EUR/USD

Yesterday, the euro fell by 85 pips after the European Central Bank's decision to raise interest rates by 0.25%. However, this decline was baffling for the following reasons: while the rate hike was not unexpected, it was not factored into the euro's current exchange rates, which has been declining by 6 figures since mid-July. Other currencies (Canadian and Australian dollars), gold, oil, and stock markets all rose, U.S. bond yields also increased, and the likelihood of interest rate hikes staying unchanged for the Federal Reserve's September meeting remains at 98%. Yesterday, U.S. retail sales data for August showed a 0.6% increase, and producer prices for the same month increased by 0.7% (1.6% YoY compared to 0.8% YoY previously), but this data came out after the euro had already started to fall.

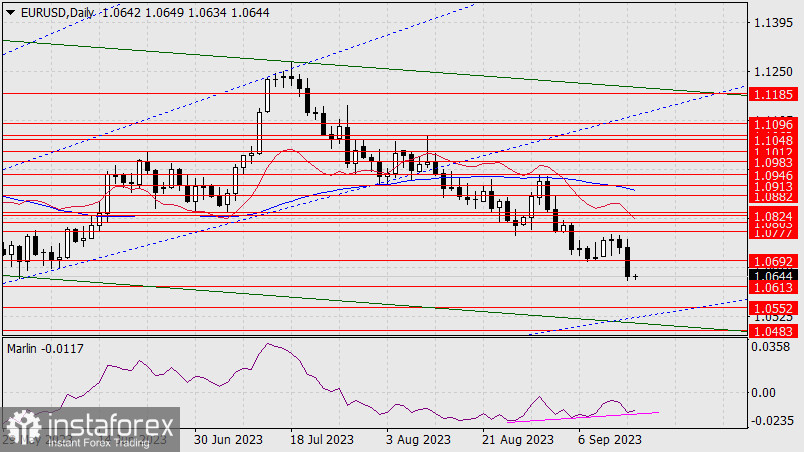

Paradoxically, the technical picture with the potential for a reversal has become clearer - a double convergence has formed on the daily chart. Also, the price reached the May 31 low, and on that day, the euro reversed and started a one-and-a-half-month uptrend. Yesterday's trading volume was significant, but if it is related to closing positions, then it wouldn't be difficult to reverse the trend. However, the downtrend persists. If it continues, and the price breaks below the nearest support at 1.0613, the target will be 1.0552, and from there, the price can even reach a strong support area consisting of Fibonacci levels, the price channel line, and the target level at 1.0483. The convergence will likely be broken.

It is possible that the price will not show its succeeding direction until the Fed holds its meeting next week. If the market ignored the U.S. CPI and the ECB interest rate hike, strategic investors are likely waiting for the Fed meeting.

On the 4-hour chart, the price is falling below the balance and MACD indicator lines, and the Marlin oscillator is decreasing in the bearish territory. The pair has a bearish bias, and it could reach the target of 1.0613.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română