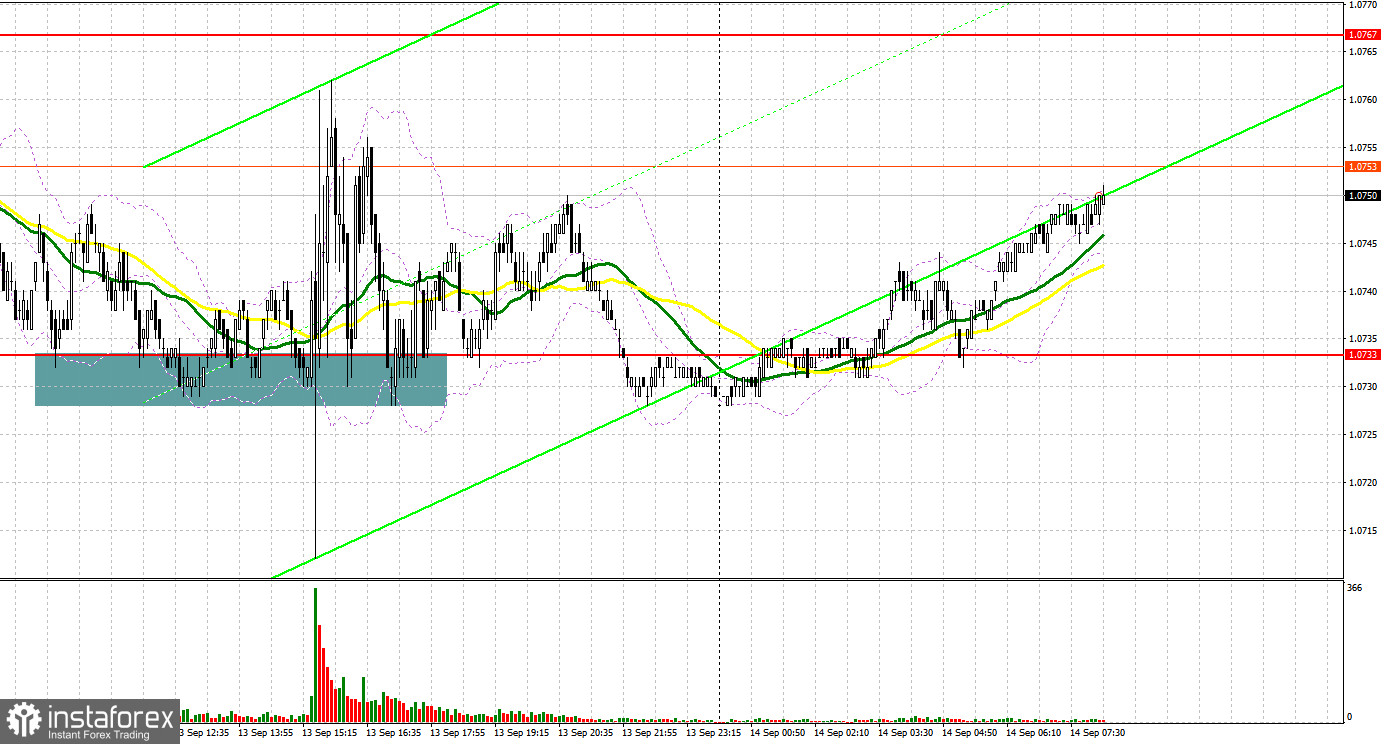

Yesterday, the pair formed several excellent entry signals. Let's see what happened on the 5-minute chart. In my morning review I mentioned the level of 1.0733 as a possible entry point. A decrease and a false breakout at the 1.0733 level produced a buy signal, but after an upward correction by 13 points, the currency pair came under pressure again. In the afternoon, following the US inflation report, sellers tried to break below 1.0733, but failed, which created another buy signal.

For long positions on EUR/USD:

The August US CPI data almost coincided with economists' forecasts. The dollar weakened after the inflation report raised expectations that the Federal Reserve will pause its rate hiking cycle at next week's meeting. But today all eyes are on another important event: everything will start with the European Central Bank's key interest rate decision and monetary policy report, followed by a press conference by ECB President Christine Lagarde. A hawkish tone will support the euro and its bullish correction, just like the decision to raise interest rates. In case the ECB shows a softer stance, the pressure on the euro will increase and buyers will have to defend the support at 1.0733, which acts as the middle of the sideways channel and is in line with the bullish moving averages. This will serve as a confirmation of a correct entry point for long positions aiming for a recovery towards the 1.0767 resistance, which performed flawlessly this week. A breakout and a downward test of this range against the backdrop of strong eurozone data will bolster demand for the euro, offering it a chance to spike to 1.0798. The most distant target remains the 1.0825 area where I intend to lock in profits. Should the EUR/USD pair decline and show no activity at 1.0733, bears will reclaim market control. Under such circumstances, only a false breakout near 1.0700, which we did not reach yesterday, will give a buy signal. I will open long positions immediately on a bounce from 1.0665, considering an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

Sellers continue to defend weekly highs and count on the ECB to show a dovish stance and keep rates unchanged. During the European session, I will only sell after a rise and a false breakout near 1.0767, which will push EUR/USD down to the middle of the 1.0733 channel. Only upon breaking and consolidating below this range, coupled with an upward retest, do I anticipate another sell signal with a target of 1.0700, where stronger buyers are likely to emerge. The ultimate target lies at 1.0665, where I will be locking in profits. In the event of an upward movement in EUR/USD and the absence of bears at 1.0767, which will be possible only if the ECB shows an aggressive stance, bulls will have a chance to build an upward correction against the bearish trend. Under such developments, I will postpone going short until the price hits the new resistance at 1.0798. You can sell at this level but only after a failed consolidation. I will open short positions immediately on a bounce from the 1.0825 high, aiming for a downward correction of 30-35 pips.

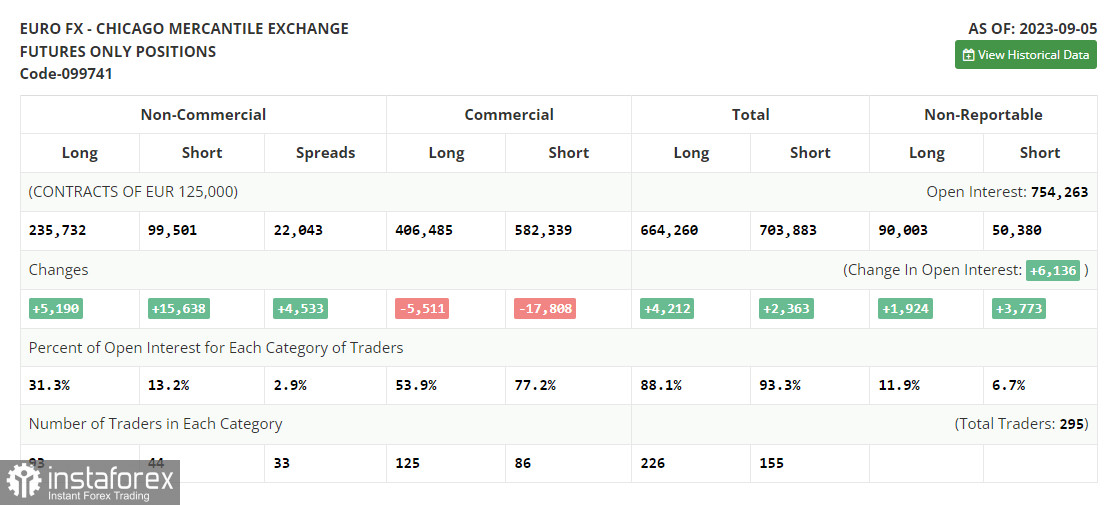

COT report:

The Commitments of Traders (COT) report for September 5 displayed an increase in both long and short positions. Pronounced negative shifts in the Eurozone's economic activity, coupled with downward revisions of the GDP data for the second quarter, have augmented short positions for the trading instrument. Amplifying this sentiment, statements from the Federal Reserve representatives hinting at potential rate hikes in the US explain why the US dollar is surging while the European currency is losing ground. In the immediate horizon, crucial US inflation figures are on tap, poised to influence the future course of monetary policy and affect the direction of EUR/USD. Notably, as the euro is declining, we can observe an increase in long positions, reflecting the improved appetite of risk-asset buyers at these comfortable price levels. The COT report shows that non-commercial long positions rose by 5,190 to 235,732, while non-commercial short positions surged by 15,638, reaching 99,501. Consequently, the spread between long and short positions expanded by 4,533. The closing price declined to 1.0728 from 1.0882, signaling a bearish market trend.

Indicator signals:

Moving averages:

The instrument is trading just above the 30 and 50-day moving averages. It indicates that the buyers are trying to return to the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0730 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română