EUR/USD

Higher Timeframes

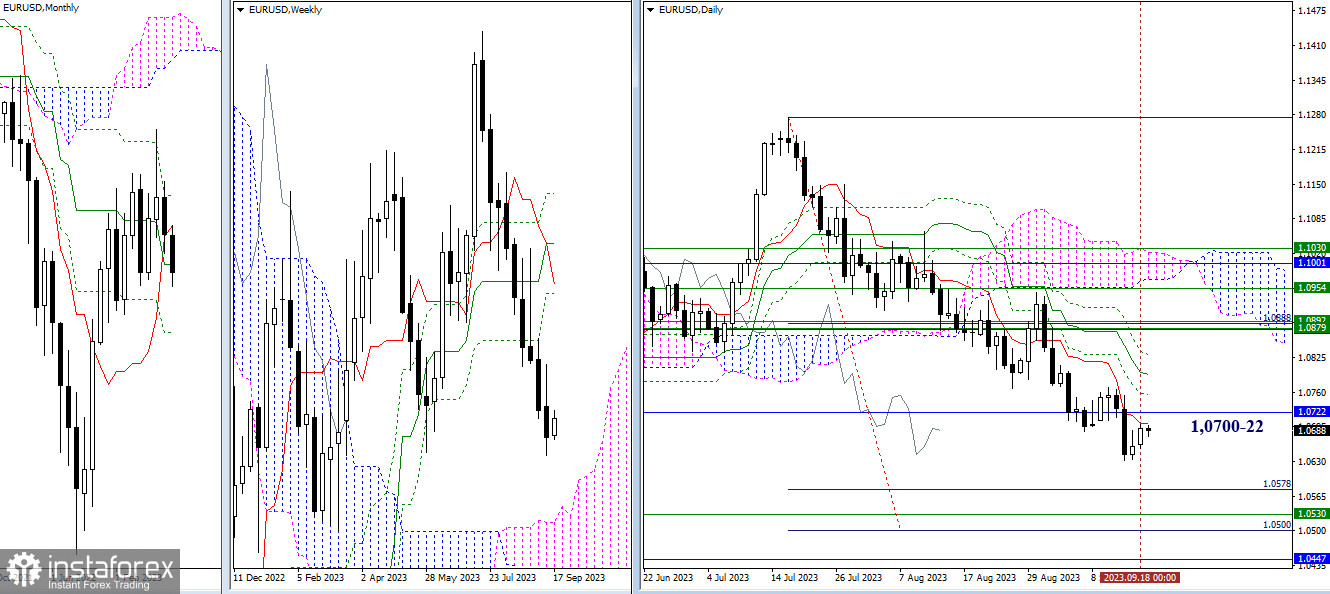

The market is currently in another stage of correction. Yesterday, bullish players tested the resistance of the daily short-term trend (1.0700). The range of 1.0700 – 1.0722, where the daily short-term trend and the monthly medium-term trend converge, is crucial for the restoration of bullish positions and the emergence of new possibilities for strengthening sentiment. After consolidating above 1.0700-22, the task for bullish players will be to eliminate the daily death cross, with the next levels in the current situation marked at 1.0755 – 1.0793 – 1.0830. In the case of correction completion and the continuation of the downward trend, the zone of bearish reference points remains unchanged today (1.0578 – 1.0530 – 1.0500 – 1.0447).

H4 – H1

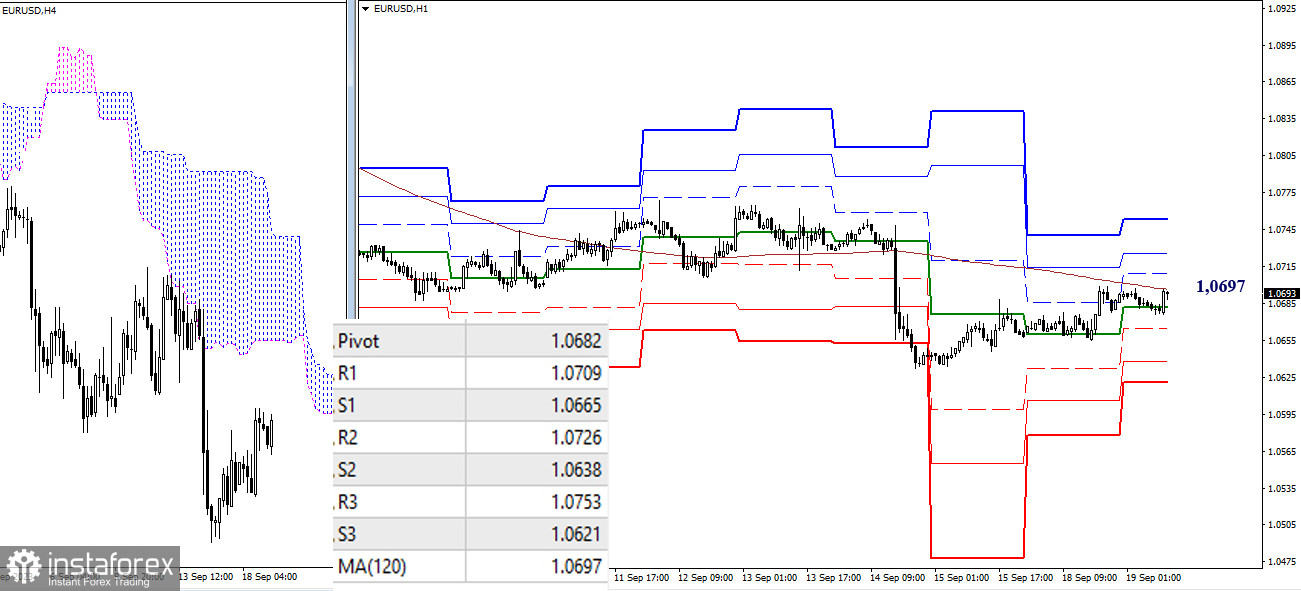

On the lower timeframes, bullish players have started to interact with the key level—the weekly long-term trend, currently located at 1.0697. Possessing this level and receiving support from it can reinforce the sentiment. Other additional intraday reference points are the classic pivot points, which today can be noted at 1.0709 – 1.0726 – 1.0753 (resistances) and 1.0665 – 1.0638 – 1.0621 (supports).

***

GBP/USD

Higher Timeframes

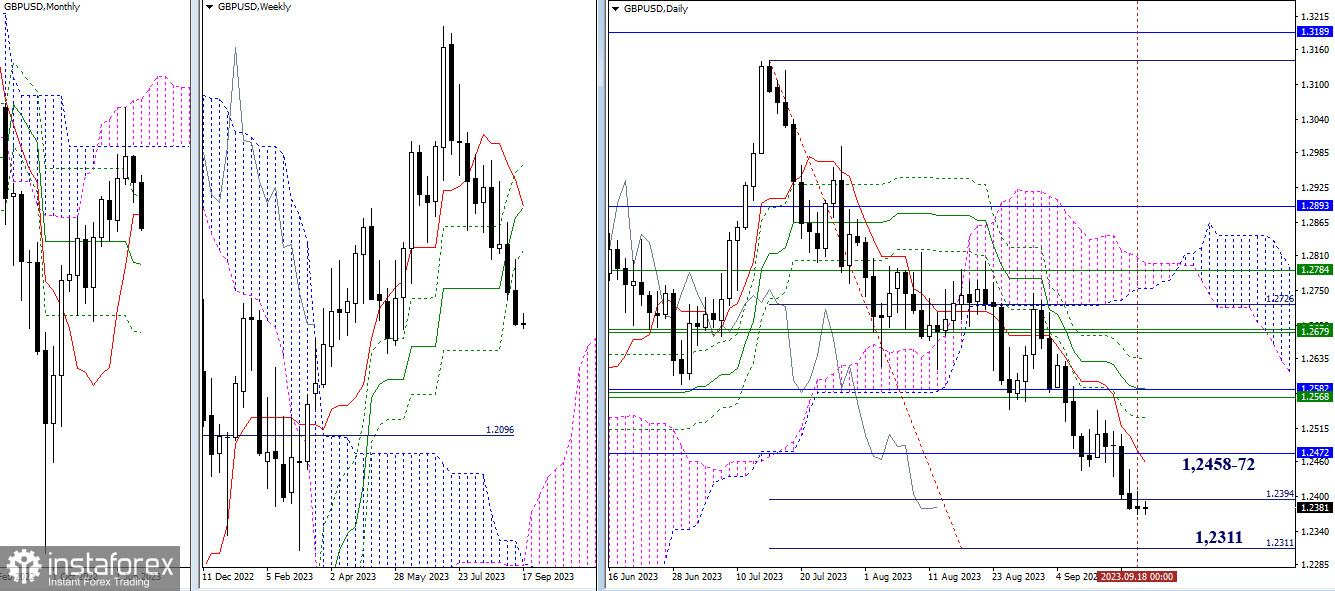

The pair updated last week's low yesterday, but there was no significant movement. The range of the previous day is too small, resembling more of a slowdown or pause. In the event of an upward correction on the daily chart, the nearest reference point could be the convergence of the monthly (1.2472) and daily (1.2458) short-term trends. A resumption of the decline will once again focus the market's attention on the 100% completion of the daily bearish target for breaking the Ichimoku cloud (1.2311).

H4 – H1

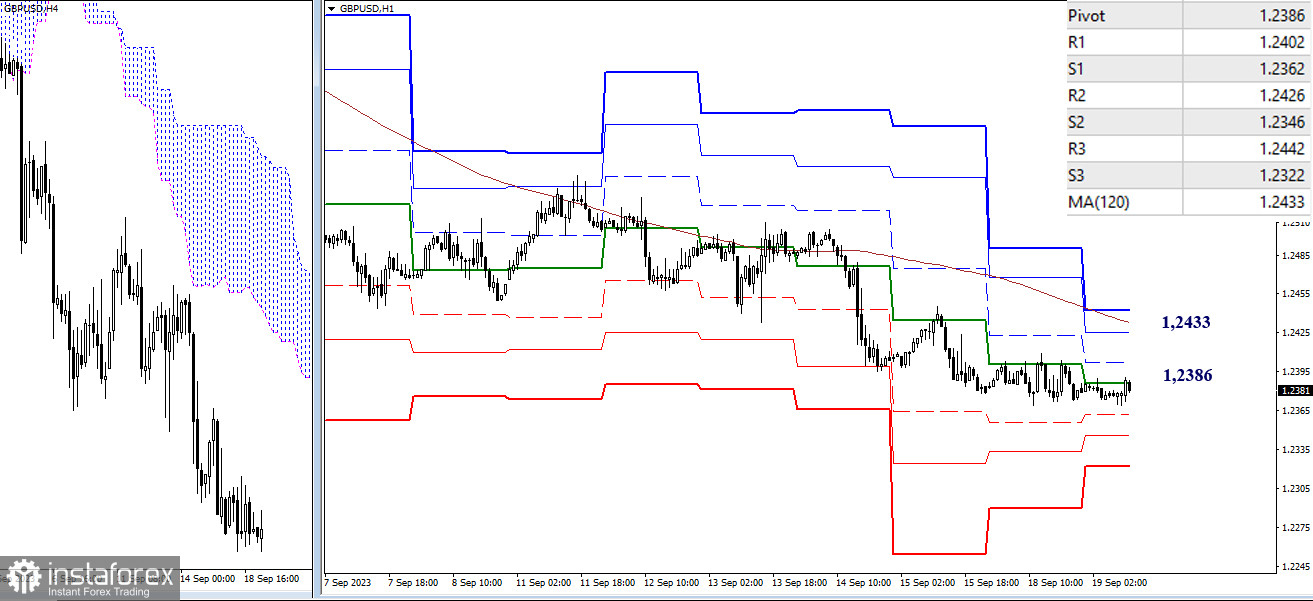

On the lower timeframes, the central pivot point of the day has been successful in holding back the corrective rise of bullish players for a considerable time. Today, this level is located at 1.2386. A break above would allow us to consider a rise towards the main resistance—the weekly long-term trend (1.2433). Intermediate resistances on this path may be provided by the classic pivot points R1 (1.2402) and R2 (1.2426). If the pair returns to continuing the downward trend, then within the day, the values on the path of bearish players may include the supports of the classic pivot points (1.2362 – 1.2346 – 1.2322).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română