A rise in UK unemployment rate from 4.2% to 4.3% exerted downward pressure on the pound. However, the decline was purely symbolic. Moreover, by the end of the day, the pound recouped losses and returned to its values at the start of the trading day. This shows that the market simply ignored the reports. And there is no doubt that today's industrial output report, which is estimated to slow from 0.7% to 0.3%, awaits the same fate. The market will focus on the US CPI data. What's more, if it weren't for tomorrow's European Central Bank meeting, this would have been the main event of the week. Especially since the US inflation rate is likely to accelerate from 3.2% to 3.5%. There are even other forecasts predicting an increase in inflation to 3.6%. But it doesn't really matter how much inflation will rise. Just the fact that it will rise can convince investors that the Federal Reserve will raise interest rates again next week. And this will clearly support the dollar's strength. Moreover, it will be quite noticeable.

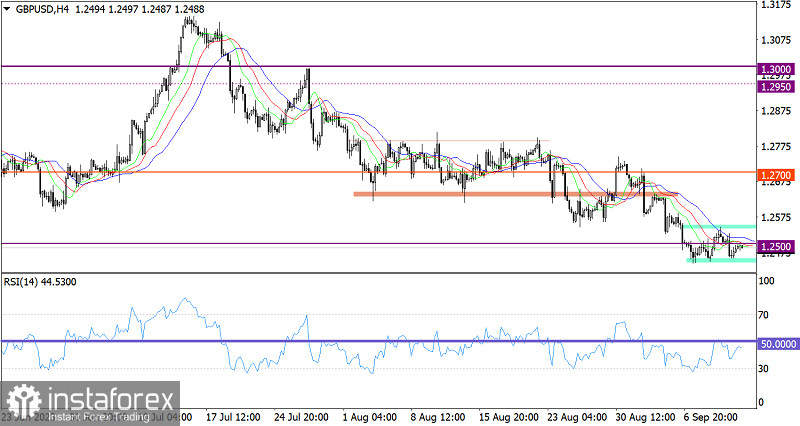

The GBP/USD pair has become stagnant near the base of the downward cycle. As a result, the pair traded in a 100-pip range.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, thus reflecting bearish sentiment among traders.

On the same time frame, the Alligator's MAs are headed downwards, which corresponds to the direction of the quotes.

Outlook

In this situation, traders attach particular importance on the boundaries of the 1.2450/1.2550 range. Keeping the price beyond one level or the other will indicate the end of the flat. As a result, it will serve as a technical signal regarding the price's succeeding direction.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators provide a mixed signal as the pair remains stagnant.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română