Yesterday, no entry signals were formed. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0685 as a possible entry point. The euro went up but failed to retest the 1.0685 level. In the second half of the day, we did not get any good entry points either.

COT report

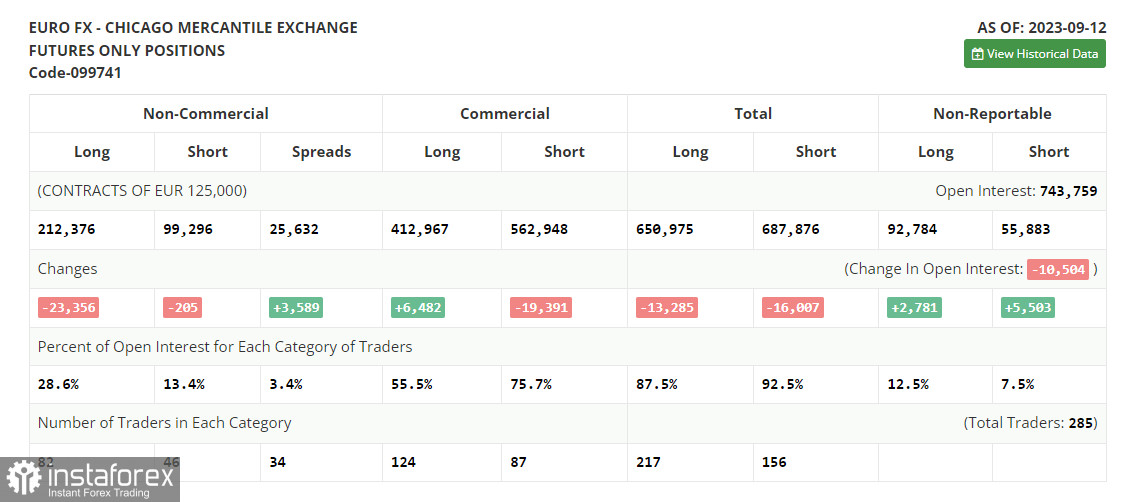

Before analyzing the future trajectory of the EUR/USD pair, let's explore the changes in the futures market and the Commitments of Traders report in particular. The COT report for September 12 revealed a sharp drop in long positions and a modest decline in the long ones. This decline can be attributed to some significant negative developments in the Eurozone economy and a downward revision of the GDP for the second quarter. Despite these setbacks, the European Central Bank (ECB) made a decision to hike interest rates. Such a move in the given scenario could have unfavorable implications in the near term and it might have triggered a sharp depreciation of the European currency. In the coming days, all eyes will be on the Federal Reserve's meeting. Should the committee also decide to increase rates, the euro could face further declines against the dollar. Therefore, it would be wise to exercise caution before making any purchases in the current environment. The COT report indicates a drop in non-commercial long positions by 23,356 to 212,376. On the other hand, non-commercial short positions saw a minor decrease of 205, standing at 99,296. Consequently, the spread between long and short positions expanded by 6,589. The closing price fell to 1.0736 compared to the previous value of 1.0728, signaling a bearish market trend.

For long positions on EUR/USD

The euro's upside correction could come to an end at any moment, especially with today's release of revised inflation data for the Eurozone. Market participants are eagerly awaiting figures for the Eurozone's Consumer Price Index (CPI) for August. More importantly, the core CPI, which is an important inflation gauge for the European Central Bank (ECB), might come in below the preliminary estimate of 5.3%. If the figures are revised downwards, pressure on the euro could increase since this could force the ECB to maintain higher rates for an extended period. Considering these factors, I plan to act on a dip in EUR/USD after it forms a false breakout around the newly established support at 1.0657. Above this level, we have the moving averages that favor the bulls, making it a crucial level to watch. The immediate target in sight is the resistance at 1.0695. A breakout and a downward test of this level, accompanied by the Eurozone's declining inflation data, will boost demand for the euro, offering a chance for a correction and a surge to 1.0731. The ultimate target would be the 1.0767 area, where I intend to lock in profits. If EUR/USD declines and there is no activity at 1.0657, bears will regain market control, ending the bullish correction. Only the formation of a false breakout around 1.0620 will give a signal to buy the euro. I will open long positions immediately on the rebound from 1.0588, aiming for an upward correction of 30-35 points within the day.

For short positions on EUR/USD

Sellers keep stepping in each time the euro rises, indicating their presence ahead of the crucial two-day Federal Reserve meeting starting today. However, in the first half of the day, the market might react to inflation data in the Eurozone. If EUR/USD surges, bears should defend the 1.0695 resistance. A false breakout there would provide an entry point for a downward move to the key 1.0657 support, a significant level for a correction. A breakout of this level and consolidation below it, followed by a bottom-up test, may generate another sell signal targeting 1.0620, where I expect larger buyers to step in. The ultimate target is the 1.0588 area, where I intend to take profit. If EUR/USD moves upward during the European session and bears are absent at 1.0695, the bulls will maintain the upper hand. In such a scenario, I will refrain from going short until the price hits the new resistance at 1.0731. You can sell here as well but only after a failed consolidation. I will open short positions immediately on the rebound from the 1.0767 high, aiming for a downward correction of 30-35 points.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a possible uptrend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0657 will act as support. If the price goes up, the upper band of the indicator at 1.0695 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română