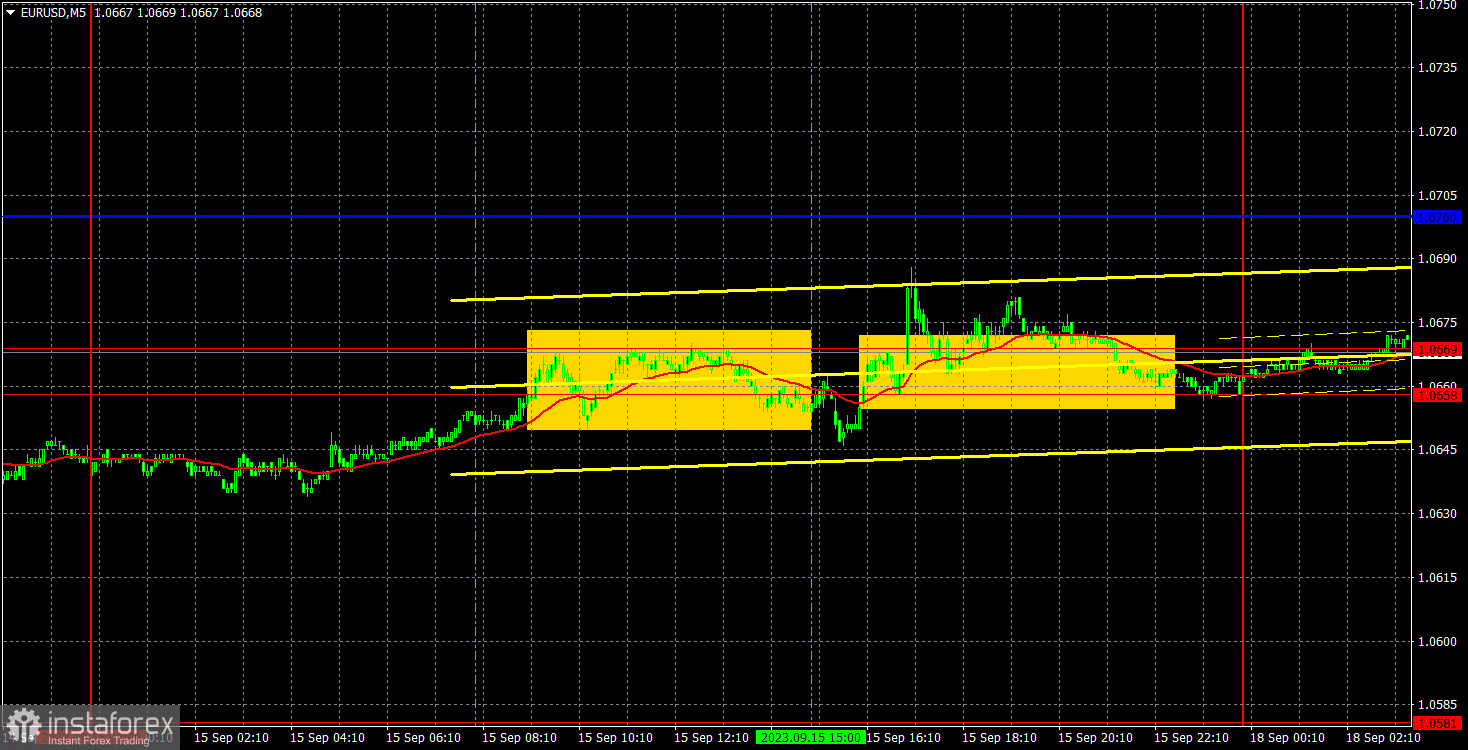

Analysis of EUR/USD 5M

On Friday, EUR/USD exhibited movements that are quite difficult to describe in words. In general, Thursday was the only day that deserved attention. The results of the European Central Bank meeting were announced, and the market eagerly started to sell the euro, even though the central bank decided to raise the key interest rate by 0.25%. However, this is no longer important because the market understands that the ECB is approaching the end of its tightening cycle. There is no longer any difference whether the final rate hike occurs in September or October. There were no significant events in both the US and the EU, which is clearly reflected in the pair's volatility. ECB President Christine Lagarde was supposed to speak again, but obviously she didn't say anything interesting. US reports on industrial production and consumer sentiment slightly weighed on the dollar, but the reaction was minimal.

It doesn't make sense to consider the trading signals either. First, the price sluggishly moved toward the 1.0658-1.0669 range, then rebounded from it by about 10 pips, and then settled above it by about 10 pips. It was difficult to consider each of these reversals as a signal. We believe that by the start of the US trading session (when the first signal was formed), it was already clear that there would be no significant movements, and volatility was practically zero, so entering the market was not advisable.

COT report:

On Friday, a new COT report for September 12 was released. Over the last 12 months, COT reports fully corresponded to what is happening in the market. The chart above clearly shows that the net position of major traders (the second indicator) began to grow in September 2022 and at about the same time the euro started rising too. In the last 6-7 months, the net position has not risen but the euro remains at very high levels and is declining rather slowly. Nonetheless, it is still declining. Any significant decline often starts from a small one. At the moment, the net position of non-commercial traders is bullish and remains strong, but the euro is gradually falling.

I have already mentioned the fact that a fairly high value of the net position signals the end of an uptrend. Perhaps that time has come. The red and green lines are very far from each other, and they have even started to converge. Usually, it precedes the end of the trend. Therefore, we believe that the uptrend is coming to an end. During the last reporting week, the number of long positions of the non-commercial group of traders decreased by 23,300 and the number of short ones fell by 200. The net position decreased by 23,100 contracts. The number of long positions is higher than the number of short ones of non-commercial traders by 113,000 but the gap is narrowing, which is a good sign. Even without COT reports, it is obvious that the euro should decline, and the COT reports support this scenario.

Analysis of EUR/USD 1H

On the 1H chart, the currency pair maintains a downtrend. It hasn't managed to correct, and there's no solid reason for strong growth. We previously warned that the euro's fall could resume at any moment. It did resume, surprisingly on Thursday when it was least expected. However, the overall decline of the euro is absolutely logical and justified. We believe it will continue in the medium term.

On September 18, traders should pay attention to the following key levels: 1.0485, 1.0537, 1.0581, 1,0658-1,0669, 1.0768, 1.0806, 1.0868, 1.0935, 1.1043, 1.1092, as well as the Senkou Span B (1.0816) and Kijun-sen (1.0700) lines. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits. Traders look for signals at rebounds and breakouts. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 15 pips. This will protect against possible losses if the signal turns out to be false.

On Monday, ECB Vice President Luis de Guindos is scheduled to speak. However, Lagarde herself did not provide any significant information on Friday, and de Guindos has already mentioned that interest rates are unlikely to rise again at least once. Therefore, we do not expect anything interesting from today's speech.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română