GBP/USD Market Dynamics: A Precise Analysis of Horizontal Trend Development

Pound Strives for Direction Amidst Key Technical Levels

Key Takeaways

- Bullish Break Above 100 MA: The GBP/USD pair eyes a potential upward trajectory beyond the 100 MA at 1.2625.

- Bearish Indicators Surface: A bearish engulfing pattern hints at possible downward momentum.

- Market Awaits Clear Breakout: Locked between the 50 MA and 100 MA, the pair's direction remains undecided.

In the ever-evolving forex market, the GBP/USD pair presents a fascinating study of currency behavior, especially as it hovers between significant technical markers. As of February 20, 2024, this currency pair finds itself in a state of anticipation, awaiting a decisive movement that could set the tone for upcoming trading sessions.

Market Overview: Analyzing Current Trends

The GBP/USD pair's recent ascent above a critical supply zone suggests an underlying bullish sentiment. However, this optimism is curbed by the currency pair's struggle to maintain momentum beyond the 100 MA, indicating a complex interplay of forces at work. The proximity of the pair to pivotal moving averages underscores a market teetering on the edge of a significant breakout or breakdown.

In-Depth Technical Outlook

The GBP/USD currency pair has recently navigated through a pivotal phase, breaching the short-term supply zone between 1.2613 and 1.2595, marking a new local high at 1.2628. This movement signifies a persistent bullish momentum, with the pair positioned for a possible ascend above the 100 Moving Average (MA) seen at 1.2625, targeting the next resistance level at 1.2691.

Conversely, the presence of a bearish engulfing pattern raises caution among traders, suggesting a potential shift towards bearish sentiment if the pair descends below the immediate technical support levels at 1.2612, 1.2603, and 1.2595.

Indicator Insights:

- Mixed signals from technical indicators and moving averages reflect the market's uncertainty, with a slight lean towards bearish sentiment as more moving averages indicate a sell signal.

Sentiment Analysis:

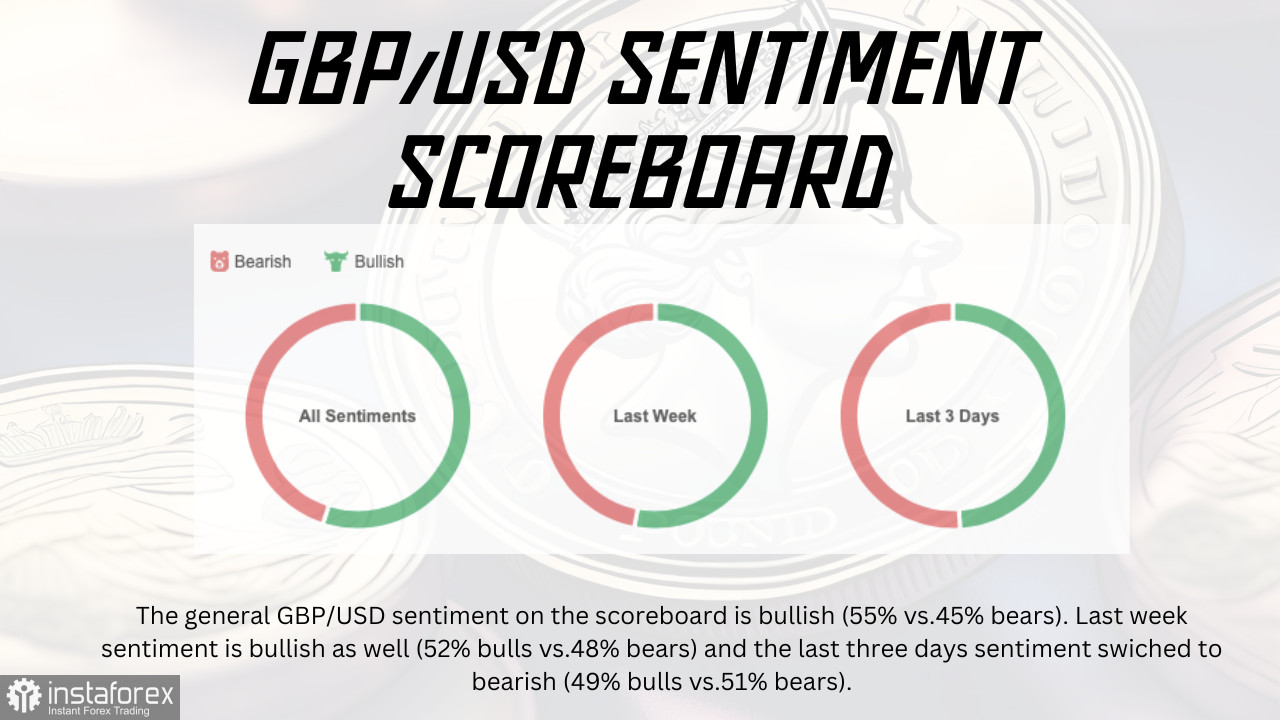

- The prevailing market sentiment oscillates, with a recent shift to bearishness, highlighting the market's sensitivity to immediate technical levels and underlying economic indicators.

Pivot Points for the Week:

- The weekly pivot points delineate critical levels for traders to monitor, with the WR1 and WS1 points marking immediate targets for bullish and bearish scenarios, respectively.

WR3 - 1.26951

WR2 - 1.26671

WR1 - 1.26519

Weekly Pivot - 1.26391

WS1 - 1.26239

WS2 - 1.26111

WS3 - 1.25831

Technical Indicators and Sentiment Analysis

A closer examination of indicator signals reveals a divergent market view. While the majority of moving averages suggest a bearish outlook, a notable number remain bullish, painting a picture of a market divided. This sentiment is mirrored in the sentiment scoreboard, where bullish confidence from the previous week gives way to a more bearish stance in recent days.

Bullish and Bearish Perspectives: A Balanced View

- For the bulls, the key lies in breaching the EMA 100 barrier, which could pave the way for a sustained upward journey towards and beyond the next resistance level.

- The bears, on the other hand, might find validation in the bearish engulfing pattern, with a fall below the DEMA 50 serving as a precursor to further declines.

Conclusion:

As traders and market participants keenly observe the GBP/USD pair, the emphasis rests on monitoring these critical technical levels and indicators. The dynamic interplay between bullish and bearish forces suggests a market ripe for strategic trades, with a clear breakout above or breakdown below established markers set to define the path forward.

Strategic Trading Insights:

- Bulls should watch for a confirmed breakout above the EMA 100, leveraging momentum for potential gains.

- Bears might consider positions on signs of sustained weakness, especially if key support levels give way, signaling a deeper correction.

In conclusion, the GBP/USD pair stands at a crossroads, with its future direction hinging on the resolution of current technical uncertainties. As the market awaits this decisive movement, traders are advised to remain vigilant, ready to act on the unfolding scenario that aligns with their strategic outlook.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română