Analysis of GBP/USD 5M

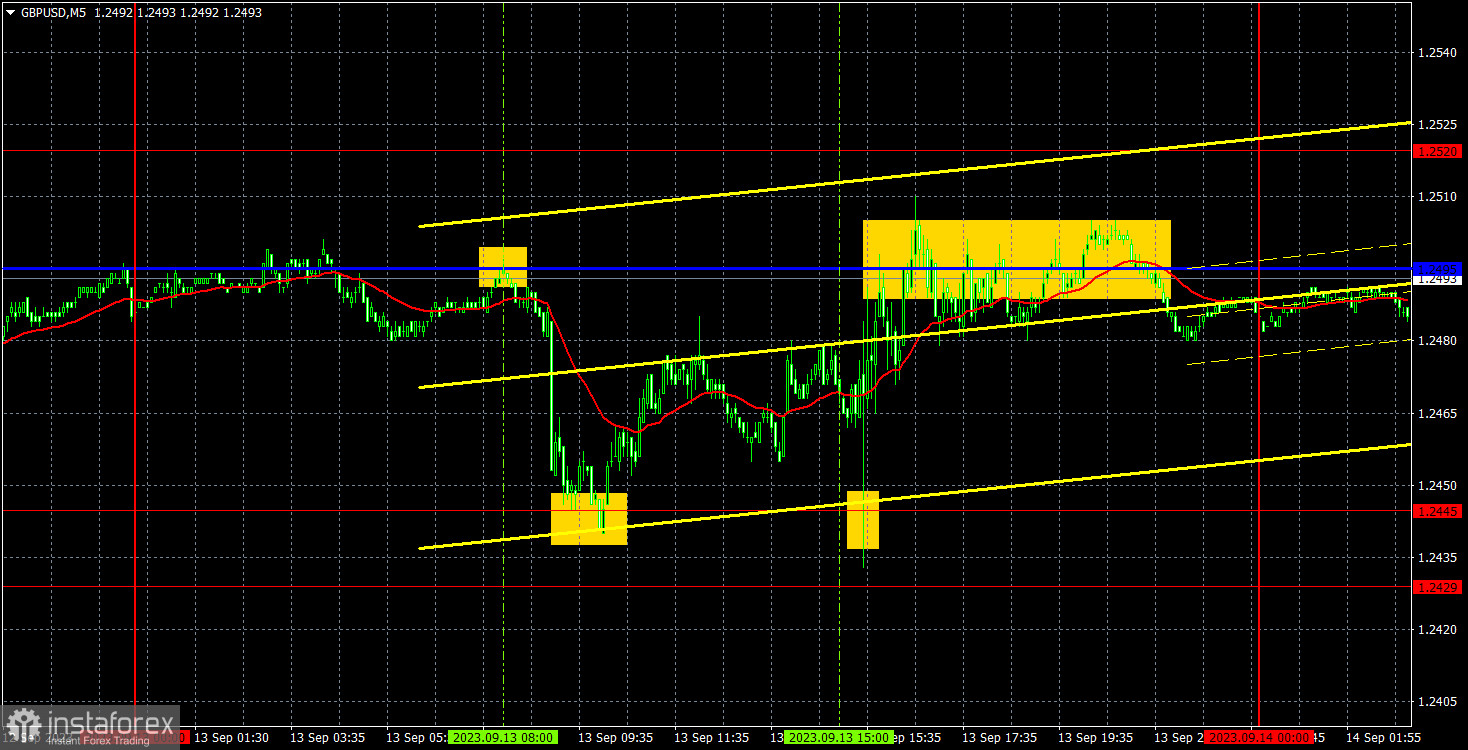

On Wednesday, GBP/USD continued to correct higher, but it mostly moved sideways. Like the euro, none of the day's fundamental reports provided any support to the pound. The price stayed between the level of 1.2445 and the Kijun-sen line (1.2495) throughout the day, creating a 50-point sideways channel. In the morning, the UK reports exerted downward pressure on the pound and the pair fell from the upper band of this channel to the lower one. At the beginning of the US trading session, the inflation report was released, which traders interpreted negatively for the dollar, so the pair rose from the lower band of the sideways channel back to the upper one. This is the kind of influence the data had on the pair's movement.

Speaking of trading signals, the first sell signal formed near the critical line at the beginning of the European session. Afterwards, the pair fell to the level of 1.2445 and formed a buy signal near it. As a result, one could have earned about 30 pips from a short position. The long position should have been moved to break-even before the US inflation report was released or closed manually. In any case, there was no loss on it. Later in the day, the pair traded along the Kijun-sen line. As a result, there was profit, but it was relatively small due to low volatility and the flat phase.

COT report:

According to the latest report, the non-commercial group of traders closed 900 long positions and opened 9,800 short ones. Thus, the net position of non-commercial traders decreased by 10,700 positions in a week. The net position has been steadily growing over the past 11 months as well as the pound sterling. Now, the net position has advanced markedly. This is why the pair will hardly maintain its bullish momentum. I believe that a long and protracted downward movement should begin. COT reports signal a slight growth of the British currency but it will not be able to rise in the long term. There are no drivers for opening new long positions. Sell signals are starting to appear on the 4-hour and 24-hour charts.

The British currency has already grown by a total of 2,800 pips, from its absolute lows reached last year, which is a significant increase. Without a downward correction, the continuation of the uptrend will be illogical. We are not against the uptrend; we just believe a solid correction is needed first. The market perceives the fundamental background one-sidedly, ignoring any data in favor of the dollar. The Non-commercial group of traders has a total of 97,000 long positions and 48,700 short ones. I remain skeptical about the long-term growth of the pound sterling, and the market has recently started to pay more attention to selling.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD has settled below the ascending trendline, so the pair may extend its downward movement. The pound has a bearish bias and cannot enter a significant corrective phase. Over the past five days, all the movements on the hourly chart seem more like a flat than a correction. Next week, traders will look to the meetings of the Federal Reserve and the Bank of England, so we can expect the end of the flat phase.

On September 14, traders should pay attention to the following key levels: 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693, 1.2786, 1.2863. The Senkou Span B (1.2594) and Kijun-sen (1.2490) lines can also be sources of signals, e.g. rebounds and breakout of these levels and lines. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 20 pips. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits.

On Thursday, there are no important reports lined up in the UK, while the US will release reports on retail sales, initial jobless claims, and the Producer Price Index. In our opinion, these aren't crucial reports, which means that they are not able to move the pair out of the sideways channel. However, there is also the European Central Bank meeting, which could influence the British pound as well.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română