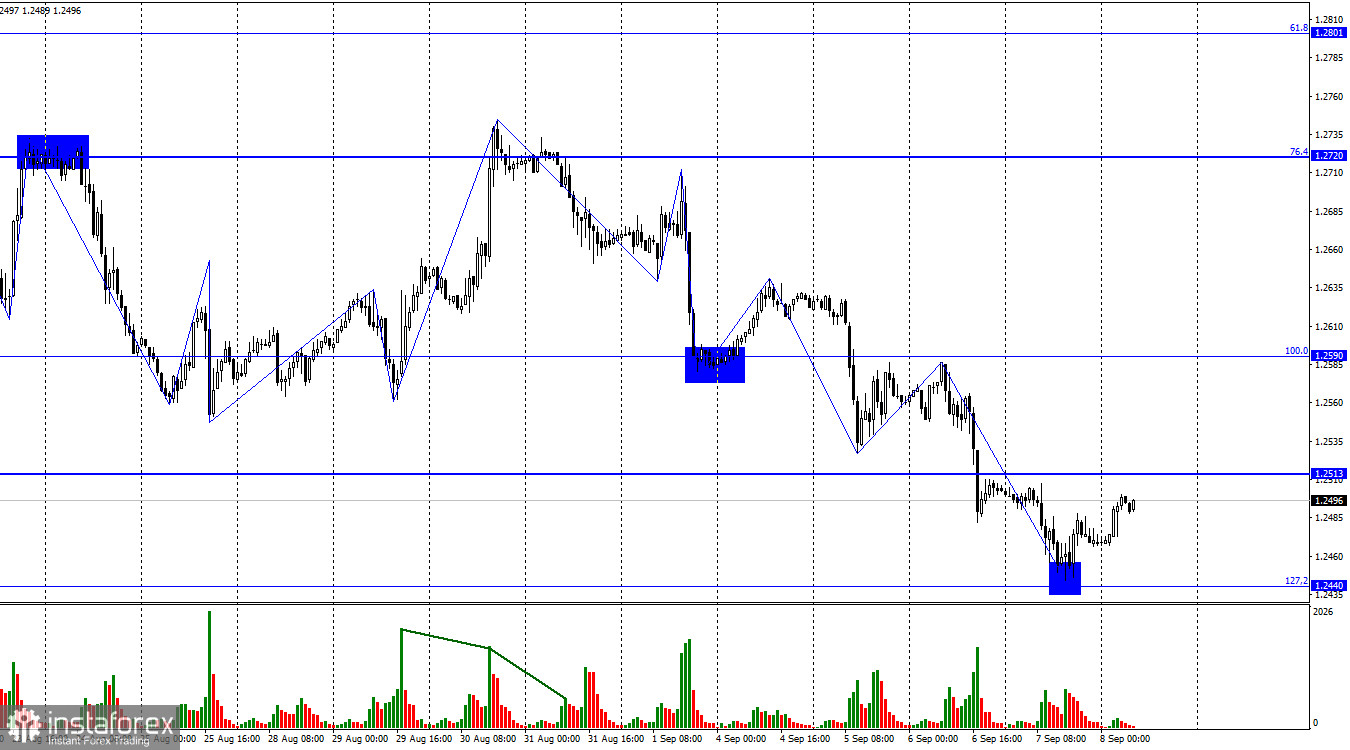

Hi, dear traders! On the 1-hour chart, yesterday the GBP/USD pair dropped to 1.2440, the 127.2%correctional level, rebounded from it and carried on with an upward trajectory towards the 1.2513 level. A pullback from this level will act in favor of the US dollar. So, GBP/USD will resume its decline towards the 1.2440 correction level. If the price consolidates above 1.2513, it will allow the pound to shift instantly to an upward trend towards 1.2590, the Fibonacci 100.0% level.

From the point of wave analysis, no changes are seen here. The latest descending wave turned out to be quite strong, its low was considerably below the previous wave's low. Now, the formation of an upward in underway, but to get the first sign of ending the bearish trend, the instrument needs to surpass the September 6 peak around 1.2590. This scenario seems unlikely today. A pullback from the 1.2513 level will lead to the formation of a new downward wave.

Yesterday, the news background for both the pound sterling and the US dollar was very weak. The report on initial jobless claims showed fewer numbers than traders anticipated. The bears received slight support again, but they too need occasional breaks. The rebound from the 1.2440 level just allowed them to take a breather. It is now vital for the bulls to secure their success, but the economic calendar is empty today. As such, everything will revolve around the 1.2513 level.

After four descending waves, I assume that the pound sterling might trade with an upward trajectory for some time. It does not make sense to guestimate when we have the 1.2513 level and the same waves in play. I believe one should wait for a trend change based on waves or technical signals to buy.

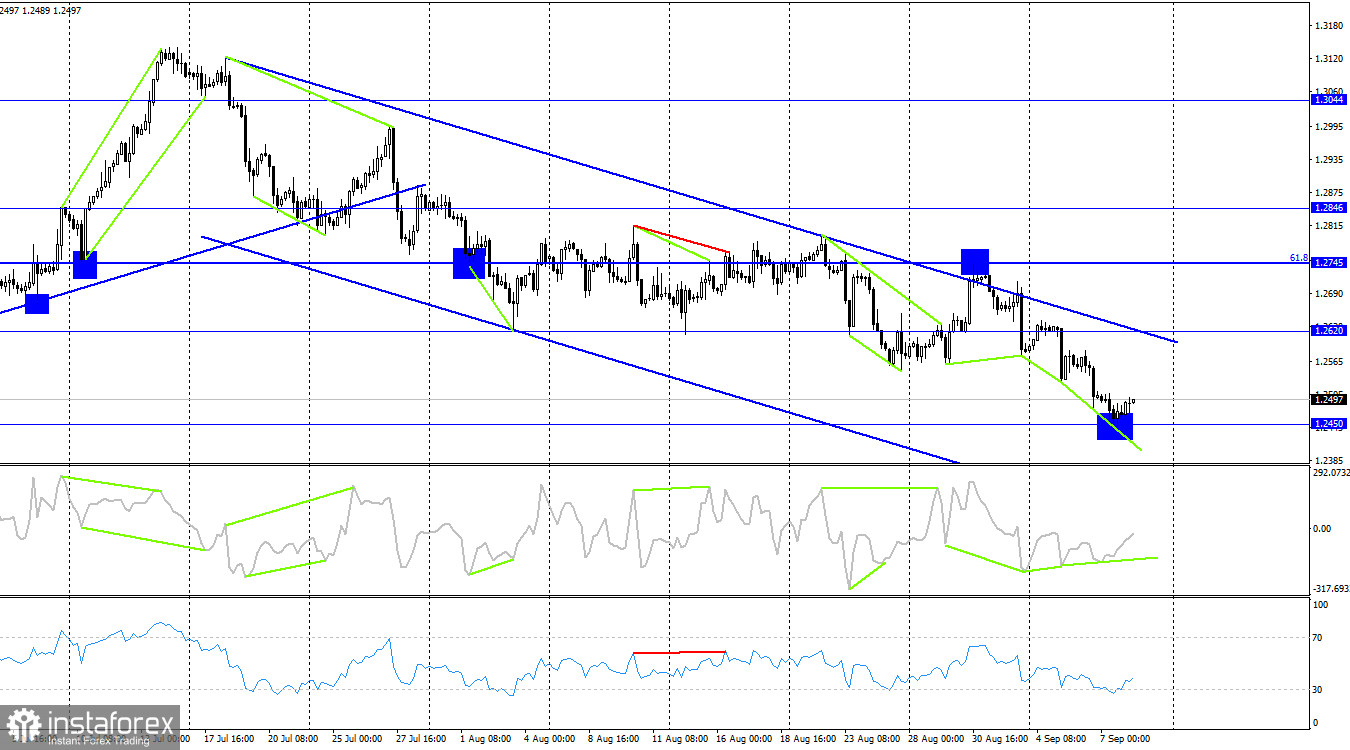

On the 4-hour chart, GBP/USD consolidated above the descending trend corridor. However, a pullback from 1.2745, the 61.8% correction level, worked in favor of the US dollar, thus enabling a new bearish sequence. A rebound from the 1.2450 level encouraged the pound sterling. Now, an upward movement to the upper border of the descending trend channel is possible. A strong rise in GBP/USD can be expected only after the price firmly settles above the trend channel. A third consecutive bullish divergence in the CCI indicator seems imminent.

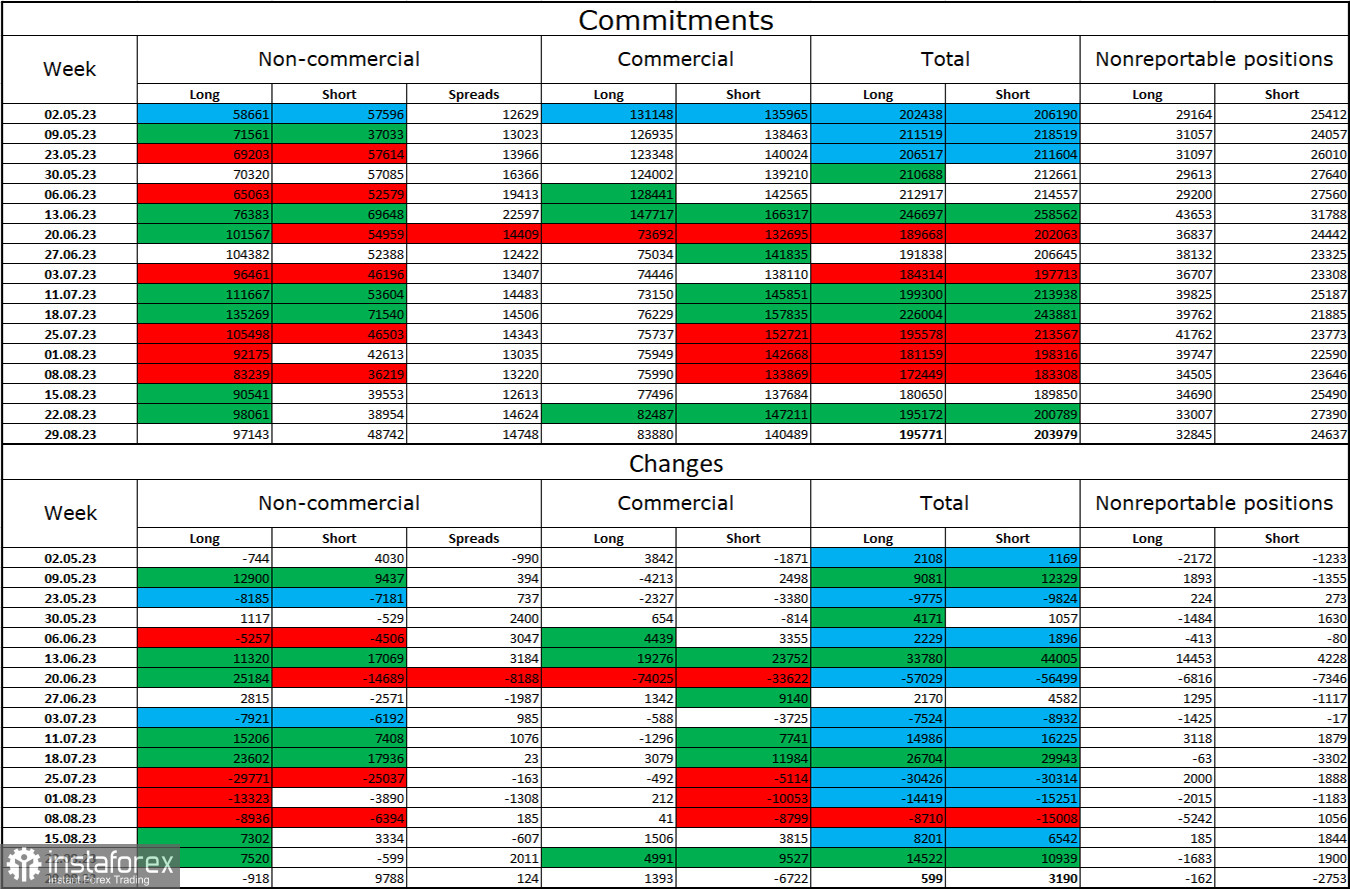

The sentiment of the Non-commercial trader category has become less bullish over the past reporting week. The number of long contracts held by speculators decreased by 918, while the number of short contracts increased by 9,788. The overall sentiment of major players remains bullish, with almost a twofold gap forming between the number of long and short contracts: 97,000 versus 48,000. In my opinion, the pound had decent prospects for continued growth a few weeks ago, but now many factors have shifted in favor of the US dollar. I don't anticipate a strong resurgence in the British pound's value. I believe that as time progresses, the bulls will continue to shed their buy positions. Only the Bank of England can change the market dynamics if it continues to raise rates longer than planned.

Commitments of Traders (COT)

Economic calendar for US and UK

On Friday, the economic calendar does not contain a single meaningful report. Therefore, the information background does not matter at all for the whole trading day.

Outlook for GBP/USD and trading tips

Short positions were valid yesterday on the condition GBP/USD closed below 1.2590 with downward targets at 1.2513 and 1.2440. Both targets have been achieved. New short positions could be planned at a breakout of 1.2513 with a downward target at 1.2440. As for long positions, I see the only opportunity which could be signaled when the price settles above 1.2513 with an upward target at 1.2590. Yesterday, I advised traders to buy the instrument during a breakout of 1.2450. These positions could still be held open for a while.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română