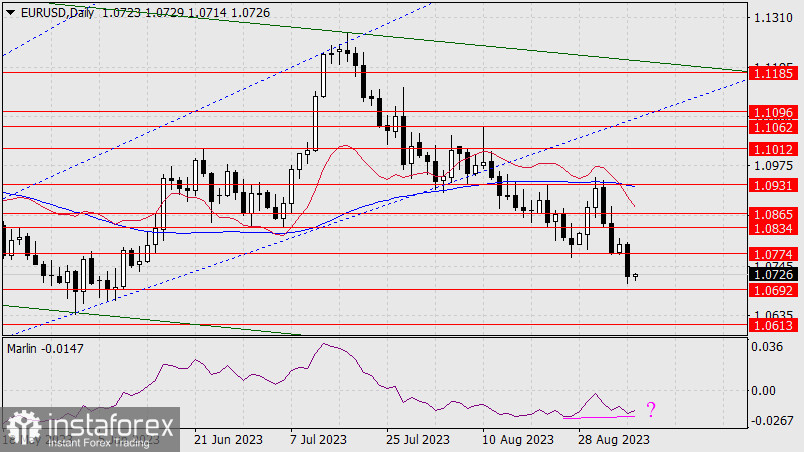

EUR/USD:

Pessimism is taking over the currency market and the broader financial landscape. Yesterday, the Reserve Bank of Australia kept its benchmark rate at 4.10%, indicating risks to the economy. European PMIs are declining, contributing to yesterday's 72-point drop in the euro. Government bond yields are rising, and stock markets are falling (S&P 500 -0.42%).

Today, Germany's manufacturing orders for July will be published, with a forecast of -4.0%, and the volume of retail sales for the same month with a forecast of -0.2%, following -0.3% in June. It seems like the euro does not have any reason to rise today.

From a technical perspective, the support at 1.0692 could serve as a landmark for the bulls, where the price is already approaching convergence with the Marlin oscillator. However, if the price manages to settle below this level, the convergence will disappear, and the target will be 1.0613 (approximately the June 27th high).

On the 4-hour chart, there are no distinct reversal signs. The Marlin oscillator's signal line is pointing upwards, and this suggests a possible slowdown in price as it approaches 1.0692.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română