The most interesting events will start on Wednesday. On Tuesday, the UK will release reports on unemployment and wages, which are also important, but the US inflation report is more crucial. It is quite significant because a lot depends on the dollar in the currency market. There are a lot of dollars in the world, and this currency is the number one reserve currency for many central banks worldwide, so quite a lot depends on the actions of the Federal Reserve. And the Fed's actions depend on US inflation. Therefore, the Consumer Price Index can be considered even more important than the European Central Bank meeting.

In previous articles, I assumed that the initial waves for both instruments were finally formed. If this is the case, then quotes of the euro and the pound could rise over the next two to three weeks. So how will the inflation report affect this process?

Currently, the markets expect inflation to accelerate to 3.6% year-on-year, while core inflation is expected to decrease to 4.3%. Let's assume that these figures align with reality. What would they tell us? If core inflation is decreasing, it would be a very good thing for the Fed, but at the same time, headline inflation may rise. A discrepancy. If headline inflation increases compared to July, the Federal Open Market Committee may decide on a longer rate hike, which is great for the dollar. However, currently, both instruments have likely started corrective upward waves, indicating that the dollar should be falling, not rising. Therefore, in the case of rising inflation, the dollar may briefly strengthen, but afterwards it will continue to fall.

If inflation in the US does not increase or it slows down in August, then the second wave for the euro and the pound will receive favorable conditions. This would mean that there is no need for the Fed to be more aggressive, and the dollar won't be in demand in the markets this week. As a result, the upward movement will continue.

Based on everything mentioned above, I expect the uptrend to continue regardless of the inflation figure and the ECB's decision. This scenario may be canceled once the British pound successfully attempts to break the 1.2444 level. This mark is the basis for my forecast.

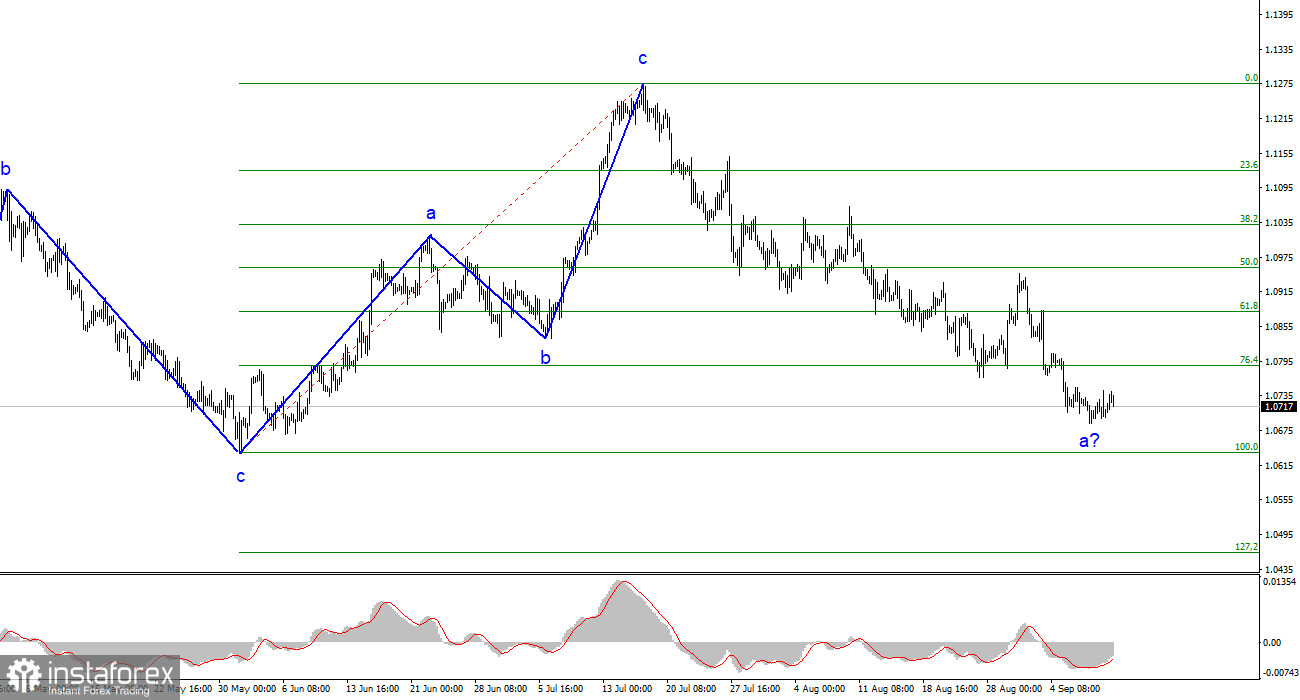

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite feasible. Therefore, I will continue to sell the instrument with targets located near the levels of 1.0636 and 1.0483. A successful attempt to break through the 1.0788 level will indicate the market's readiness to sell further, and then we can expect to reach the targets I've been discussing for several weeks and months.

The wave pattern of the GBP/USD pair suggests a decline within the downtrend. There is a risk of completing the current downward wave if it is d, and not wave 1. In this case, the construction of wave 5 might begin from the current marks. But in my opinion, we are currently witnessing the first wave of a new segment. Therefore, the most that we can expect from this is the construction of wave "2" or "b". An unsuccessful attempt to break the 1.2444 level, corresponding to 100.0% on the Fibonacci scale, may indicate the market's readiness to build an upward wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română