Long-term perspective.

The GBP/USD currency pair lost only 50 points this week. The pair's volatility was low for most of the week, although not negligible. On average, the pound moved 70-80 points daily, allowing for trading opportunities. However, the most active day of the week was Thursday, when there were no significant events in the UK and only a few secondary reports in the US. On this day, the ECB announced the results of its meeting, raising the key interest rate and suggesting that it would do so again in the future. This led to a drop in the euro, dragging the pound lower. Such paradoxical events and the market's reaction to them are intriguing and challenging to interpret.

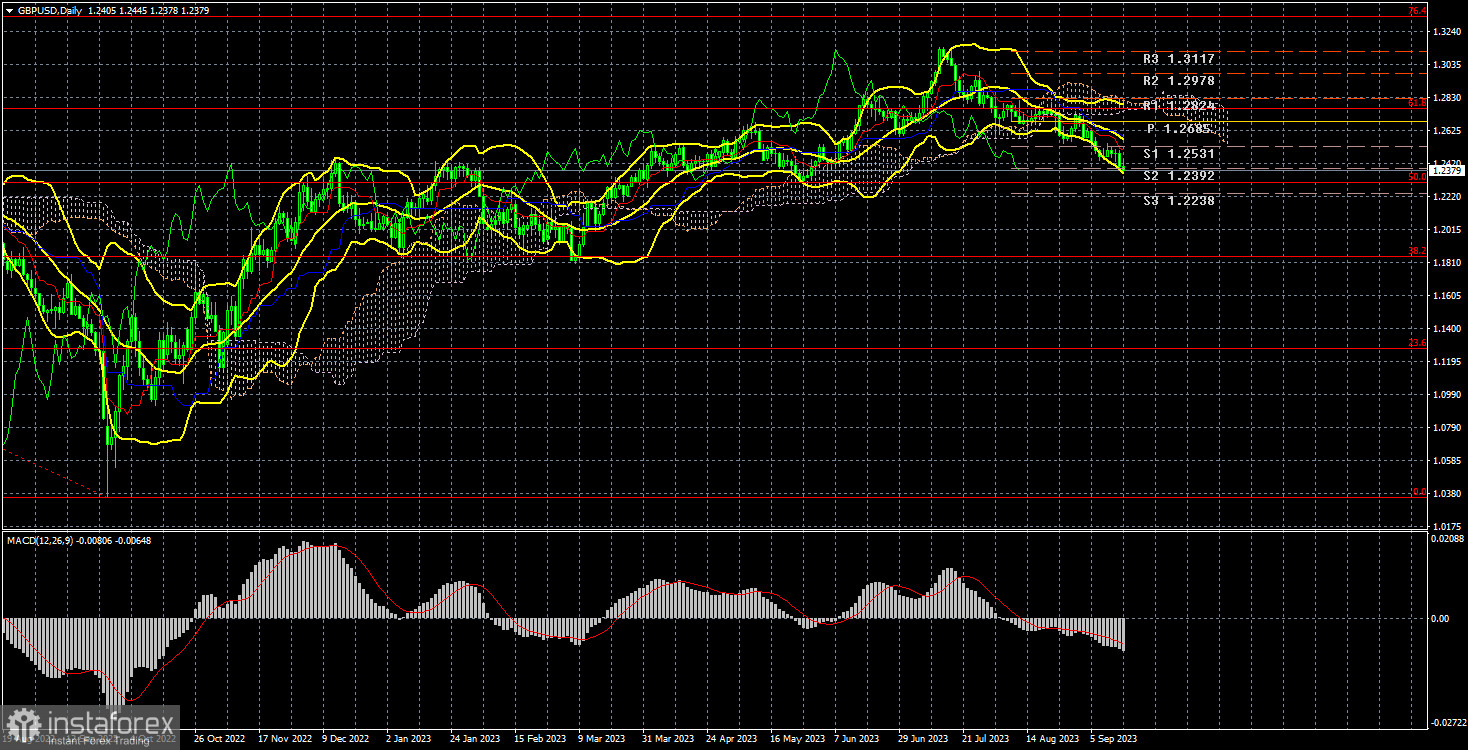

On other days of the week, when there were important events in the US and the UK, the market remained stagnant. Cumulatively, the British currency continues to decline and is now within arm's reach of the 50.0% Fibonacci level, which also serves as the last local minimum. Thus, the pound may bounce off this level and appreciate slightly, but we expect further declines in the coming months.

Next week, the Bank of England and the Federal Reserve will hold meetings, so anything can happen. We have already seen how the key interest rate can rise and the currency of that central bank can fall. Surprises or non-standard market reactions may await us next week. Making long-term conclusions from the macroeconomic statistics we have received over the last five days is very challenging. Inflation in the US has increased, but at the same time, core inflation has fallen. It is still being determined what decision the Federal Reserve will make now. In the UK, unemployment has risen, wages have increased significantly, and unemployment benefits claims have decreased significantly. GDP and industrial production both fell in July. British statistics remain weaker than American ones, and the Bank of England is likely approaching the end of its monetary policy tightening cycle.

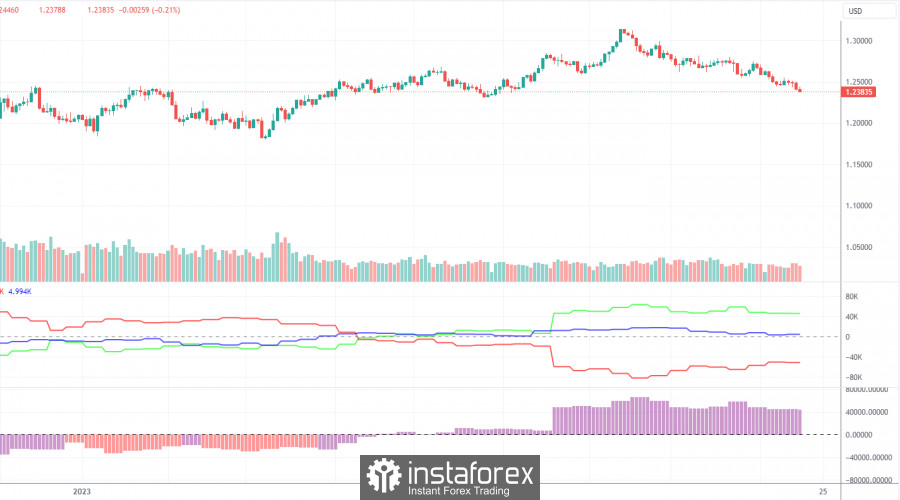

COT Analysis.

According to the latest report on the British pound, the "Non-commercial" group opened 4.7 thousand buy contracts and 4.9 thousand sell contracts. Thus, the net position of non-commercial traders decreased by 0.2 thousand contracts over the week. The net position indicator has steadily risen over the last 12 months and remains high, while the British pound has not rushed southward. However, the British pound has declined in the last two months. If it rose for a year before that, why should it now show a rapid decline? We may be at the very beginning of a prolonged downtrend.

The British currency has risen by 2800 pips from its absolute lows reached last year, a significant amount. Without a strong downward correction, further growth would be entirely illogical. We are not against an uptrend; we believe that a substantial correction is needed first, and then we should examine the supporting factors for the dollar and the pound. The "Non-commercial" group currently has 97.3 thousand contracts open for buying and 51.1 thousand contracts for selling. We remain skeptical about the long-term rise of the British currency as we do not see any fundamental and macroeconomic grounds for it.

Fundamental Events Overview:

In the UK, there were quite a few macroeconomic events this week. However, much of the data either disappointed or was largely ignored by market participants. The British pound has been on a two-month decline, and this descent is well-founded. So, what changed this week? The economic data from the UK remains weak, and finally, the pound is declining for valid reasons. Everything is going as planned. In the US, the only noteworthy report to pay attention to this week was the inflation report. However, after its publication, more questions arose than were answered. The Federal Reserve may raise interest rates at least one more time this year, but when will that happen? In September or later? This is now less important. For now, the dollar holds the advantage in the market in almost any scenario.

Trading plan for the week of September 18th to 22nd:

- The GBP/USD pair continues to form a new downward correction, which this time looks more convincing than all the previous ones. Every previous attempt to correct appeared feeble, but now we have seen a move below the Ichimoku cloud, indicating that further decline is likely. The price is below all the Ichimoku indicator lines, making long positions irrelevant. If the price consolidates above the Kijun-sen line, it may signal a potential resumption of the uptrend. In this case, the target is the Fibonacci level of 76.4% at 1.3330.

- As for selling, it is currently the more sensible option. The pound has been rising for a long time, but practically all factors and indicators point southward. Therefore, selling is not only possible but even advisable. The nearest target is the Fibonacci level of 50.0% at 1.2302, which is only 80 points away. We expect this level to be surpassed, and the decline will continue with a target of 1.1840.

Explanation of illustrations:

Price support and resistance levels, Fibonacci levels - these are the target levels when opening buy or sell positions. Take Profit levels can be placed around them.

Indicators: Ichimoku (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the size of the net position for each category of traders.

Indicator 2 on COT charts - the size of the net position for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română