EUR/JPY continues to develop an upward trend, including due to the divergence in monetary policies between the ECB and the Bank of Japan. Favoring buyers in yen trading and the EUR/JPY pair is also the so-called "carry-trade," where the more expensive currency is purchased at the expense of the cheaper one.

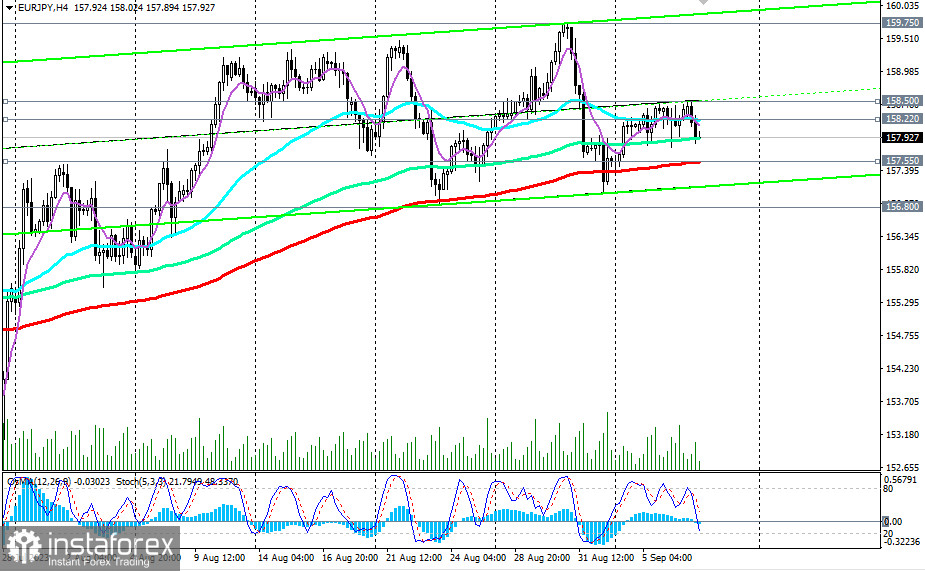

The very first signal for increasing long positions could be the breakout above the upper level of the short-term range (between 158.80 and 157.80), which has been established over the past few days.

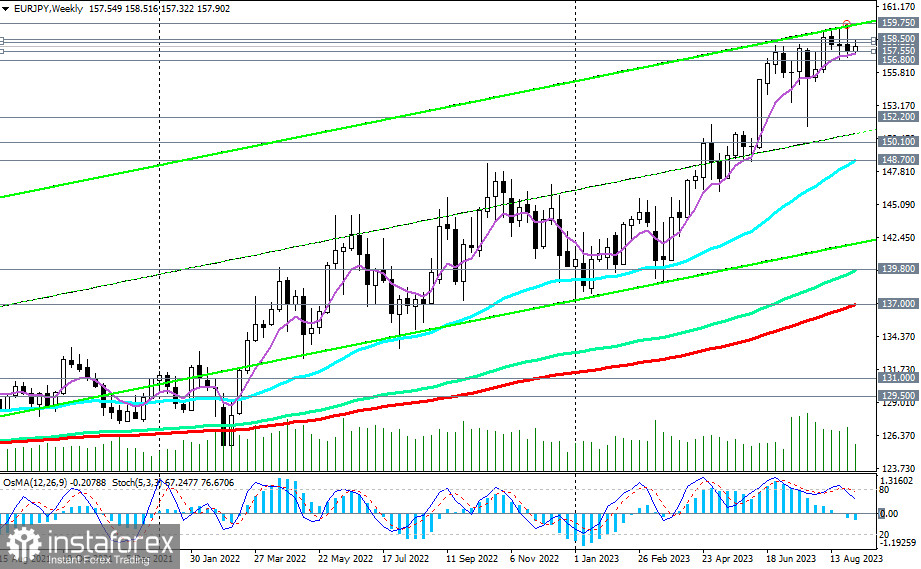

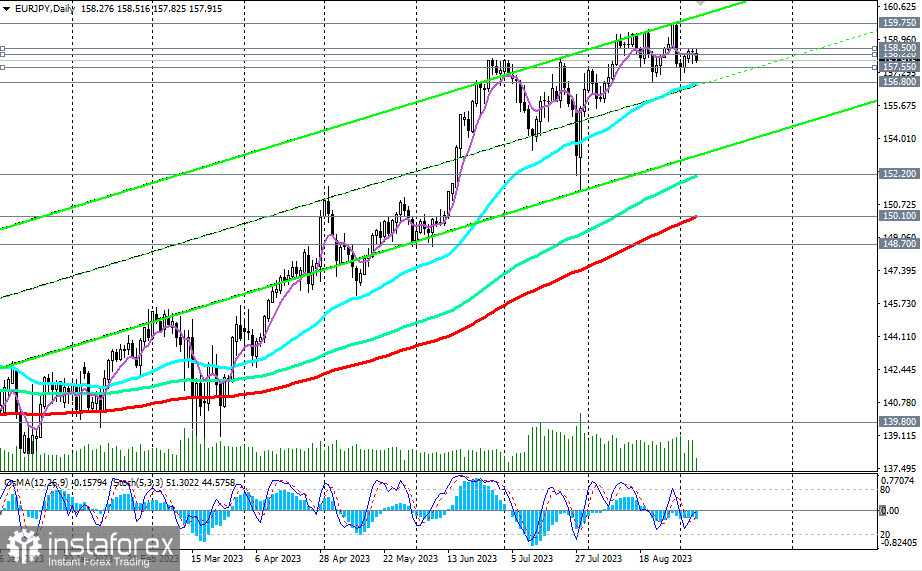

A breakout of the recent local high at 159.75 (near this level, the upper boundaries of the upward channels on the daily and weekly charts also pass) could trigger further growth in the pair, which continues to trade within the framework of the long-term bullish trend.

In an alternative scenario, the first signal for opening short positions could be a break below the 157.80 mark, and confirmation would come from breaking through the important short-term support level at 157.55 (200 EMA on the 4-hour chart).

In the event of the development of this scenario, a break of the support level at 156.80 (50 EMA on the daily chart) could lead to a further decline towards key support levels 152.20 (144 EMA on the daily chart) and 150.10 (200 EMA on the daily chart). Passing through the said levels would break the medium-term bullish trend of the pair while remaining within the framework of the long-term bullish trend, above the support levels at 139.80 (144 EMA on the weekly chart) and 137.00 (200 EMA on the weekly chart).

Currently, the prevailing trend is a stable bullish trend and a strong upward impulse, so expecting such a decline in the pair is not advisable. Long positions remain preferable.

Support levels: 157.80, 157.55, 157.00, 156.80, 156.00, 152.20, 150.10, 149.00, 148.70

Resistance levels: 158.00, 158.22, 158.50, 159.00, 159.75

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română