On the hourly chart, the GBP/USD pair on Monday continued its downward process within the descending trend corridor and towards the level of 1.2342, if such movement can be called a decline. Rather, it's a pure horizontal movement with minimal trading activity. At this pace, the British pound will move towards 1.2342, about 40 points away, for several more days. A rebound of the pair's rate from this level will allow us to expect a reversal in favor of the British pound and some growth towards the upper line of the corridor. Closing quotes below 1.2342 will increase the probability of further decline towards the next corrective level of 161.8% (1.2250).

The recent downward wave has broken through all previous lows, which is already evident. Thus, the "bearish" trend is currently intact, and there are no signs of its completion. They can only appear if the price rises to 1.2500 today. Given the weak trader activity and the lack of significant news, we may have to wait for such a scenario for several days, at least until Wednesday evening. I do not expect any significant changes in the exchange rate.

The Consumer Price Index in the UK will be available tomorrow morning. Analysts believe that inflation will rise from 6.8% y/y to 7.0%, while core inflation will decrease by 0.1%. Such figures will not be able to boost traders' activity in the market. However, the numbers could be completely different. The pound may show minor growth if inflation accelerates more than traders expect. But what will this inflationary growth mean if the Bank of England raises the interest rate by 0.25% on Thursday even without it? In the grand scheme of things, this report is meaningless. Therefore, attention should be focused on the meetings of the Bank of England and the Federal Reserve, which may not be the most interesting ones in recent times, but at least one of the two central banks should raise the interest rate.

On the 4-hour chart, the pair continues to decline despite the earlier breakout above the descending trend corridor. Two rebounds of quotes from the level of 1.2450 worked in favor of the British pound, but the growth was very weak in both cases. Stronger growth of the British pound can be expected only with a new consolidation of quotes above the corridor. Closing the pair's rate below the level of 1.2450 increases the chances of a further decline of the British pound towards the next Fibonacci level of 50.0% (1.2289).

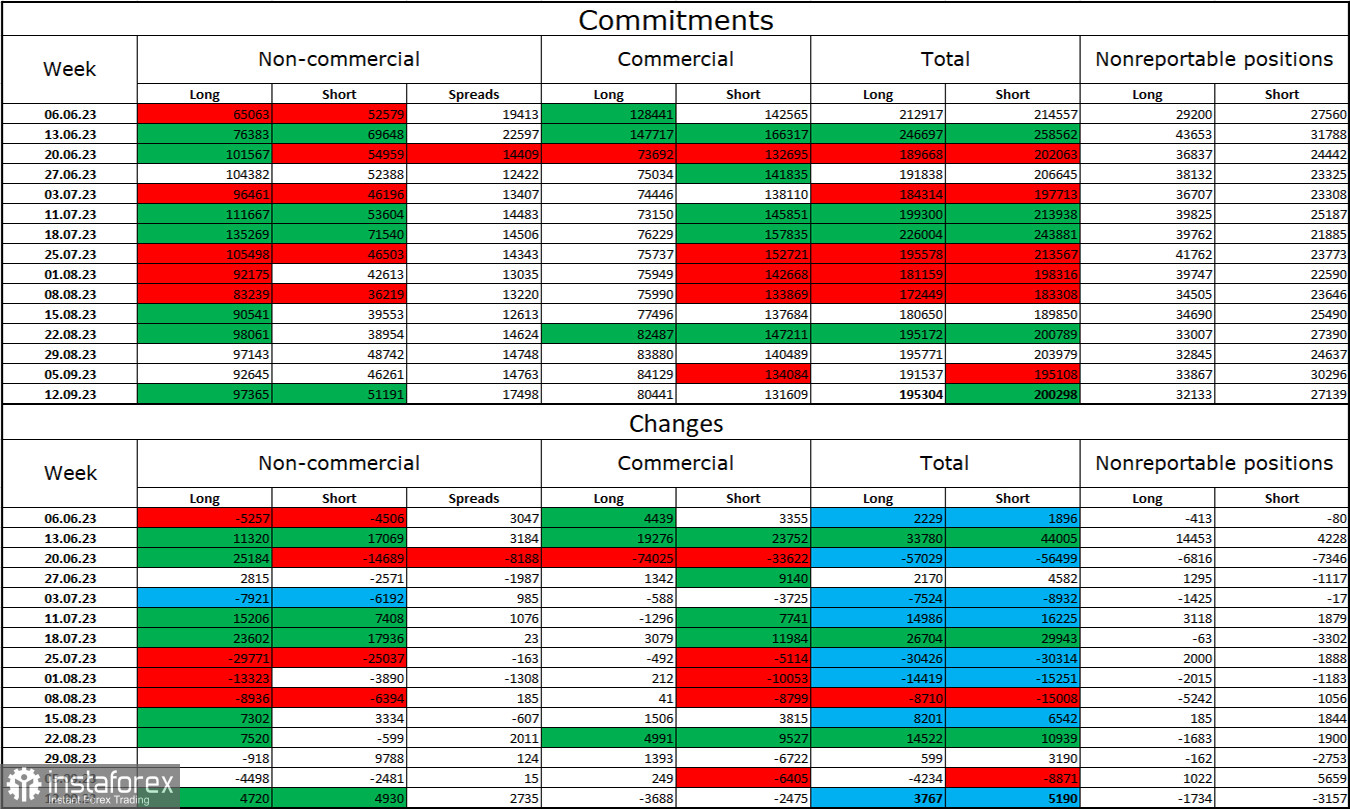

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders in the last reporting week has become less "bullish" again. The number of long contracts held by speculators increased by 4,720 units, while the number of short contracts increased by 4,930. The overall sentiment of major players remains bullish, and there is still an almost two-fold gap between the number of long and short contracts: 97,000 versus 51,000. The British pound had decent prospects for continued growth a few weeks ago, but now, many factors have favored the US dollar. I don't expect a strong pound rally soon. Over time, bulls will continue to unwind their buy positions, similar to what's happening with the euro. The Bank of England can only change market dynamics if it continues to raise interest rates longer than planned. We will find out the answer to this question this week.

The economic calendar for the US and the UK:

US - Building Permits (12:30 UTC).

On Tuesday, the economic calendar contained only some important entries. For the rest of the day, the impact of the news on market sentiment will be very weak or absent.

Forecast for GBP/USD and trader recommendations:

Selling the British pound was possible on a rebound from the level of 1.2440, with a target of 1.2342. These trades can still be kept open today. New sales should be considered at a close below 1.2342. For buying, a rebound from the level of 1.2342 with a target of 1.2440 is necessary today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română