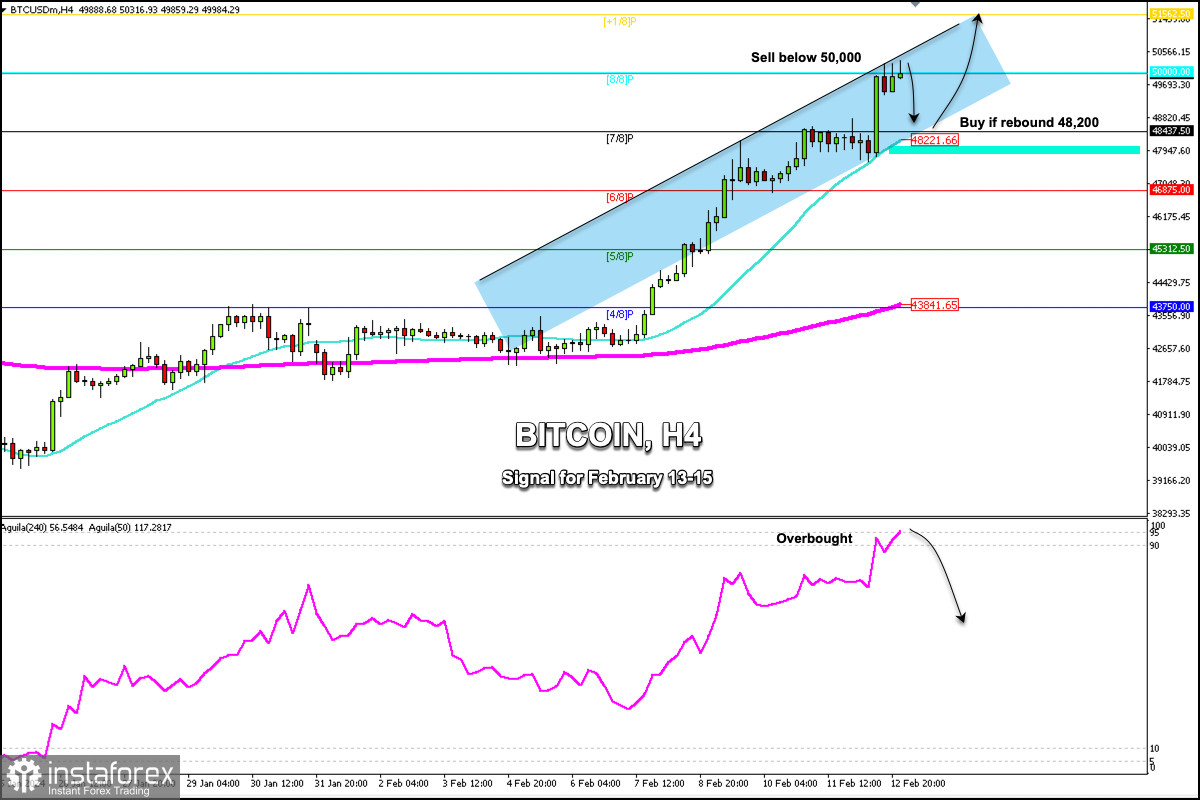

Bitcoin is trading around the psychological level of $50,000, near 8/8 Murray, and above the 21 SMA. Technically and according to the H4 chart, we observe that Bitcoin is showing strongly overbought signs, hence a technical correction is imminent in the next few days. The key for this scenario to occur for BTC is to consolidate below $50,000.

Bitcoin reached a new high at 50,316.93, the level last seen on December 27, 2021. BTC tried to reach the level of 50,000 in early January, but could not achieve it. This February, it resumed its bullish cycle from the low of 38,500 to the high of 50,300, accumulating a gain of more than 29%. If bullish strength continues, BTC is likely to face the next resistance around 51,562 (+1/8 Murray).

In the next few hours, we expect Bitcoin to trade below 8/8 Murray which could be seen as a signal to sell and we could expect it to reach the first support around 48,437.

The eagle indicator reached an extremely overbought level. So, a technical correction is imminent in the coming days. If BTC trades below the psychological level of $50,000, it could be a key selling point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română