Overview of macroeconomic reports

There are fewer macroeconomic events on Friday, and none of them are crucial. We will only highlight the US reports on industrial production and consumer sentiment. Both of these reports are of secondary importance and may only provoke a market reaction in the case of a significant deviation of the actual value from the forecast. It seems as if we've already seen and learned the most interesting developments this week. For instance, the market has shown us that it has long priced in all future rate hikes by the European Central Bank. As a result, at the moment, it is ready to sell the euro and the pound, which aligns with our expectations.

Overview of fundamental events

Among the fundamental events, we can highlight ECB President Christine Lagarde's speech. However, she spoke right after the ECB meeting on Thursday and has already provided the market with all the necessary information. Therefore, we don't expect any new information from her. Consequently, market reaction is unlikely to follow. It seems that Friday will be another uneventful day, although both the euro and the pound may extend its decline.

Bottom line

No particularly influential events on Friday. Beginners may pay attention to Lagarde's speech and the US data, but the market will probably brush it off. This means that there is no need to expect strong movements on Friday.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

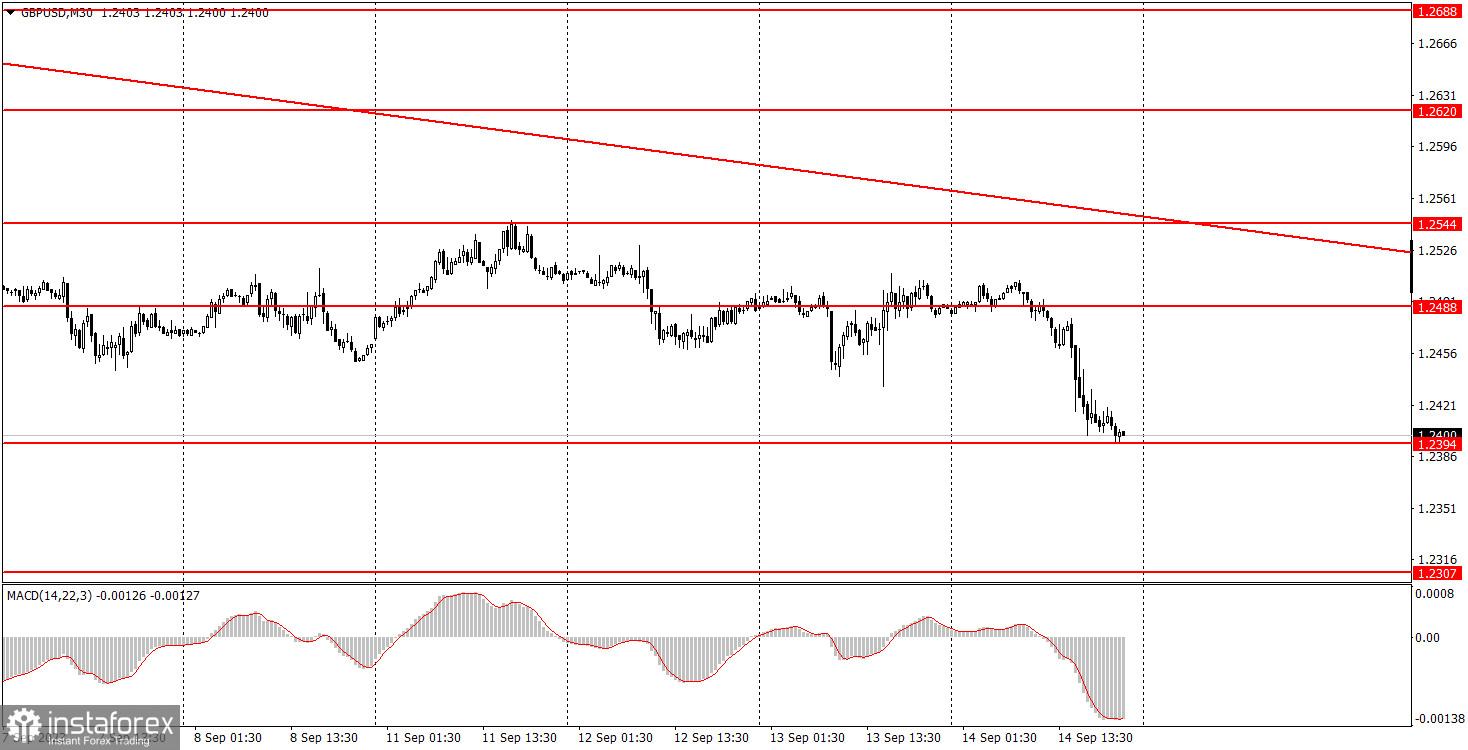

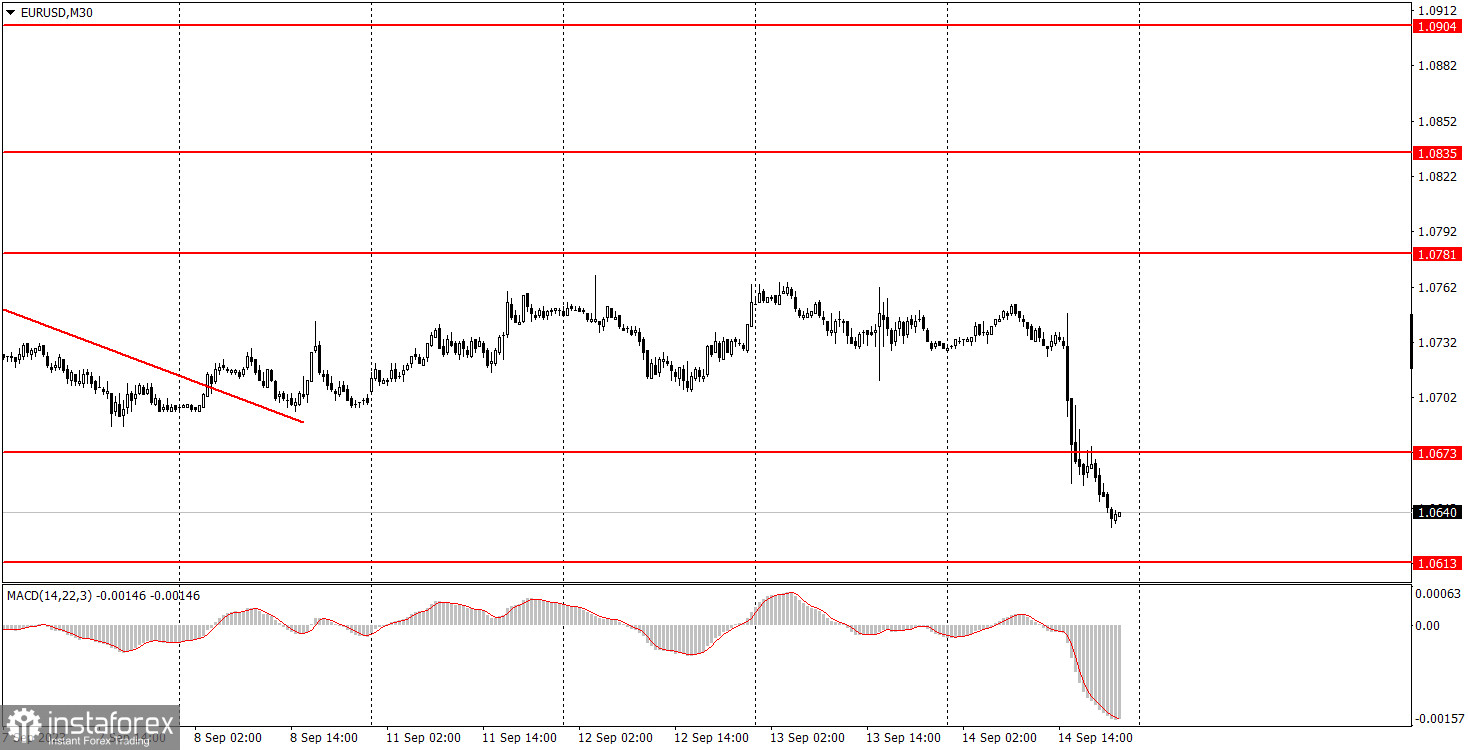

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română