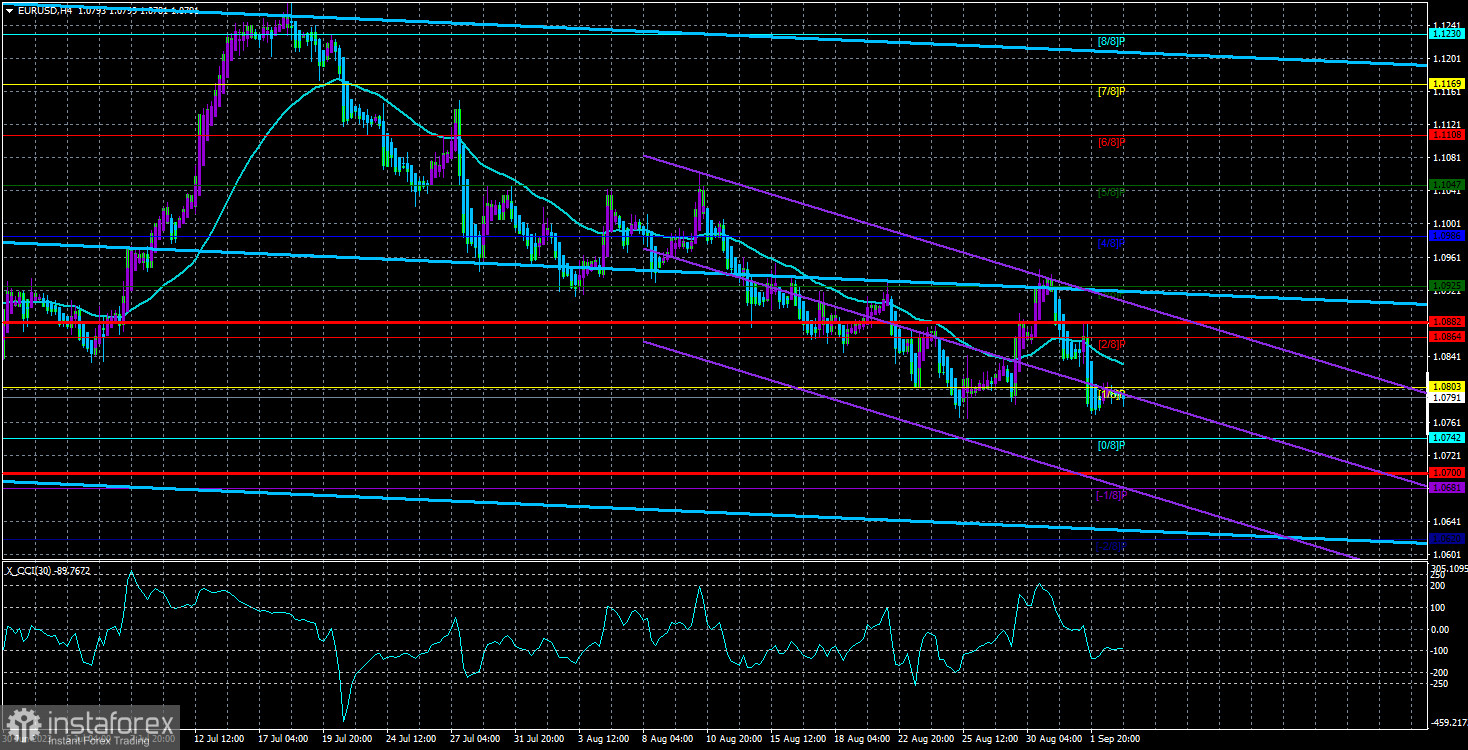

The currency pair EUR/USD traded reluctantly during the week's first trading day. The overall volatility of the day was very low, so no significant price changes could affect the technical picture. After the decline on Thursday and Friday, the pair's quotes remain below the moving average, but the Murray level of "6/8" at 1.2573 prevents the pair from going further down. In recent articles, we have regularly discussed that the decline at the end of last week looked illogical, so a new upward turn is possible this week. This would mean that the price would again establish itself above the moving average line, formally changing the trend to ascending.

Formally – because the pair has been trading quite chaotically in recent weeks. The downward trend persists, as seen in the illustration above, but there is an impression that the primary bearish momentum has faded. Perhaps they were counting on support from the macroeconomic backdrop from the United States last week but did not receive it. Talks of an American recession have resurfaced, now predicted for next year. However, regardless of the situation in the United States, the economic picture in the European Union is still much worse. Economic growth of 0.3% per quarter in Europe is considered a blessing. Moreover, it is still uncertain what the outcome of the second quarter will be, as the corresponding report will be published this week, and its final assessment may differ from the previous two.

In the 24-hour timeframe, the price confidently surpassed the Ichimoku cloud, the most powerful factor for further depreciation of the European currency. We are not expecting anything other than a decline in the euro. And considering that the ECB's hawkish rhetoric is gradually softening, we don't see any reason to buy the euro.

Christine Lagarde avoided the question.

On Monday, Christine Lagarde, the head of the ECB, gave her first of at least two planned appearances for this week. In principle, Lagarde did not make any significant statements, and when asked about the rate decision at the next regulator's meeting, she delicately avoided answering the question. There was no market reaction to this event, but the European currency could have fallen yesterday due to Madame Lagarde's modesty.

From our point of view, Lagarde's silence means only one thing – the ECB is preparing for a pause, which is a prelude to the end of the tightening cycle. From the beginning of the year, we have consistently stated that the European regulator will be unable to raise the rate to the same levels as the Bank of England and the Federal Reserve. This is how history has unfolded. Even during the 2007-2008 crisis, the ECB rate increased much less than the Fed and the Bank of England rates. Therefore, it should not have been expected to be at high values from the start.

The euro has been rising for 11-12 months, but the ECB's interest rate is still lower than the Fed. The ECB is sending clear signals of its readiness to conclude the tightening cycle in 2023. All of this suggests one thing: the European currency should continue to fall. By the end of the year, the fundamental background may change not in favor of the dollar, as the Fed may begin to signal a readiness to start easing monetary policy. But if, in this case, the euro starts to rise again, it will create a situation where the market interprets all factors in favor of the euro.

Today, Lagarde will have another appearance, but if she was not forthcoming with journalists yesterday, there should be no expectations of loud statements today. Yesterday, speeches were also made by Philip Lane and Fabio Panetta, and today, it's Luis de Guindos and Isabel Schnabel's turn. However, members of the monetary committee have been prohibited from commenting on the pending rate decision. If so, all three speeches today will likely go without a market reaction.

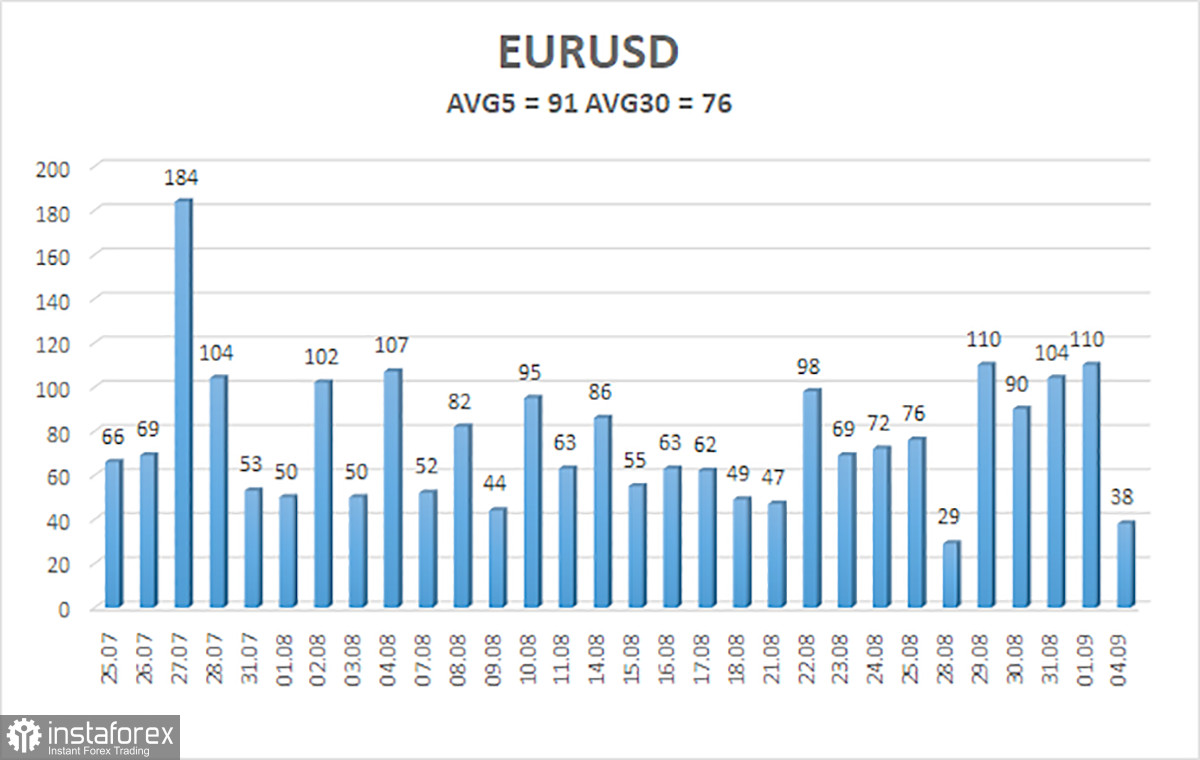

The average volatility of the EUR/USD currency pair over the last five trading days as of September 5th is 91 pips, characterized as "average." Therefore, we expect the pair to move between the levels of 1.0700 and 1.0882 on Tuesday. A reversal of the Heiken Ashi indicator upwards will indicate a new upward correction phase.

Nearest support levels:

S1 – 1.0742

S2 – 1.0681

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0803

R2 – 1.0864

R3 – 1.0925

Trading recommendations:

The EUR/USD pair has fallen back below the moving average. Short positions can be maintained with targets at 1.0742 and 1.0700 until the Heiken Ashi indicator reverses upwards. Long positions can be considered if the price consolidates above the moving average with targets at 1.0925 and 1.0986.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move over the next day based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română