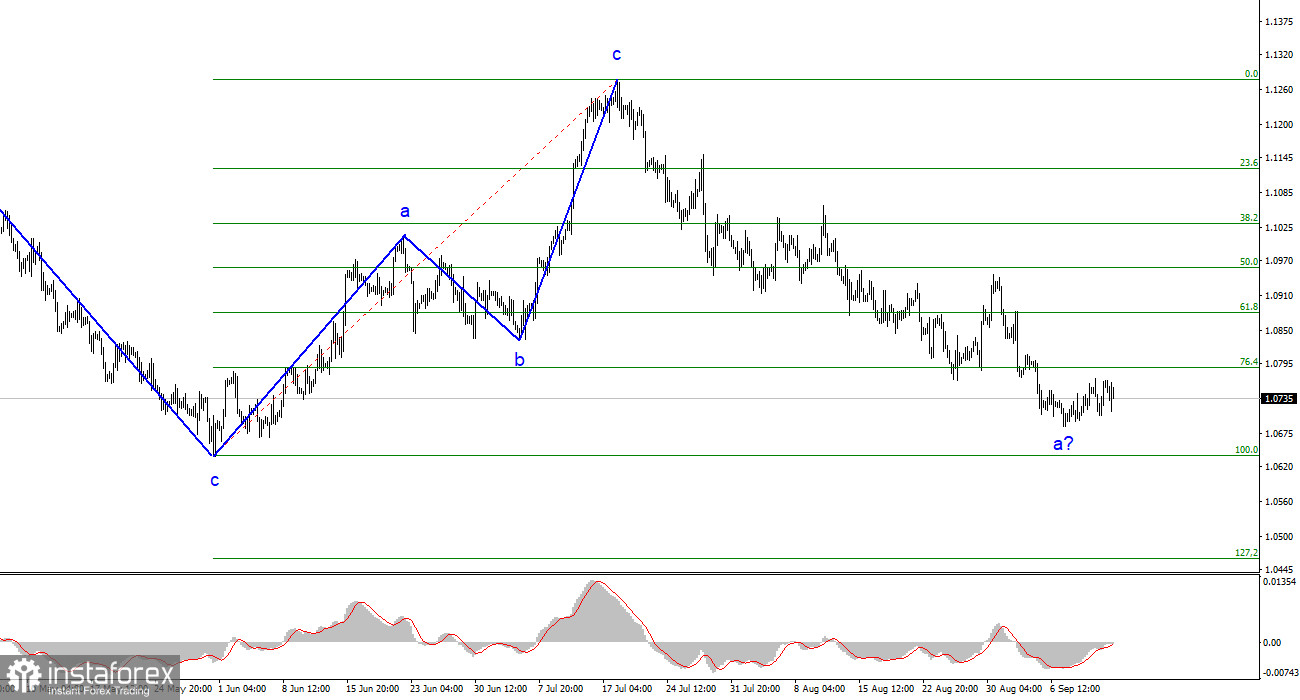

The wave analysis of the 4-hour chart for the EUR/USD pair remains clear. The entire ascending trend segment, which began its formation last year, has taken on a complex structure, and over the past year, we have seen only three wave structures alternating. Recently, I have regularly mentioned that I expect the pair to reach around the 1.5 figure, from where the last upward three-wave structure began to form. I still stand by my words. Another upward three-wave structure is complete, so the market continues to build a downward trend segment.

The recent increase in quotes does not resemble a full-fledged wave 2 or b. A similar wave was observed from August 3 to 10. Most likely, this is an internal corrective wave in 1 or a. If this is the case, the decline in quotes may continue for some time within the framework of the first wave of the downward trend segment. And this is not the end of the euro's decline since the construction of the third wave is still required. Five internal waves are already visible within the first wave, indicating its completion.

Economic statistics from the Eurozone continue to disappoint.

The EUR/USD pair's exchange rate dropped by 20 basis points on Wednesday, with the amplitude remaining relatively low. I have previously mentioned that now is a good time to start building an upward wave 2 or b. However, the recent increase over the past few days makes me skeptical about the current scenario. The euro exchange rate has moved 50 basis points away from its recent low. In 4 days, it moved by 5 points. It is unlikely that such an increase can be considered a wave on a global scale. Undoubtedly, the upward movement may intensify. For example, as early as tomorrow, when the ECB completes its sixth meeting in 2023. The interest rate is unlikely to rise this time, making a decrease in demand for the European currency more likely. In addition, economic information from the EU occasionally enters the market. And it does not support euro buyers.

Today, in the Eurozone, only one report was released, and it could have been more important and interesting for the market. Industrial production in July 2023 decreased by 1.1% compared to July 2022. The market expected a decline, but not such a strong one. In annual terms, the decline was 2.2%, marking the fifth consecutive month of year-on-year decline rather than growth. Nothing is surprising about this, as we are currently tightening monetary policy, which means worsening financial and credit conditions and a cooling economy. However, I am interested in the euro exchange rate, and it cannot rise if the EU economy is only declining.

General Conclusions:

Based on the analysis, the upward wave set formation is complete. The targets for the downward trend segment around 1.0500–1.0600 are realistic. Therefore, I recommend selling the pair with targets near 1.0636 and 1.0483. A successful attempt to break through the level of 1.0788 indicates the market's readiness to continue selling. We can expect to achieve the abovementioned targets, which I have been talking about for several weeks and months.

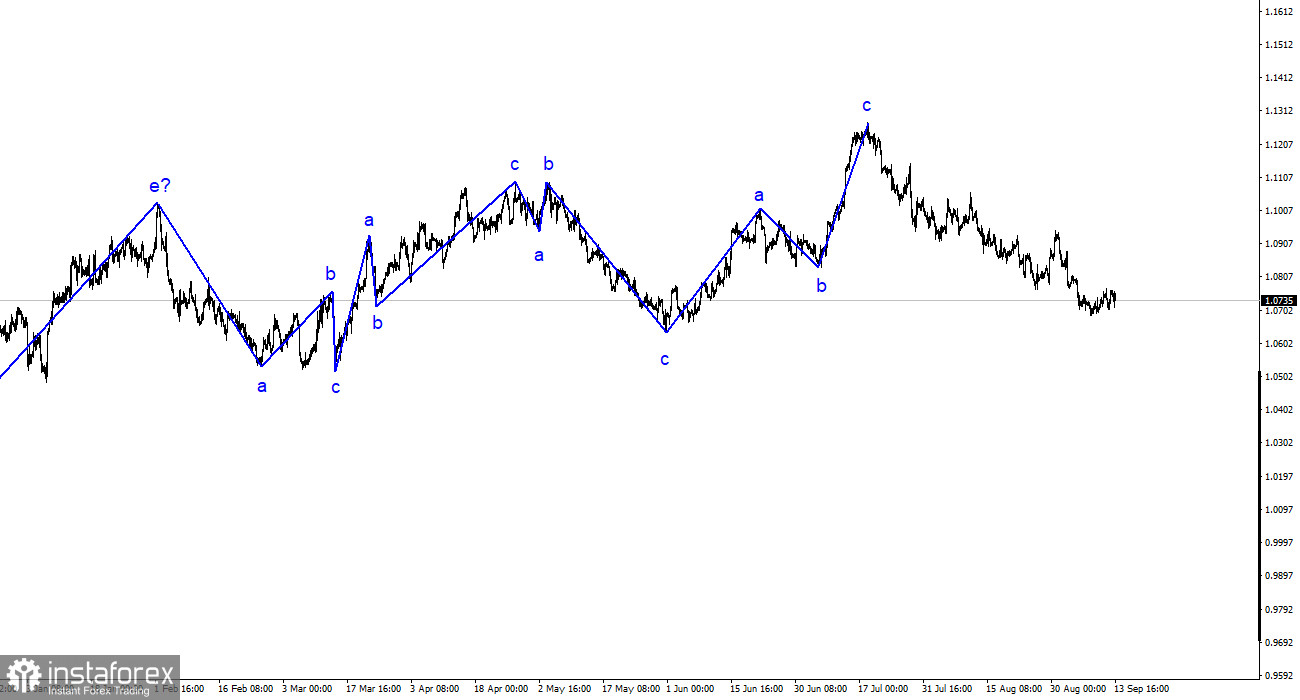

On the larger wave scale, the wave analysis of the ascending trend segment has taken on an extended form but is likely completed. We have seen five upward waves, likely to be the structure of a-b-c-d-e. The pair then built four three-wave structures: two downward and two upward. Now, it has moved on to constructing another downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română