The latest weekly gold review pointed out the gradual easing of pessimism in the market. However, analysts remain with their cautious bias. Daniel Pavilonis, Senior Commodity Broker at RJO Futures said gold will likely show weakness in the coming days, following its confinement in the range between $1900 and $2000.

On the other hand, Mark Leibovit, publisher of VR Metals/Resource Letter, believes that the yield on Treasury bonds peaked for the near term, so they may increase gold positions.

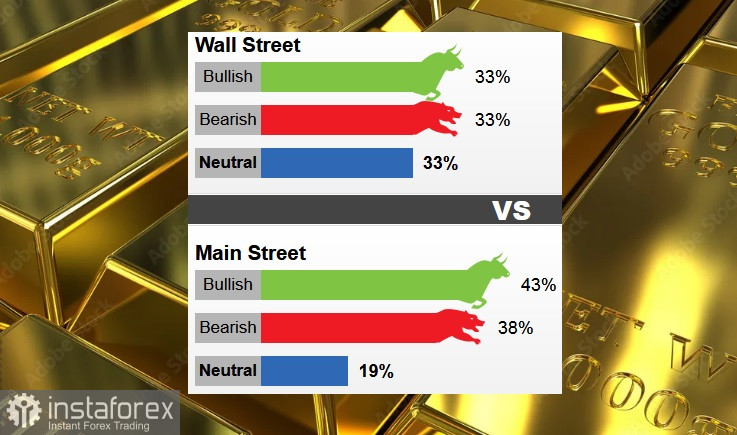

A survey conducted last Friday revealed an evenly distributed forecast, with 33% expecting gold prices to rise, another 33% expecting prices to fall, and the last 33% remain unchanged. In an online poll, 43% expected an increase, 38% expected a decrease in prices, and 19% remained neutral.

Bannockburn Global Forex Managing Director Mark Chandler said gold will likely rise during the week, with prices reaching around $1950.

He mentioned that six G10 central banks will meet, in which UK and Sweden may raise rates. Some believe that Norway and Switzerland might also raise rates, but Chandler does not share this view. He also believes that the Fed will keep rates unchanged.

Meanwhile, Adam Button, Chief Currency Analyst at Forexlive.com said gold prices will decline, while Sean Lusk, Co-Director of Commercial Hedging at Walsh Trading, believes that the precious metal will rise.

The most important news for this week will be the FOMC meeting, which will determine the direction of prices in the near term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română