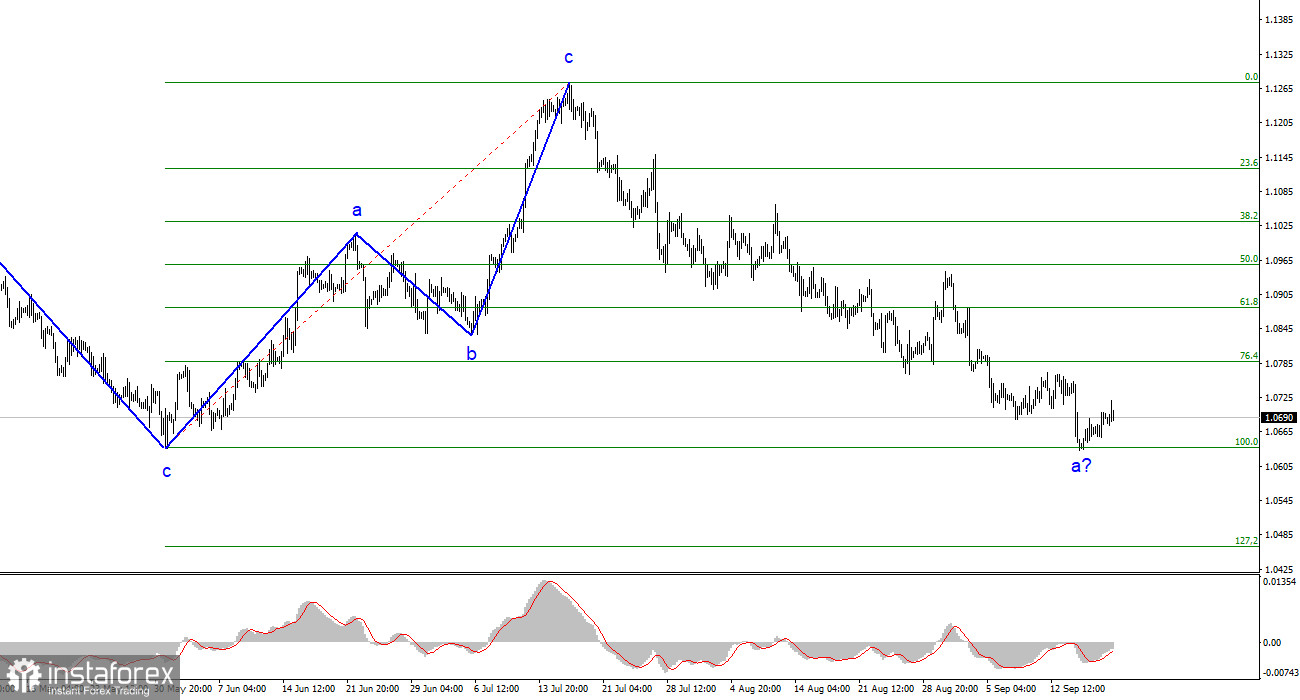

The recent increase in quotes does not resemble a full-fledged wave 2 or b. We saw a similar wave from August 3 to August 10. Most likely, this is an internal corrective wave 1 or a. If this is true, the decline in quotes may continue for some time as part of the first wave of the descending trend segment. This is not the end of the drop in the European currency, as constructing the third wave is still required. There are already five internal waves inside the first wave, so its completion is approaching. An unsuccessful attempt to break through the 1.0637 level, equivalent to 100.0% on the Fibonacci, may indicate readiness to build a corrective wave.

Can the ECB interest rate issue be considered closed?

The euro/dollar pair rate increased by 30 basis points on Monday and remained unchanged today. Combining the last three days, the European currency has moved away from last week's lows by 50 basis points. It's not even worth discussing such a price change over three days. The market is standing still and waiting. What it's waiting for is still being determined, as the ECB meeting, which is directly related to the European currency, has already occurred. Right after the meeting, almost half of the monetary policy committee spoke, with most of them discussing the lack of a need to continue raising interest rates. Based on the above, it would have been reasonable if the decline in the European currency had continued on Friday, Monday, and Tuesday.

However, instead, the euro is rising. It is rising slowly, and today, the final inflation report for August was released, showing a slightly greater slowdown than was discussed two weeks ago. The consumer price index fell by 0.1% from 5.3% to 5.2%. This is a minimal slowdown, but inflation may continue to decline for some time, as interest rates were raised at the recent ECB meetings. However, given the very likely completion of the policy-tightening process in the European Union, what will happen next is hard to predict. Inflation may stop slowing down or do so very slowly. Such a scenario is not a cause for concern for the ECB, but it is unlikely to support the European currency. The decline in the EUR/USD pair will continue.

General Conclusions.

Based on the analysis, the construction of the upward wave set is complete. I still consider targets in the range of 1.0500-1.0600 for the downward trend segment quite realistic. Therefore, I continue to recommend selling the pair. The unsuccessful attempt to break through the 1.0636 level indicates the possible completion of the construction of the first wave, which has taken on a fairly protracted form. For now, the presumed wave 2 or b looks extremely unconvincing.

On the larger wave scale, the wave labeling of the ascending trend segment has taken on a protracted form but is likely to be completed. We have seen five upward waves, most likely constituting the structure a-b-c-d-e. The pair then built four three-wave structures: two downward and two upward. It has entered the stage of building another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română