On Tuesday, the U.S. stock market ended the day lower, with the Nasdaq experiencing the most significant drop, primarily due to the downturn of Nvidia's chipmaker stocks ahead of its awaited earnings report, while Walmart's rise helped mitigate losses in the Dow Industrials index.

Shares of Nvidia (NVDA.O) declined by 4.35%, marking the most substantial daily percentage loss since October 17. This was followed by a 1.56% decrease in the broader Philadelphia Semiconductor Index (.SOX), dragging down the shares of other semiconductor manufacturers.

Investors expressed concerns about whether Nvidia's quarterly results, expected after market close on Wednesday, could justify its high valuation, which is based on a price-to-earnings ratio slightly over 32, and whether it would continue to fuel the hype around stocks related to artificial intelligence (AI).

Nvidia's focus on AI has made it the third most valuable company in the U.S., recently surpassing Tesla (TSLA.O) as the most traded stock on Wall Street.

Shares of Super Micro Computer (SMCI.O), another company believed to benefit from AI, fell by 1.96%, marking the second consecutive day of decline after a nearly 20% drop on Friday, ending a nine-session streak of gains.

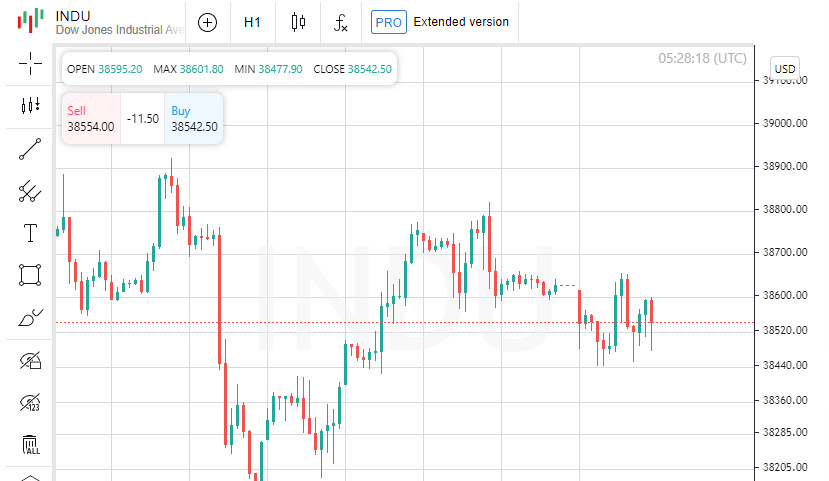

The S&P 500 (.SPX) lost 30.06 points, or 0.60%, closing at 4975.51, while the Nasdaq Composite (.IXIC) dropped 144.87 points, or 0.92%, to 15630.78. The Dow Jones Industrial Average (.DJI) fell by 64.19 points, or 0.17%, to 38,56.80.

Walmart (WMT.N) closed at a record high, leading the Dow Industrials after the American retail giant forecasted sales for the 2025 fiscal year well above Wall Street expectations and raised its annual dividends by 9%.

The S&P 500 Consumer Goods Sector (.SPLRCS), which includes Walmart, rose by 1.13%, becoming the only sector among the 11 major S&P sectors to show growth, while the Information Technology Sector (.SPLRCT) declined by 1.27%, the weakest performance.

Shares of Home Depot, part of the Dow, fluctuated throughout the day but closed up by 0.06% after the home improvement retailer forecasted full-year results below analysts' estimates.

The Wall Street rally from the previous week stalled as higher-than-expected U.S. inflation data pushed back market expectations regarding the timing of rate cuts by the Federal Reserve. A slight majority of economists surveyed by Reuters expect a rate cut in June, noting the risk of further delays to the first reduction.

Investors were also awaiting the publication of the minutes from the last Federal Reserve policy meeting and comments from several central bank officials later in the week.

Shares of smart TV manufacturer Vizio (VZIO.N) jumped by 16.26% after Walmart announced its acquisition of the company for $2.3 billion.

Discover Financial Services (DFS.N) shares surged by 12.61% amid plans by Warren Buffett-backed consumer bank Capital One to acquire the American credit card issuer for $35.3 billion. Capital One shares rose by 0.12%.

On the New York Stock Exchange, decliners outnumbered advancers by a ratio of 1.4 to 1, while on Nasdaq, decliners exceeded advancers by a ratio of 1.9 to 1.

The S&P 500 set 29 new 52-week highs and 3 new lows, whereas Nasdaq recorded 111 new highs and 95 new lows.

The dollar weakened, and global stock indexes fell on Tuesday as fading optimism over central banks soon lowering interest rates left major European and Japanese stock indexes just below their historic highs.

Higher-than-expected U.S. inflation data last week diminished expectations for an imminent start to the Federal Reserve's easing cycle, pushing back rate cut expectations to June, according to a slight majority of economists surveyed by Reuters, who also noted the risk of further delay in the first reduction.

Despite calls for deflation based on below-trend economic growth expectations, the real picture in the U.S. economy shows only a slight slowdown, according to Philip Colmar, a global strategist at MRB Partners in New York.

The U.S. dollar index, measuring the currency against six others, fell by 0.24%, while the global MSCI stock index (.MIWD00000PUS) lost 0.35%.

The European STOXX 600 index (.STOXX) closed down 0.10%, ignoring European Central Bank data showing that annual contractual wage growth in the eurozone slowed to 4.5% in the last quarter of the previous year compared to 4.7% in the preceding period.

The ECB has identified wage growth as the most significant risk in its eighteen-month crusade against inflation. ECB wage agreement analysis indicates that wage growth will remain high this year, with an increasing number of companies expecting price hikes, according to Marco Wagner, a senior economist at Commerzbank.

The reaction to interest rate forecasts from asset classes other than bonds has been muted so far, but U.S. economic growth compared to other countries is likely to shift central banks' sharp expectations, according to Marvin Lo, a senior global macro strategist at State Street in Boston.

Since mid-January, the market has reduced rate cut expectations by 60 basis points for the Fed, the same for the Bank of Canada, 37 basis points for the ECB, and 57 basis points for the Bank of England, he said.

The yield on two-year Treasury notes, reflecting interest rate expectations, fell by 4.8 basis points to 4.608%, while the yield on benchmark 10-year notes decreased by 2.4 basis points to 4.271%.

The dollar weakened after China cut rates to support its struggling real estate market, sparking hopes for additional stimuli to boost global growth.

The yen strengthened but remained below the 150.88 per dollar level reached last Monday, the lowest in 11 weeks, as investors focused on whether the resumption of the Japanese currency's weakness would trigger intervention.

Oil prices fell more than 1% as concerns over global demand offset price support from the conflict between Israel and HAMAS.

Brent crude futures fell by $1.22 to $82.34 a barrel. The six-month Brent spread on Tuesday was the highest since October, indicating a tighter market.

WTI crude for March delivery, which expires on Tuesday, fell by $1.01 to $78.18 a barrel. The more actively traded April contract fell by $1.30 to $77.04 a barrel.

Gold prices rose to their highest level in more than a week amid the dollar's decline, with futures on American gold increasing by 0.8% to $2039.80 an ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română