EUR/USD

Higher Timeframes

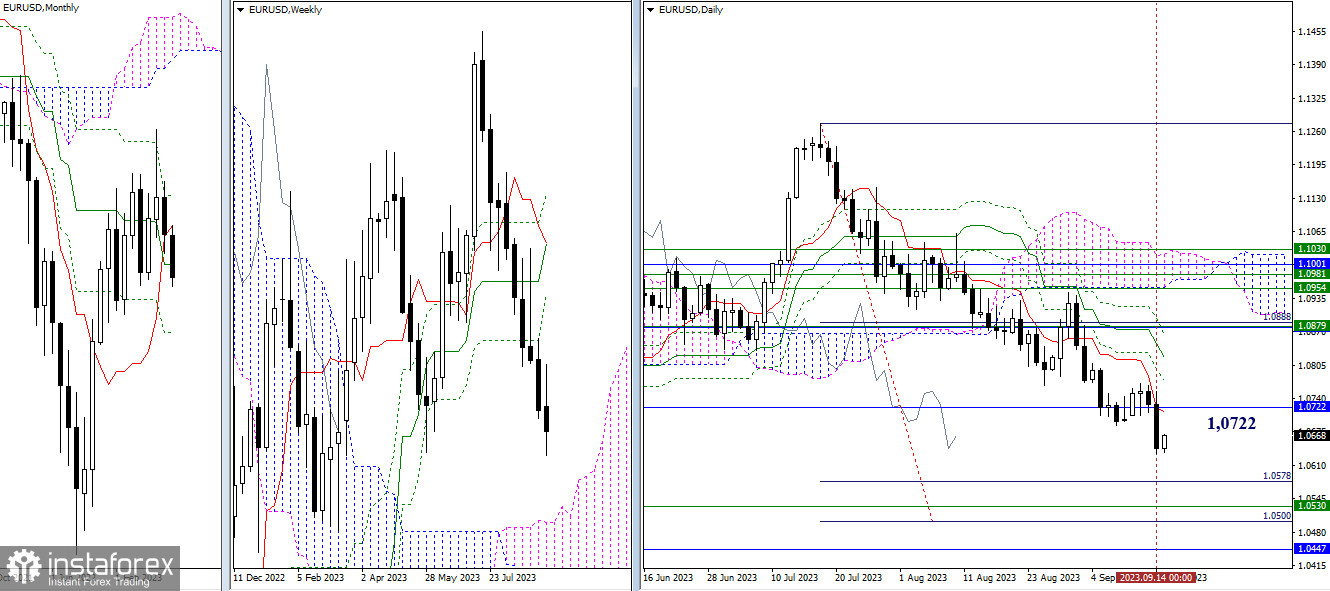

Another week is nearing its end. After a corrective consolidation, bearish players are trying to exit the zone of attraction of the monthly medium-term trend (1.0722) and continue the downward trend on the daily chart. In the current situation, there is a fairly wide support zone, including the daily target for breaking the Ichimoku cloud (1.0500 – 1.0578), the upper boundary of the weekly cloud (1.0530), and the final level of the monthly Ichimoku cross (1.0447).

H4 – H1

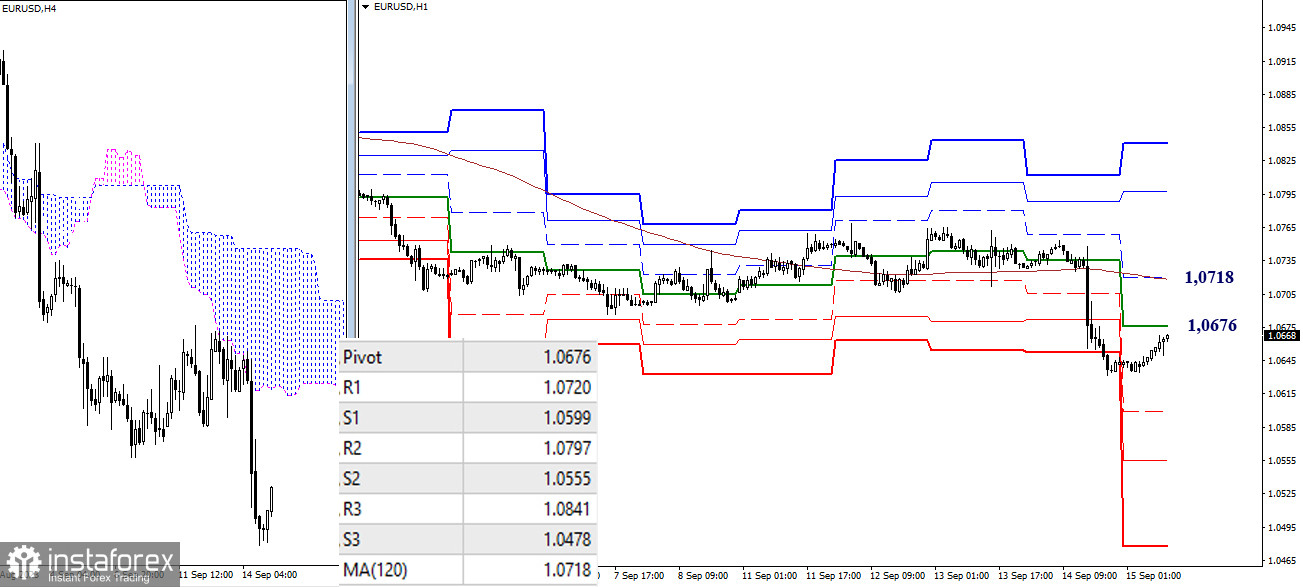

The weekly long-term trend finally succumbed to downward pressure yesterday, resulting in a shift in favor of bears on lower timeframes. The targets for further decline today are located at 1.0599 – 1.0555 – 1.0478 (support levels of classic pivot points). At the moment, there is a corrective rally, the tasks of which include surpassing the central pivot point of the day (1.0676) and interacting with the weekly long-term trend (1.0718). The outcome of this interaction and the behavior of the moving average can alter the current balance of power on lower timeframes. Additional upside targets after surpassing 1.0718 will be the resistance levels of the classic pivot points (1.0797 – 1.0841).

***

GBP/USD

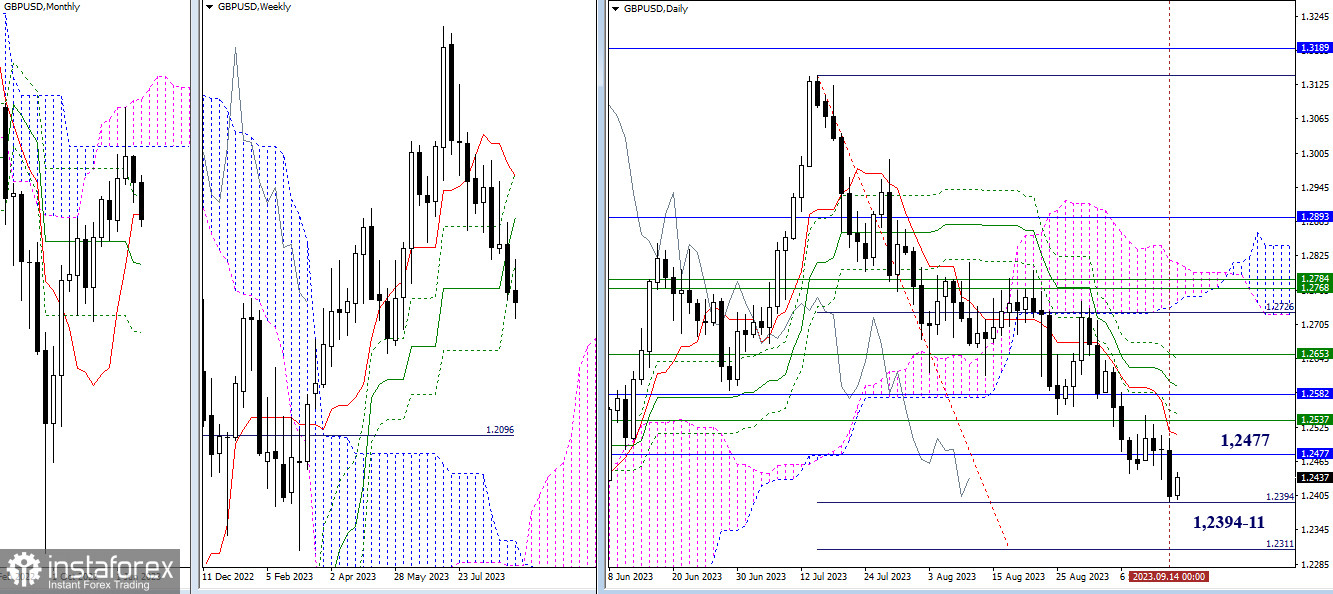

Higher Timeframes

Yesterday, bearish players resumed their decline and tested the first target level for breaking the daily Ichimoku cloud (1.2394). The next task is to fully achieve the daily target (1.2311). The levels that were tested during the last corrective rally continue to serve as resistances today, still located at 1.2477 – 1.2512 – 1.2537 (monthly and daily short-term trends + final level of the weekly Ichimoku cross).

H4 – H1

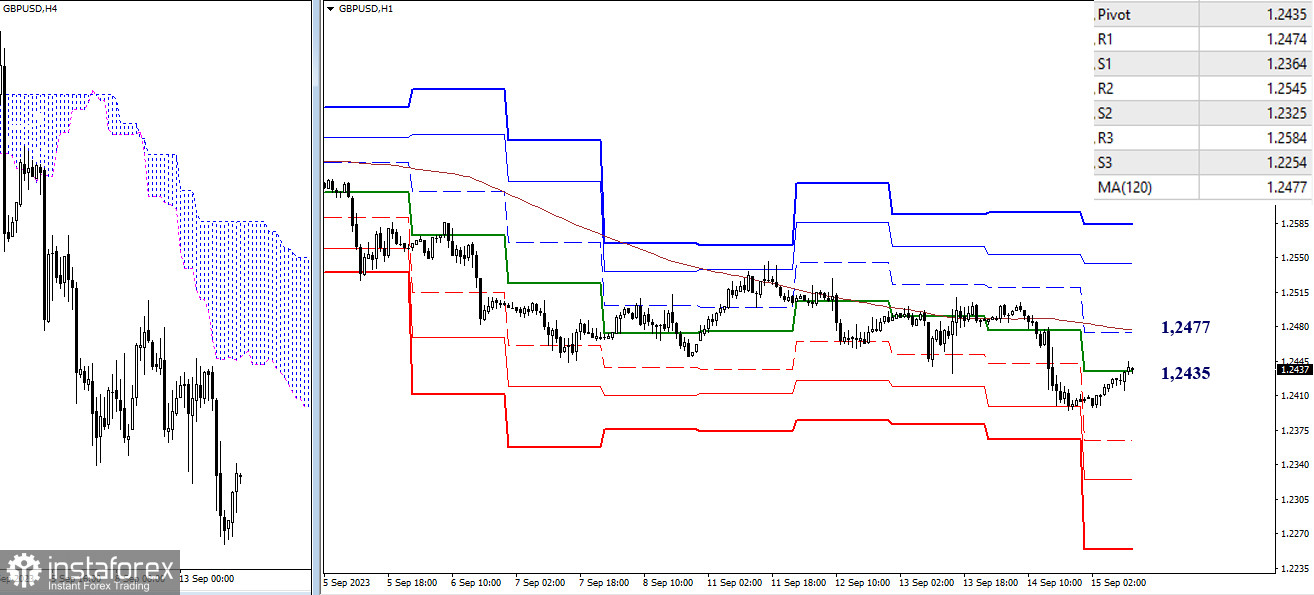

On lower timeframes, the main advantage currently belongs to bearish players. The targets for further decline are the support level of the classic pivot points (1.2364 – 1.2325 – 1.2254). The targets for the ongoing upward correction are at 1.2435 (central pivot point of the day) and 1.2477 (weekly long-term trend). A solid break above and a reversal of the moving average can change the current balance of power in favor of bullish sentiments. In this case, additional targets for continued upward movement within the day will be 1.2545 and 1.2584 (resistance levels of the classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română