In general, the market is at a standstill, and not just because of the absence of influential reports and events. The US inflation report will be released tomorrow, which could provide answers about the Federal Reserve's future course of actions. And the European Central Bank's Governing Council meeting will take place on Thursday. In anticipation of such significant events, few will be willing to take risks. So, the market will most likely continue to tread water.

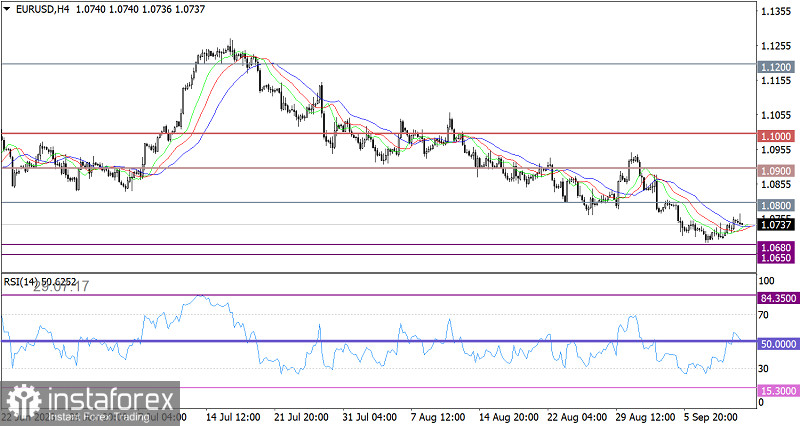

The EUR/USD pair started to correct higher from the 1.0650/1.0680 area, which acts as support. The euro's partial recovery has not resulted in crucial changes, and the downward cycle remains relevant.

On the four-hour chart, the RSI crossed the 50 middle line, thus reflecting an increase in the volume of long positions in the euro.

On the same time frame, the Alligator's MAs signal a convergence, corresponding to the corrective phase.

Outlook

As long as the exchange rate does not return to the aforementioned area, the corrective phase will continue, making it possible for the euro to move towards the level of 1.0800.

To extend the bearish scenario, the price should remain below 1.0650. In this case, the volume of short positions may increase once the pair reaches 1.0500.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators are pointing to a retracement stage. Meanwhile, in the mid-term period, the indicators are reflecting a downward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română